Accountants Eastwood: If you're running a business, are a sole trader or are otherwise self-employed in Eastwood, you'll find certain advantages to having your own accountant. At the very least your accountant can manage important tasks like completing your tax returns and keeping your books up to date, giving you more time to focus on your business. The benefits of this type of professional help far outweighs the extra costs involved. As you move forward you will find this help is even more essential.

You may be surprised to find that accountants don't just handle taxes, they've got many roles. Check that any prospective Eastwood accountant is suitable for the services that you need. Whether you use an accountant working within a larger accountancy practice or one who is working independently is up to you. A company will employ a number of accountants, each specialising in differing disciplines of accounting. It is likely that auditors, actuaries, forensic accountants, tax accountants, bookkeepers, investment accountants, cost accountants, financial accountants, accounting technicians, chartered accountants and management accountants will be available within an accounting company of any note.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Qualified accountants may come with higher costs but may also save you more tax. It should go without saying that accountants fees are tax deductable. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

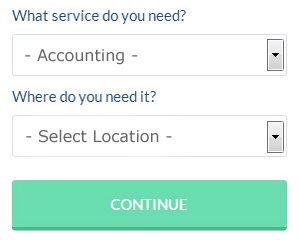

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. All that is required is the ticking of a few boxes so that they can understand your exact needs. Then you just have to wait for some prospective accountants to contact you. At the time of writing this service was totally free.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. The popularity of these services has been increasing in recent years. Picking a reputable company is important if you choose to go with this option. Be sure to study customer reviews and testimonials. We will not be recommending any individual online accounting service in this article.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! You can take much of the hard graft out of this procedure by using a software program such as Andica, ACCTAX, Ajaccts, Forbes, Nomisma, Capium, Keytime, Sage, Gbooks, GoSimple, Absolute Topup, 123 e-Filing, Taxfiler, TaxCalc, Taxshield, Basetax, BTCSoftware, CalCal, Ablegatio, Taxforward or Xero. Don't leave your self-assessment until the last minute, allow yourself plenty of time. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Financial Actuaries Eastwood

An actuary manages, advises on and assesses financial and monetary risks. Actuaries apply their mathematical skills to determine the probability and risk of future occurrences and to calculate their financial effect on a business and it's clientele. An actuary uses statistics and mathematics to assess the fiscal effect of uncertainty and help their clients limit risk.

How to Be a Better Money Manager for Your Business

In the last several years, thousands of people have discovered one great thing about starting their own business: they completely control their income potential. They are in control of the amount of money they spend and if they're wise, the only limit to their earning potential is their willingness to put in the work. Nonetheless, this aspect of business is something that people find overwhelming despite the fact that many of them have successfully used a budget in managing their personal finances. Luckily there are plenty of things that you can do to make it easier on yourself. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. When you do this, you're going to have the money needed to pay your taxes for the quarter. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

Be aware of where every last cent of your money is being spent, both in your business and personal life. Sure, it's annoying to have to track everything you spend money on but doing this actually has a lot of benefits. When you actually write down where you spend your money, it helps you keep track of your spending habits. Many people are earning decent money but they have poor money management skills that they often find themselves wondering where all their money has gone. This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. And of course, when you're filling out tax forms, you'll find it so much easier when you have a record of where, what, and how much you spent on business related things.

Keep a tight lid on your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. You should, however, spend money on things that will benefit your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. You'll also be able to save money on office supplies if you buy in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Avoid spending too much on your entertainment as well; be moderate instead.

There are lots of ways to practice self improvement in your business. For one, you can improve how you manage your money. Everyone can use help in learning how to manage money better. When you learn proper money management, your self-confidence can be helped a lot. It also helps you organize many areas of your life both personally and professionally. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Small Business Accountants Eastwood

Making certain that your accounts are accurate and up-to-date can be a stressful task for any small business owner in Eastwood. A dedicated small business accountant in Eastwood will offer you a hassle-free means to keep your annual accounts, tax returns and VAT in perfect order.

A professional small business accountant in Eastwood will consider that it is their responsibility to help develop your business, and provide you with reliable financial guidance for security and peace of mind in your particular circumstances. A decent accounting firm in Eastwood should be able to offer you proactive small business advice to optimise your tax efficiency while at the same time reducing business costs; critical in the sometimes shadowy world of business taxation.

In order to do their job correctly, a small business accountant in Eastwood will have to know exact details with regards to your current financial standing, business structure and any future investment that you may be considering, or already have set up.

Eastwood accountants will help with corporation tax, accounting services for media companies Eastwood, company formations, mergers and acquisitions in Eastwood, double entry accounting Eastwood, accounting services for buy to let property rentals in Eastwood, management accounts, limited company accounting, PAYE in Eastwood, payroll accounting, estate planning, business disposal and acquisition, capital gains tax Eastwood, partnership accounts, cashflow projections, investment reviews, accounting services for the construction industry, bookkeeping in Eastwood, charities, tax investigations Eastwood, accounting support services, general accounting services, tax preparation, pension forecasts, litigation support, partnership registrations in Eastwood, VAT returns, self-employed registrations, business support and planning in Eastwood, small business accounting, company secretarial services, self-assessment tax returns and other forms of accounting in Eastwood, Nottinghamshire. These are just a few of the tasks that are undertaken by local accountants. Eastwood specialists will inform you of their entire range of services.

Eastwood Accounting Services

- Eastwood Personal Taxation

- Eastwood Debt Recovery

- Eastwood Tax Planning

- Eastwood Tax Returns

- Eastwood Audits

- Eastwood Bookkeepers

- Eastwood Account Management

- Eastwood Payroll Management

- Eastwood Self-Assessment

- Eastwood Specialist Tax

- Eastwood Tax Advice

- Eastwood Tax Refunds

- Eastwood Chartered Accountants

- Eastwood Bookkeeping Healthchecks

Also find accountants in: Torworth, Hawton, Elton, North Clifton, Bleasby, Sutton On Trent, Kirton, Cossall, Girton, Clarborough, Thorpe, South Clifton, Grassthorpe, Epperstone, Cropwell Bishop, Tithby, Grove, South Muskham, Halam, Everton, Kingston On Soar, Cottam, Nuthall, Worksop, Orston, Normanton, Annesley, West Drayton, Tollerton, Gonalston, Ompton, Fiskerton, Southwell, Holme Pierrepont, Cropwell Butler and more.

Accountant Eastwood

Accountant Eastwood Accountants Near Eastwood

Accountants Near Eastwood Accountants Eastwood

Accountants EastwoodMore Nottinghamshire Accountants: Arnold, Newark-on-Trent, Retford, Worksop, Stapleford, West Bridgford, Nottingham, Eastwood, Carlton, Sutton-in-Ashfield, Mansfield, Beeston and Hucknall.

TOP - Accountants Eastwood - Financial Advisers

Chartered Accountant Eastwood - Tax Return Preparation Eastwood - Auditing Eastwood - Small Business Accountant Eastwood - Bookkeeping Eastwood - Financial Accountants Eastwood - Financial Advice Eastwood - Tax Accountants Eastwood - Self-Assessments Eastwood