Accountants Bromley: Does completing your self-assessment tax form cause you problems every year? A lot of folks in Bromley have the same problem as you. But is there an easy way to find a local Bromley accountant to do this job for you? This might be the best option if you consider self-assessment just too time-consuming. A run of the mill accountant or bookkeeper in Bromley is likely to charge you a ball park figure of £200-£300 for the completion of your self-assessment. You can definitely get it done cheaper by using online services.

So, what type of accounting service should you search for and how much should you pay? The internet is undoubtedly the most popular place to look these days, so that would certainly be a good place to begin. Though, making certain that you single out an accountant you can trust might not be quite so straightforward. Always bear in mind that pretty much any individual in Bromley can go into business as an accountant. They don't have any legal requirement to obtain any qualifications for this sort of work.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. A qualified accountant may cost a little more but in return give you peace of mind. Accounting fees are of course a business expense and can be included as such on your tax return. Only larger Limited Companies are actually required by law to use a trained accountant.

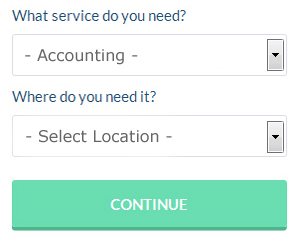

There is an online company called Bark who will do much of the work for you in finding an accountant in Bromley. With Bark it is simply a process of ticking a few boxes and submitting a form. In no time at all you will get messages from accountants in the Bromley area.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. You still need to do your homework to pick out a company you can trust. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. Software is also available to make doing your self-assessment even easier. Some of the best ones include Taxfiler, Basetax, Nomisma, Keytime, Xero, Absolute Topup, Andica, BTCSoftware, TaxCalc, Ablegatio, CalCal, 123 e-Filing, GoSimple, Taxforward, Capium, Forbes, Ajaccts, Taxshield, Gbooks, Sage and ACCTAX. If you don't get your self-assessment in on time you will get fined by HMRC.

Payroll Services Bromley

Dealing with staff payrolls can be a stressful part of running a business enterprise in Bromley, irrespective of its size. The laws regarding payrolls and the legal requirements for accuracy and openness means that dealing with a business's payroll can be an intimidating task.

Using a professional accountant in Bromley, to take care of your payroll requirements is the easiest way to minimise the workload of your own financial team. The payroll service will work with HMRC and pension scheme administrators, and oversee BACS transfers to guarantee timely and accurate payment to all staff.

It will also be necessary for a dedicated payroll management accountant in Bromley to provide an accurate P60 tax form for all staff members at the conclusion of the financial year (by 31st May). A P45 tax form will also be given to any staff member who stops working for the business, in accordance with current legislations.

Auditors Bromley

An auditor is an individual or company hired by an organisation or firm to execute an audit, which is the official inspection of the accounts, generally by an unbiased body. They often also act as advisors to advocate possible the prevention of risk and the application of cost reductions. Auditors have to be licensed by the regulating authority for auditing and accounting and also have the necessary qualifications. (Tags: Auditor Bromley, Auditing Bromley, Auditors Bromley)

Small Business Accountants Bromley

Running a small business in Bromley is pretty stress-filled, without having to worry about your accounts and other bookkeeping chores. Appointing a small business accountant in Bromley will allow you to operate your business knowing your tax returns, VAT and annual accounts, amongst many other business tax requirements, are being fully met.

Helping you to improve your business, and giving financial advice relating to your particular situation, are just a couple of the means by which a small business accountant in Bromley can benefit you. An accountancy firm in Bromley should provide you with an allocated small business accountant and mentor who will clear the haze that shrouds business taxation, so as to improve your tax efficiences.

It is also crucial that you explain your plans for the future, the structure of your business and your current financial circumstances truthfully to your small business accountant.

Bromley accountants will help with business start-ups Bromley, taxation accounting services Bromley, financial planning Bromley, pension forecasts, accounting services for media companies in Bromley, year end accounts Bromley, small business accounting, auditing and accounting Bromley, tax preparation, consulting services Bromley, inheritance tax Bromley, company formations, business advisory services, business support and planning, litigation support, financial statements in Bromley, payroll accounting, accounting services for the construction sector Bromley, estate planning, bureau payroll services Bromley, general accounting services Bromley, corporation tax, accounting and financial advice, corporate finance Bromley, sole traders, charities, investment reviews, business outsourcing Bromley, accounting support services, VAT registrations in Bromley, contractor accounts Bromley, HMRC submissions and other professional accounting services in Bromley, Greater London. Listed are just a small portion of the duties that are performed by nearby accountants. Bromley providers will keep you informed about their entire range of accounting services.

You do, in fact have the very best resource close at hand in the form of the net. There is so much inspiration and information available online for stuff like personal tax assistance, small business accounting, auditing & accounting and self-assessment help, that you will very soon be bursting with suggestions for your accounting requirements. An example could be this article about how to locate an accountant to fill out your tax return.

Bromley Accounting Services

- Bromley Payroll Services

- Bromley Tax Refunds

- Bromley Forensic Accounting

- Bromley Chartered Accountants

- Bromley Taxation Advice

- Bromley Tax Investigations

- Bromley Bookkeeping

- Bromley Bookkeeping Healthchecks

- Bromley Account Management

- Bromley Personal Taxation

- Bromley VAT Returns

- Bromley Specialist Tax

- Bromley Financial Advice

- Bromley Tax Planning

Also find accountants in: Seven Sisters Road, Aldersgate, Winchmore Hill, Coldblow, Maida Hill, Barnes, Lancaster Gate, Ladbroke Grove, Beddington, Dagenham, Leytonstone, Kingston Upon Thames, Coulsdon, Harrow On The Hill, East India Dock Road, New Addington, Isleworth, Acton, Bayswater Road, Hampstead, Olympia, St Johns, Holloway, Hampstead Heath, Greenwich, West India Quay, Trent Park, Capel Manor, Hadley Wood, Osterley Park, Biggin Hill, Smithfield, Addington, Richmond, Marylebone and more.

Accountant Bromley

Accountant Bromley Accountants Near Me

Accountants Near Me Accountants Bromley

Accountants BromleyMore Greater London Accountants: Hounslow, Barnet, Harrow, Kingston upon Thames, Greenwich, Richmond upon Thames, Bromley, Bexley, Croydon, Enfield, London and Ealing.

TOP - Accountants Bromley - Financial Advisers

Financial Advice Bromley - Small Business Accountants Bromley - Affordable Accountant Bromley - Investment Accountant Bromley - Chartered Accountant Bromley - Tax Accountants Bromley - Tax Return Preparation Bromley - Financial Accountants Bromley - Self-Assessments Bromley