Accountants Kirkby: Completing your yearly self-assessment form can be something of a headache. Lots of people in Kirkby and throughout Britain have to cope with this on a yearly basis. But how can you track down a local accountant in Kirkby to do it for you? Perhaps it is simply the case that self-assessment is too complex for you to do on your own. Usually Kirkby High Street accountants will do this for around £220-£300. You will be able to get this done significantly cheaper by using one of the various online services.

So, precisely what is the best way to locate an accountant in Kirkby, and what type of service should you expect? An internet search engine will pretty soon provide a list of possible candidates in Kirkby. However, which of these Kirkby accountants is the best choice for you and which one can be trusted? Always bear in mind that just about any individual in Kirkby can call themselves an accountant. They don't need to have any particular qualifications.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. The extra peace of mind should compensate for any higher costs. Your accountant's fees are tax deductable. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

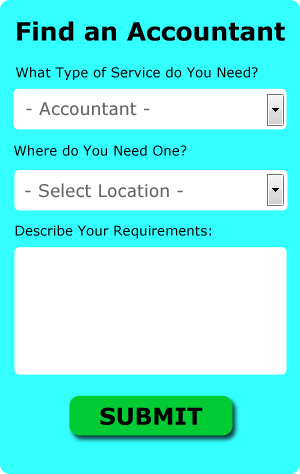

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. You'll be presented with a simple form which can be completed in a minute or two. Your details will be sent out to potential accountants and they will contact you directly with details and prices. At the time of writing this service was totally free.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. More accountants are offering this modern alternative. Some of these companies are more reputable than others. The better ones can soon be singled out by carefully studying reviews online. Sorry but we cannot recommend any individual service on this website.

The very best in this profession are chartered accountants, they will also be the most expensive. These people are financial experts and are more commonly used by bigger companies. So, these are your possible options.

Although filling in your own tax return may seem too complicated, it is not actually that hard. Software is also available to make doing your self-assessment even easier. Some of the best ones include Taxforward, 123 e-Filing, CalCal, Keytime, Nomisma, BTCSoftware, Forbes, ACCTAX, Sage, Absolute Topup, Gbooks, GoSimple, Taxshield, Ajaccts, Capium, Andica, Basetax, Xero, Ablegatio, Taxfiler and TaxCalc. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. You will receive a fine of £100 if you are up to three months late with your tax return.

Small Business Accountants Kirkby

Operating a small business in Kirkby is stressful enough, without having to worry about doing your accounts and other similar bookkeeping chores. A decent small business accountant in Kirkby will provide you with a stress free method to keep your tax returns, VAT and annual accounts in perfect order.

A competent small business accountant in Kirkby will consider that it is their responsibility to develop your business, and offer you reliable financial advice for security and peace of mind in your unique circumstances. An accountancy firm in Kirkby will provide a dedicated small business accountant and mentor who will clear away the fog that shrouds the area of business taxation, in order to improve your tax efficiences.

A small business accountant, to do their job properly, will have to know complete details with regards to your current financial situation, company structure and any potential investment that you may be thinking about, or already have put in place. (Tags: Small Business Accountants Kirkby, Small Business Accountant Kirkby, Small Business Accounting Kirkby).

Actuaries Kirkby

An actuary is a professional who assesses the measurement and managing of risk and uncertainty. An actuary employs financial and statistical hypotheses to evaluate the chances of a certain event taking place and its possible monetary impact. Actuaries provide reviews of financial security systems, with an emphasis on their complexity, their mathematics, and their mechanisms.

Practicing Better Money Management to Help Your Business Succeed

Properly using money management strategies is one of those things that is most difficult to learn when you're just starting a business. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. The truth is that business budgeting and financial planning is quite a lot different from personal budgeting and financial planning (though having experience in the latter can help with the former). Your confidence can take a hard hit if you ruin your finances on accident. You can be better at money management and if you keep reading, you'll learn a few strategies to help you do so.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. This certainly makes it easy for you to pay them because you only have to make one payment every month instead. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. Not only will this help you deal with just one payment and not have to pay interest charges, this will help boost your credit score as well.

