Accountants Bloxwich: Do you get nothing but a headache when you're filling out your yearly self-assessment form? Don't worry, you're not the only one, plenty of others in Bloxwich face the same concerns. But how do you track down an accountant in Bloxwich to accomplish this for you? It could be the case that doing your own self-assessment is simply too challenging. The average Bloxwich bookkeeper or accountant will charge about £200-£300 for completing your tax returns. You can unquestionably get it done more cheaply by using online services.

You'll quickly discover that there are various different categories of accountant. Take some time to track down an accountant that matches your specific needs. Another decision you will have to make is whether to go for an accounting firm or an independent accountant. An accountancy company will comprise accountants with different fields of expertise. With an accounting practice you'll have the pick of: financial accountants, bookkeepers, management accountants, auditors, accounting technicians, investment accountants, forensic accountants, tax accountants, actuaries, chartered accountants and cost accountants.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. At the very least you should look for somebody with an AAT qualification. It is worth paying a little more for that extra peace of mind. Accounting fees are of course a business expense and can be included as such on your tax return.

If you want to reach out to a number of local Bloxwich accountants, you could always use a service called Bark. It is just a case of ticking some boxes on a form. In no time at all you will get messages from accountants in the Bloxwich area. And the great thing about Bark is that it is completely free to use.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. For many self-employed people this is a convenient and time-effective solution. Don't simply go with the first company you find on Google, take time to do some research. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. With a chartered accountant you will certainly have the best on your side.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. You could even use a software program like ACCTAX, 123 e-Filing, Gbooks, Forbes, Xero, BTCSoftware, Taxfiler, Absolute Topup, Taxshield, Taxforward, Basetax, Ajaccts, Keytime, CalCal, TaxCalc, Ablegatio, Nomisma, Capium, Sage, GoSimple or Andica to make life even easier. Whichever service you use your tax returns will need to be in on time to avoid penalties. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

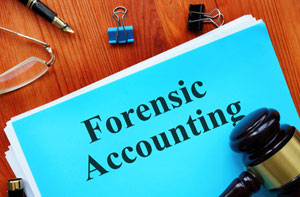

Forensic Accounting Bloxwich

When you happen to be looking to find an accountant in Bloxwich you'll doubtless encounter the phrase "forensic accounting" and be curious about what the differences are between a normal accountant and a forensic accountant. The actual word 'forensic' is the thing that gives it away, meaning literally "denoting or relating to the application of scientific methods and techniques for the investigation of a crime." Also referred to as 'forensic accountancy' or 'financial forensics', it uses investigative skills, auditing and accounting to detect irregularities in financial accounts which have been involved in fraud or theft. Some bigger accounting firms in the Bloxwich area might even have independent forensic accounting divisions with forensic accountants focusing on specific forms of fraud, and could be addressing personal injury claims, bankruptcy, tax fraud, professional negligence, insolvency, money laundering and insurance claims.

Actuaries Bloxwich

An actuary is a business expert who deals with the measurement and managing of risk and uncertainty. These risks can impact a company's balance sheet and call for expert liability management, asset management and valuation skills. To be an actuary it is necessary to possess an economic, mathematical and statistical awareness of day to day scenarios in the world of finance.

The Best Money Management Techniques for Business Self Improvement

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For instance, if you don't manage your finances properly, this can hurt you and your business. You might not think that there is much to money management because in the beginning it might be pretty simple. However, as the business grows, its finances will become complicated, so keep these tips in mind for when you need them.

Hire a good accountant. Don't neglect the importance of having an accountant managing your books full time. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. The great thing is that all the paperwork will be handled by your accountant. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This will actually help you organize and manage your business and personal finances better. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. You can decide how much you should pay yourself. Your salary can be an hourly rate or a portion of your business income.

Don't throw away your receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. They're also records of business related expenses. Keep them all in one central location. Tracking your expenses becomes easy if you have all your receipts in one place. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. You'll benefit a great deal if you remember and put these tips we've shared to use. You're much more likely to experience business and personal success when you have your finances under control.

Bloxwich accountants will help with small business accounting, PAYE in Bloxwich, annual tax returns, accounting support services, accounting services for media companies Bloxwich, HMRC submissions, tax investigations, pension planning, VAT returns, partnership accounts in Bloxwich, business planning and support, assurance services, partnership registrations, capital gains tax, limited company accounting in Bloxwich, payslips, self-employed registrations, bureau payroll services in Bloxwich, year end accounts, business advisory services in Bloxwich, consulting services, sole traders in Bloxwich, investment reviews in Bloxwich, business outsourcing, VAT payer registration, taxation accounting services Bloxwich, mergers and acquisitions, cash flow in Bloxwich, inheritance tax in Bloxwich, double entry accounting, audit and compliance reporting, estate planning and other accounting services in Bloxwich, West Midlands. These are just a few of the tasks that are accomplished by nearby accountants. Bloxwich providers will tell you about their entire range of services.

You actually have the best possible resource at your fingertips in the shape of the internet. There's such a lot of information and inspiration available online for stuff like accounting & auditing, self-assessment help, personal tax assistance and small business accounting, that you will very soon be overwhelmed with ideas for your accounting needs. An example may be this illuminating article outlining 5 tips for selecting a top-notch accountant.

Bloxwich Accounting Services

- Bloxwich Account Management

- Bloxwich Financial Advice

- Bloxwich Payroll Services

- Bloxwich Bookkeeping

- Bloxwich Tax Refunds

- Bloxwich Bookkeeping Healthchecks

- Bloxwich Tax Planning

- Bloxwich Debt Recovery

- Bloxwich Auditing Services

- Bloxwich Tax Returns

- Bloxwich PAYE Healthchecks

- Bloxwich Business Planning

- Bloxwich Taxation Advice

- Bloxwich Chartered Accountants

Also find accountants in: Longford, Kings Hill, Illey, Walsall, Cotteridge, Copt Heath, Wall Heath, Bickenhill, Wergs, Sutton Coldfield, Chad Valley, Upper Eastern Green, Gornalwood, Dudley, Bournbrook, Monmore Green, Darlaston, Pelsall, Balsall Common, Pickford Green, Eastcote, Oldbury, Kings Norton, Woodside, Castle Bromwich, Brownshill Green, Elmdon Heath, Brierley Hill, Smethwick, Edgbaston, Maw Green, Wollaston, Pensnett, Vigo, Northfield and more.

Accountant Bloxwich

Accountant Bloxwich Accountants Near Bloxwich

Accountants Near Bloxwich Accountants Bloxwich

Accountants BloxwichMore West Midlands Accountants: Oldbury, Smethwick, Kingswinford, Blackheath, Sedgley, Wednesfield, Aldridge, Willenhall, Brownhills, Tipton, Darlaston, Coseley, Birmingham, Brierley Hill, Dudley, Solihull, West Bromwich, Wolverhampton, Halesowen, Walsall, Sutton Coldfield, Bilston, Coventry, Wednesbury, Bloxwich, Rowley Regis and Stourbridge.

TOP - Accountants Bloxwich - Financial Advisers

Bookkeeping Bloxwich - Tax Preparation Bloxwich - Investment Accountant Bloxwich - Self-Assessments Bloxwich - Cheap Accountant Bloxwich - Online Accounting Bloxwich - Tax Advice Bloxwich - Auditors Bloxwich - Small Business Accountants Bloxwich