Accountants Dundee: Do you find that completing your annual self-assessment form gives you a headache? A lot of folks in Dundee and throughout the UK have to cope with this every year. You might prefer to track down a local Dundee accountant to do it for you. If you find that doing your self-assessment tax return is too stressful, this might be the best alternative. This should cost you approximately £200-£300 if you use the services of an average Dundee accountant. If this sounds like a lot to you, then think about using an online service.

So, how do you go about acquiring an honest Dundee accountant? The internet seems to be the "in" place to look nowadays, so that would definitely be a good place to begin. But, are they all trustworthy? You should never forget that anyone in Dundee can call themselves an accountant. They are able to offer bookkeeping and accounting services in Dundee whether they've got qualifications or not.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. Membership of the AAT shows that they hold the minimum recommended qualification. Qualified Dundee accountants might charge a bit more but they may also get you the maximum tax savings. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

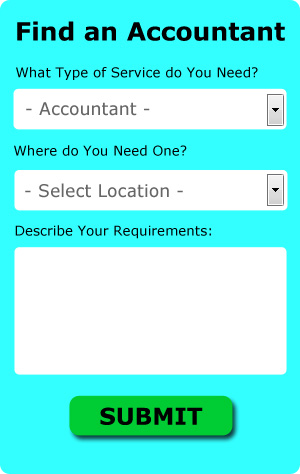

You could use an online service like Bark who will help you find an accountant. You just have to fill in a simple form and answer some basic questions. It is then simply a case of waiting for some suitable responses. Bark offer this service free of charge.

If you prefer the cheaper option of using an online tax returns service there are several available. The popularity of these services has been increasing in recent years. Make a short list of such companies and do your homework to find the most reputable. It should be a simple task to find some online reviews to help you make your choice. Sorry, but we cannot give any recommendations in this respect.

The most highly qualified and generally most expensive within this profession are chartered accountants. However, as a sole trader or smaller business in Dundee using one of these specialists may be a bit of overkill. So, at the end of the day the choice is yours.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Taxshield, Xero, Basetax, Capium, Andica, Ablegatio, Gbooks, CalCal, Taxforward, Sage, TaxCalc, Ajaccts, Keytime, BTCSoftware, ACCTAX, GoSimple, Absolute Topup, Forbes, Taxfiler, 123 e-Filing and Nomisma. Getting your self-assessment form submitted on time is the most important thing. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

Auditors Dundee

An auditor is an individual appointed to review and verify the reliability of financial records and ensure that businesses or organisations observe tax laws. They offer businesses from fraud, highlight discrepancies in accounting strategies and, from time to time, operate on a consultancy basis, helping organisations to identify solutions to boost operational efficiency. For anybody to start working as an auditor they should have certain specified qualifications and be licensed by the regulatory body for auditing and accounting.

Payroll Services Dundee

Dealing with staff payrolls can be a complicated area of running a business enterprise in Dundee, no matter its size. The laws concerning payrolls and the legal requirements for accuracy and openness means that dealing with a company's payroll can be an intimidating task.

Using an experienced accountant in Dundee, to deal with your payroll is a simple way to reduce the workload of your own financial team. A managed payroll service accountant will work alongside HMRC, with pensions schemes and take care of BACS payments to make sure your personnel are always paid on time, and that all required deductions are correct.

Following current regulations, a professional payroll accountant in Dundee will also provide every one of your workers with a P60 tax form after the end of each financial year. At the end of a staff member's contract with your company, the payroll accountant should also provide a current P45 form outlining what tax has been paid during the last financial period. (Tags: Payroll Accountant Dundee, Payroll Services Dundee, Payroll Administrator Dundee).

Tips to Help You Manage Your Business Finances Better

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. You may be thinking that money management is something that you should already be able to do. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. You can be better at money management and if you keep reading, you'll learn a few strategies to help you do so.

Avoid combining your business expenses and personal expenses in one account. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. Make it easy on yourself (or your accountant) by having an account for your business and another for your personal expenses.