Each week, balance your books. But if your business is one where you use registers or you receive multiple payments every day, it might be better if you balance your books at the end of the day every day. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This will save you the trouble of tracking down discrepancies each month or each quarter. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Do you receive cash payments regularly in your business? It may be a good idea to deposit money at the end of the day or as soon as possible. This will minimize the temptation of having money available that you can easily spend. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. You can avoid this problem by putting your cash in your bank account at the end of the day.

Proper money management involves a lot of things. It's not only about keeping a record of when you spent what. When it comes to your business finances, you have many things to keep track of. With the tips above, you'll have an easier time tracking your money. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Payroll Services Kirkby

Dealing with staff payrolls can be a complicated part of running a business in Kirkby, irrespective of its size. Dealing with company payrolls requires that all legal obligations regarding their transparency, timings and exactness are observed to the minutest detail.

A small business may well not have the advantage of a dedicated financial specialist and the simplest way to deal with the issue of staff payrolls is to retain the services of an external accounting firm in Kirkby. The payroll management service will work along with HMRC and pension scheme administrators, and oversee BACS transfers to guarantee accurate and timely payment to all employees.

Following current regulations, a dedicated payroll accountant in Kirkby will also provide every one of your employees with a P60 after the end of each financial year. At the end of a staff member's contract, the payroll company will provide an updated P45 outlining what tax has been paid during the last financial period.

Kirkby accountants will help with charities, double entry accounting Kirkby, employment law, VAT registration, investment reviews, consulting services in Kirkby, business disposal and acquisition, financial and accounting advice, accounting services for the construction sector in Kirkby, payslips in Kirkby, debt recovery in Kirkby, litigation support, tax investigations, business start-ups, workplace pensions Kirkby, bookkeeping, bureau payroll services, accounting and auditing in Kirkby, inheritance tax Kirkby, contractor accounts, annual tax returns, partnership registration in Kirkby, company formations Kirkby, HMRC submissions, monthly payroll, assurance services in Kirkby, corporate finance, accounting services for property rentals Kirkby, sole traders in Kirkby, PAYE Kirkby, business advisory in Kirkby, self-employed registration and other forms of accounting in Kirkby, Merseyside. Listed are just a few of the duties that are handled by local accountants. Kirkby providers will be happy to tell you about their whole range of accountancy services.

Kirkby Accounting Services

- Kirkby VAT Returns

- Kirkby Taxation Advice

- Kirkby Debt Recovery

- Kirkby Auditing

- Kirkby Chartered Accountants

- Kirkby Tax Refunds

- Kirkby Financial Advice

- Kirkby PAYE Healthchecks

- Kirkby Self-Assessment

- Kirkby Bookkeeping Healthchecks

- Kirkby Payroll Management

- Kirkby Business Planning

- Kirkby Account Management

- Kirkby Forensic Accounting

Also find accountants in: Rock Ferry, Halewood, Frankby, Waterloo, Prenton, Ford, Bidston, St Helens, Hightown, Grassendale, Little Crosby, Bootle, Kirkby, Moreton, Southport, Newton Le Willows, Lydiate, Garswood, Clock Face, Sefton, Litherland, New Brighton, Sutton Leach, Eastham, Rainhill, Marshside, Pensby, Bromborough, Heswall, Seaforth, Caldy, Netherton, Billinge, Ince Blundell, Wallasey and more.

Accountant Kirkby

Accountant Kirkby Accountants Near Kirkby

Accountants Near Kirkby Accountants Kirkby

Accountants KirkbyMore Merseyside Accountants: Crosby, Maghull, Birkenhead, Southport, Bebington, Liverpool, St Helens, Halewood, Haydock, Heswall, Bootle, Newton-le-Willows, Wallasey, Litherland, Prescot, Kirkby and Formby.

TOP - Accountants Kirkby - Financial Advisers

Self-Assessments Kirkby - Financial Advice Kirkby - Investment Accounting Kirkby - Chartered Accountant Kirkby - Affordable Accountant Kirkby - Tax Advice Kirkby - Small Business Accountant Kirkby - Financial Accountants Kirkby - Bookkeeping Kirkby