Accountants Rotherham: Do you get little else but a headache when filling out your yearly tax self-assessment form? A lot of people in Rotherham have the same problem as you. But is there an easy way to find a local Rotherham accountant to do this job for you? If self-assessment is too complex for you, this might be the way forward. The cost of completing and sending in your self-assessment form is around £200-£300 if carried out by a typical Rotherham accountant. You can however get it done more cheaply by using online services.

In your search for an accountant in the Rotherham area, you may be baffled by the different types that you can choose from. Therefore, be certain to pick one that matches your requirements perfectly. You will come to realise that there are accountants who work independently and accountants who work for accountancy firms. Within an accounting company there will be specialists in distinct disciplines of accountancy. It wouldn't be a surprise to find auditors, accounting technicians, actuaries, forensic accountants, chartered accountants, management accountants, financial accountants, bookkeepers, investment accountants, tax preparation accountants and cost accountants all offering their expertise within any decent sized accounting company.

It is advisable for you to find an accountant in Rotherham who is properly qualified. For basic tax returns an AAT qualified accountant should be sufficient. Qualified Rotherham accountants might charge a bit more but they may also get you the maximum tax savings. Your accountant's fees are tax deductable.

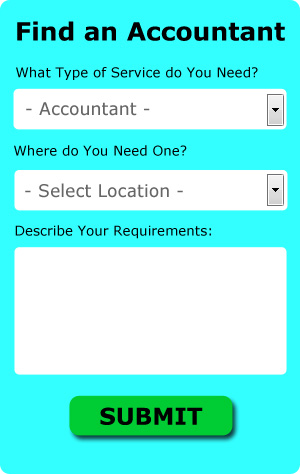

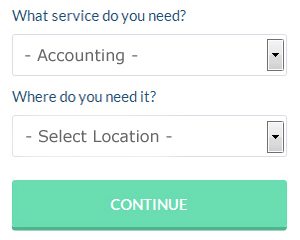

You could use an online service like Bark who will help you find an accountant. It is just a case of ticking some boxes on a form. Within a few hours you should hear from some local accountants who are willing to help you. When this article was written Bark was free to use.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Over the last few years many more of these services have been appearing. Should you decide to go down this route, take care in choosing a legitimate company. A good method for doing this is to check out any available customer reviews and testimonials.

At the end of the day you could always do it yourself and it will cost you nothing but time. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of ACCTAX, Taxshield, 123 e-Filing, Gbooks, Basetax, BTCSoftware, Xero, CalCal, Andica, Ablegatio, Taxforward, GoSimple, Keytime, Taxfiler, Nomisma, Absolute Topup, Sage, Forbes, Ajaccts, TaxCalc and Capium. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Small Business Accountants Rotherham

Making certain your accounts are accurate and up-to-date can be a stressful job for anyone running a small business in Rotherham. If your annual accounts are getting you down and tax returns and VAT issues are causing sleepless nights, it would be advisable to employ a dedicated small business accountant in Rotherham.

An experienced small business accountant in Rotherham will regard it as their responsibility to help develop your business, and offer you sound financial advice for security and peace of mind in your particular situation. A quality accounting firm in Rotherham will be able to give proactive small business guidance to maximise your tax efficiency while lowering costs; crucial in the sometimes murky field of business taxation.

You also ought to be supplied with a dedicated accountancy manager who understands your company's circumstances, your future plans and your business structure.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. This can cause you to not succeed in your business endeavor. Use the following tips to help you manage your money better.

Hire an accountant. An accountant is well worth the business expense because she can manage your books for you full time. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. The great thing is that all the paperwork will be handled by your accountant. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Offer your clients payment plans. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. If you have steady income coming in, you're in a better position to plan your budget, get your bills paid on time, and properly manage your money in general. This can certainly boost your self-confidence.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. Put your cash in the bank at the end of every work day.

Proper money management involves a number of different things. You might think that this is a basic skill and it shouldn't be that complicated, but the truth is that as a small business owner, proper money management is an intricate and often complicated process. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. If you want your business to be profitable, you need to stay on top of your finances.

Rotherham accountants will help with workplace pensions, consulting services, management accounts, accounting services for media companies, partnership registration, small business accounting, bookkeeping, litigation support Rotherham, personal tax in Rotherham, inheritance tax, taxation accounting services, business outsourcing Rotherham, HMRC submissions, business support and planning, business disposal and acquisition in Rotherham, financial statements in Rotherham, debt recovery Rotherham, VAT returns, charities, double entry accounting in Rotherham, year end accounts in Rotherham, monthly payroll in Rotherham, investment reviews, corporate finance Rotherham, sole traders, company formations, tax returns, general accounting services in Rotherham, accounting services for the construction industry in Rotherham, corporate tax, consultancy and systems advice Rotherham, accounting services for landlords in Rotherham and other accounting services in Rotherham, South Yorkshire. Listed are just a few of the activities that are performed by local accountants. Rotherham professionals will be happy to inform you of their full range of services.

When hunting for inspiration and ideas for accounting & auditing, self-assessment help, small business accounting and personal tax assistance, you do not need to look much further than the world wide web to find all the information that you need. With such a diversity of expertly written blog posts and webpages to select from, you will very shortly be brimming with amazing ideas for your upcoming project. Just recently we came across this engaging article on the subject of choosing the right accountant for your business.

Rotherham Accounting Services

- Rotherham Business Accounting

- Rotherham Tax Returns

- Rotherham Taxation Advice

- Rotherham Tax Planning

- Rotherham Account Management

- Rotherham Tax Refunds

- Rotherham Self-Assessment

- Rotherham Personal Taxation

- Rotherham Auditing

- Rotherham Forensic Accounting

- Rotherham Bookkeeping

- Rotherham PAYE Healthchecks

- Rotherham Payroll Management

- Rotherham Financial Advice

Also find accountants in: Wickersley, Birdwell, Thurlstone, Handsworth, Stainforth, New Rossington, Woodsetts, Clayton, Brodsworth, Ardsley, Dunford Bridge, Burghwallis, High Melton, Campsall, Oughtibridge, Kexbrough, Barnburgh, Laughton En Le Morthen, Shafton, Beauchief, Bentley, Beighton, Finningly, Firbeck, Barnsley, Halfway, Hoyland, Carlton, Sprotbrough, Penistone, Swinton, Bessacarr, Edenthorpe, Denaby Main, Dalton and more.

Accountant Rotherham

Accountant Rotherham Accountants Near Me

Accountants Near Me Accountants Rotherham

Accountants RotherhamMore South Yorkshire Accountants: Chapeltown, Bentley, Barnsley, Hoyland, Maltby, Rawmarsh, Wath-upon-Dearne, Dinnington, Rotherham, Conisbrough, Sheffield, Doncaster and Wombwell.

TOP - Accountants Rotherham - Financial Advisers

Financial Accountants Rotherham - Financial Advice Rotherham - Investment Accountant Rotherham - Auditing Rotherham - Bookkeeping Rotherham - Self-Assessments Rotherham - Tax Preparation Rotherham - Tax Accountants Rotherham - Affordable Accountant Rotherham