Track your expenditures to the penny, and do this in both your personal and professional life. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. With this money management strategy, you can have a clear picture of just what your spending habits are. Nobody likes that feeling of "I know I'm earning money, where is it going?" Writing it down helps you see exactly where it is going, and if you are on a tight budget, it can help you identify areas in which you have the potential to save quite a lot. Then there's the benefit of streamlining things when you're completing tax forms.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. When you do this, however, it's very possible that you'll forget all about the money you took out and then when you're doing your books, you're going to wonder why you're short. You'll be better off putting your money in the bank at the end of each work day.

When you're in business, there are plenty of opportunities for you to improve yourself in the process. For one, you can learn how to manage your finances better. Most people wish they were better money managers. When you learn proper money management, your self-confidence can be helped a lot. In addition, it becomes easier to organize most areas of your professional and personal life. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Dundee accountants will help with business advisory, contractor accounts in Dundee, estate planning Dundee, inheritance tax Dundee, accounting services for landlords, HMRC submissions, business start-ups, business acquisition and disposal, financial planning in Dundee, tax investigations, bookkeeping in Dundee, tax preparation Dundee, monthly payroll, charities Dundee, VAT payer registration, consultancy and systems advice in Dundee, accounting services for media companies in Dundee, financial and accounting advice, taxation accounting services, general accounting services, sole traders in Dundee, auditing and accounting in Dundee, corporate finance, company formations in Dundee, limited company accounting Dundee, assurance services Dundee, partnership registration, bureau payroll services in Dundee, workplace pensions, company secretarial services in Dundee, pension advice Dundee, audit and compliance reporting Dundee and other accounting related services in Dundee, Scotland. These are just an example of the tasks that are conducted by local accountants. Dundee professionals will be delighted to keep you abreast of their whole range of services.

You do, in fact have the best possible resource right at your fingertips in the form of the net. There is such a lot of inspiration and information readily available online for stuff like personal tax assistance, self-assessment help, accounting for small businesses and auditing & accounting, that you will soon be knee-deep in ideas for your accounting needs. A good example could be this enlightening article describing choosing the right accountant.

Dundee Accounting Services

- Dundee Chartered Accountants

- Dundee Bookkeepers

- Dundee Financial Audits

- Dundee Tax Returns

- Dundee Account Management

- Dundee PAYE Healthchecks

- Dundee VAT Returns

- Dundee Business Accounting

- Dundee Tax Refunds

- Dundee Personal Taxation

- Dundee Audits

- Dundee Debt Recovery

- Dundee Payroll Management

- Dundee Tax Advice

Also find accountants in: Fraserburgh, Westhill, Bonnyrigg, Dunfermline, Ellon, Renfrew, Stirling, Edinburgh, Aberdeen, Kirkcaldy, Polmont, Kirkintilloch, Viewpark, East Kilbride, Larkhall, Airdrie, Ayr, Denny, Peterhead, Motherwell, Kilmarnock, Arbroath, Greenock, Rutherglen, Larbert, Penicuik, Jedburgh, Glasgow, Cambuslang, Musselburgh, Stonehaven, Dumfries, Dumbarton, Johnstone, Peebles and more.

Accountant Dundee

Accountant Dundee Accountants Near Dundee

Accountants Near Dundee Accountants Dundee

Accountants DundeeMore Scotland Accountants: Glenrothes, Falkirk, Irvine, Greenock, Livingston, Dunfermline, Aberdeen, Dumfries, Coatbridge, Cumbernauld, Paisley, Edinburgh, Glasgow, Hamilton, Inverness, Airdrie, Motherwell, Stirling, East Kilbride, Kirkcaldy, Dundee, Kilmarnock, Perth and Ayr.

TOP - Accountants Dundee - Financial Advisers

Financial Accountants Dundee - Bookkeeping Dundee - Tax Preparation Dundee - Financial Advice Dundee - Chartered Accountants Dundee - Auditing Dundee - Tax Advice Dundee - Affordable Accountant Dundee - Online Accounting Dundee