Accountants Bournemouth: Does filling in your annual self-assessment form give you nightmares? This is a common problem for many others in Bournemouth, Dorset. The obvious solution would be to pay a dependable Bournemouth accountant to tackle this job instead. Maybe self-assessment is simply too challenging for you? You should expect to pay roughly two to three hundred pounds for a regular small business accountant. It's possible to get it done more cheaply than this, and using an online service might be a possibility.

So, exactly how should you set about obtaining an accountant in Bournemouth? Nowadays most people commence their hunt for an accountant or any other service on the net. Knowing just who you can trust is of course not quite as easy. You should never forget that anyone in Bournemouth can claim to be an accountant. They do not even need to have any qualifications. Which you may think is rather strange.

If you want your tax returns to be correct and error free it might be better to opt for a professional Bournemouth accountant who is appropriately qualified. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You can then be sure your tax returns are done correctly. Your accountant's fees are tax deductable. It is perfectly acceptable to use a qualified bookkeeper in Bournemouth if you are a sole trader or a smaller business.

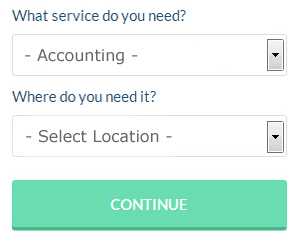

There is a unique online website called Bark which will actually find you a choice of accountants in the Bournemouth area. They provide an easy to fill in form that gives an overview of your requirements. You should start getting responses from local Bournemouth accountants within the next 24 hours. There are absolutely no charges for using this service.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This kind of service may not suit everyone but could be the answer for your needs. Some of these companies are more reputable than others. Carefully read reviews online in order to find the best available. Sorry but we cannot recommend any individual service on this website.

Going from the cheapest service to the most expensive, you could always use a chartered accountant if you are prepared to pay the price. These people are financial experts and are more commonly used by bigger companies. With a chartered accountant you will certainly have the best on your side.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. Using accounting software like Sage, CalCal, Andica, Taxfiler, Capium, TaxCalc, BTCSoftware, Basetax, Taxforward, Ajaccts, 123 e-Filing, Taxshield, ACCTAX, Absolute Topup, GoSimple, Xero, Keytime, Nomisma, Gbooks, Ablegatio or Forbes will make it even simpler to do yourself. Don't leave your self-assessment until the last minute, allow yourself plenty of time.

Payroll Services Bournemouth

For any business enterprise in Bournemouth, from independent contractors to large scale organisations, payrolls for staff can be stressful. The laws relating to payroll for transparency and accuracy mean that processing a business's payroll can be a formidable task for the uninitiated.

All small businesses don't have the help that a dedicated financial specialist can provide, and the simplest way to deal with employee payrolls is to use an independent Bournemouth accounting firm. The payroll service will work along with HMRC and pension providers, and deal with BACS transfers to guarantee accurate and timely payment to all employees.

It will also be a requirement for a payroll management service in Bournemouth to provide a P60 declaration for all workers after the end of the financial year (by May 31st). Upon the termination of an employee's contract with your company, the payroll accountant will supply a current P45 form outlining what tax has been paid during the previous financial period.

Forensic Accounting Bournemouth

Whilst conducting your search for a professional accountant in Bournemouth there's a fair chance that you will stumble upon the phrase "forensic accounting" and be curious about what that is, and how it differs from normal accounting. With the word 'forensic' literally meaning "relating to or denoting the application of scientific methods and techniques for the investigation of a crime", you ought to get a clue as to what is involved. Sometimes also called 'forensic accountancy' or 'financial forensics', it uses accounting, auditing and investigative skills to inspect financial accounts so as to identify criminal activity and fraud. Some bigger accounting firms in the Bournemouth area might even have specialist forensic accounting divisions with forensic accountants targeting certain sorts of fraud, and could be addressing bankruptcy, professional negligence, personal injury claims, tax fraud, money laundering, insolvency and insurance claims.

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. During the initial stages of your business, managing your money may be a simple task. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Start numbering your invoice. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. It makes it easy to track invoices if you have them numbered. You're able to track people who still owe you and for how much and even quickly find out who have already paid. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. It's so much easier to find errors in your invoicing too if you have an invoicing system in place.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This makes the process of accounting your personal and business life so much easier. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. How much should you pay yourself? It's up to you. It can be a percentage of your business income or it can be an hourly rate.

Make sure you account for every penny your business brings in. Keep a record of every payment you get from customers or clients. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You'll benefit a great deal if you remember and put these tips we've shared to use. You're much more likely to experience business and personal success when you have your finances under control.

Bournemouth accountants will help with HMRC submissions, inheritance tax, taxation accounting services Bournemouth, investment reviews in Bournemouth, estate planning in Bournemouth, year end accounts in Bournemouth, HMRC submissions, employment law, personal tax, financial planning, company formations Bournemouth, accounting services for the construction sector, consultancy and systems advice in Bournemouth, bookkeeping in Bournemouth, audit and compliance issues, VAT payer registration, self-assessment tax returns, business support and planning, small business accounting, litigation support, business start-ups Bournemouth, business outsourcing, accounting support services, consulting services, PAYE Bournemouth, mergers and acquisitions in Bournemouth, debt recovery, company secretarial services in Bournemouth, workplace pensions, management accounts in Bournemouth, bureau payroll services, partnership accounts in Bournemouth and other forms of accounting in Bournemouth, Dorset. These are just a small portion of the duties that are carried out by nearby accountants. Bournemouth professionals will be delighted to keep you abreast of their entire range of services.

Bournemouth Accounting Services

- Bournemouth PAYE Healthchecks

- Bournemouth Tax Planning

- Bournemouth Account Management

- Bournemouth Bookkeeping Healthchecks

- Bournemouth Business Accounting

- Bournemouth Tax Advice

- Bournemouth Personal Taxation

- Bournemouth Specialist Tax

- Bournemouth Financial Audits

- Bournemouth Tax Returns

- Bournemouth Debt Recovery

- Bournemouth Tax Refunds

- Bournemouth Financial Advice

- Bournemouth Bookkeepers

Also find accountants in: Tricketts Cross, Higher Kingcombe, Winterbourne Steepleton, Chickerell, Gussage St Michael, Grimstone, Bradford Peverell, Ashley Heath, Spetisbury, Dottery, Boveridge, Burstock, Piddlehinton, Owermoigne, Charmouth, Fifehead Magdalen, Bedchester, Coppleridge, Bincombe, Moreton, Grove, Litton Cheney, West Stour, Norden, Kington Magna, Branksome, Corscombe, Edmondsham, East Burton, West Stafford, Ridge, Stokeford, Tincleton, Okeford Fitzpaine, Kingston Russell and more.

Accountant Bournemouth

Accountant Bournemouth Accountants Near Bournemouth

Accountants Near Bournemouth Accountants Bournemouth

Accountants BournemouthMore Dorset Accountants: Christchurch, Verwood, Bridport, Sherborne, Wimborne Minster, Shaftesbury, Weymouth, Bournemouth, Ferndown, Blandford Forum, Poole, Corfe Mullen, Dorchester, Swanage and Wareham.

TOP - Accountants Bournemouth - Financial Advisers

Bookkeeping Bournemouth - Tax Advice Bournemouth - Self-Assessments Bournemouth - Tax Return Preparation Bournemouth - Online Accounting Bournemouth - Financial Advice Bournemouth - Cheap Accountant Bournemouth - Auditors Bournemouth - Chartered Accountants Bournemouth