Accountants Horley: For those of you who are self-employed in Horley, a major headache every year is filling out your annual self-assessment form. This can be a challenge for you and plenty of other Horley people in self-employment. Is it a better idea to get someone else to do this job for you? If self-assessment is too complex for you, this could be the way forward. The average Horley accountant or bookkeeper will charge about £200-£300 for doing your tax returns. Those who consider this too expensive have the alternative option of using an online tax return service.

You will find various kinds of accountants in the Horley area. A local accountant who perfectly meets your requirements is the one you should be looking for. A lot of accountants work on their own, while others are part of a larger accounting business. Accounting practices will typically have different departments each dealing with a certain discipline of accounting. The level of specialization within a practice could include investment accountants, costing accountants, bookkeepers, chartered accountants, actuaries, accounting technicians, management accountants, tax preparation accountants, auditors, forensic accountants and financial accountants.

It is advisable for you to find an accountant in Horley who is properly qualified. For simple self-assessment work an AAT qualification is what you need to look for. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. You will be able to claim the cost of your accountant as a tax deduction.

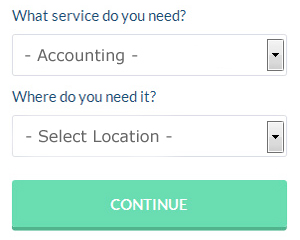

There is now a service available known as Bark, where you can look for local professionals including accountants. Filling in a clear and simple form is all that you need to do to set the process in motion. You should start getting responses from local Horley accountants within the next 24 hours. Make the most of this service because it is free.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. A number of self-employed people in Horley prefer to use this simple and convenient alternative. Some of these companies are more reputable than others. The easiest way to do this is by studying online reviews. This is something you need to do yourself as we do not wish to favour any particular service here.

While possibly a little over the top for a small business, using a chartered accountant is another option. Smaller businesses and sole traders will probably not need to aim quite this high. So, at the end of the day the choice is yours.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. Software is also available to make doing your self-assessment even easier. Some of the best ones include ACCTAX, Ajaccts, Basetax, GoSimple, CalCal, TaxCalc, Forbes, Nomisma, Keytime, Gbooks, BTCSoftware, Capium, 123 e-Filing, Taxshield, Xero, Taxforward, Andica, Sage, Taxfiler, Ablegatio and Absolute Topup. If you don't get your self-assessment in on time you will get fined by HMRC. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Forensic Accounting Horley

During your search for a competent accountant in Horley there is a pretty good chance that you will stumble upon the term "forensic accounting" and be curious about what that is, and how it differs from normal accounting. With the actual word 'forensic' meaning literally "relating to or denoting the application of scientific methods and techniques for the investigation of criminal activity", you will get an idea as to precisely what is involved. Using investigative skills, auditing and accounting to detect irregularities in financial accounts that have been involved in theft or fraud, it is also occasionally referred to as 'financial forensics' or 'forensic accountancy'. Some of the larger accountancy firms in and near to Horley have even got specialised departments addressing professional negligence, personal injury claims, tax fraud, insolvency, money laundering, insurance claims and bankruptcy.

Payroll Services Horley

Staff payrolls can be a challenging area of running a business in Horley, irrespective of its size. Controlling company payrolls requires that all legal requirements in relation to their exactness, openness and timing are observed in all cases.

Not all small businesses have their own in-house financial experts, and a simple way to handle employee payrolls is to retain the services of an outside Horley accountant. The payroll service will work along with HMRC and pension providers, and take care of BACS payments to ensure accurate and timely wage payment to all employees.

It will also be necessary for a decent payroll accountant in Horley to prepare an accurate P60 tax form for all employees at the end of the financial year (by May 31st). They will also be responsible for providing P45 tax forms at the termination of an employee's working contract.

Developing Better Money Management Skills for Improving Yourself and Your Business

Many people find that putting up a business is very exciting. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! Now that can be a little scary! However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. If you'd like to keep your finances in order, continue reading this article.

Have an account that's just for your business expenses and another for your personal expenses. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. Streamline your process with two accounts.

Track your personal and business expenditures down to the last cent. Yes, it is a pain to track every little thing you buy, but it is quite helpful. When you meticulously record every expenditure you make, whether personal or business related, you can keep an eye on your spending habits. No one likes to have that feeling of "I'm making decent money, but where is it?" This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Every single time you receive a payment, write down that you have been paid and how much. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. This money management strategy also makes it a lot easier on you to determine the amount of money you owe in taxes and even how much money you should pay yourself.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. So make sure you use the tips on proper money management that we mentioned in this article. If you want your business to be a success, it's important that you develop money management skills.

Horley accountants will help with assurance services, investment reviews, accounting and auditing, inheritance tax, company secretarial services Horley, payroll accounting, HMRC submissions Horley, business outsourcing Horley, accounting support services, HMRC liaison in Horley, business acquisition and disposal, accounting services for media companies in Horley, payslips, partnership accounts in Horley, National Insurance numbers, corporate finance, personal tax, tax preparation, general accounting services Horley, workplace pensions, corporation tax, accounting and financial advice, self-employed registrations, audit and compliance issues, double entry accounting, management accounts, year end accounts, financial planning, tax investigations in Horley, business support and planning, VAT registration Horley, company formations and other kinds of accounting in Horley, Surrey. These are just some of the tasks that are performed by local accountants. Horley professionals will be happy to tell you about their full range of accounting services.

By using the world wide web as an unlimited resource it is of course possible to uncover a host of invaluable information and ideas concerning self-assessment help, auditing & accounting, accounting for small businesses and personal tax assistance. For instance, with a quick search we located this illuminating article on choosing an accountant.

Horley Accounting Services

- Horley Personal Taxation

- Horley Tax Services

- Horley Tax Investigations

- Horley Taxation Advice

- Horley Tax Refunds

- Horley Audits

- Horley PAYE Healthchecks

- Horley VAT Returns

- Horley Financial Advice

- Horley Payroll Services

- Horley Business Accounting

- Horley Debt Recovery

- Horley Bookkeepers

- Horley Specialist Tax

Also find accountants in: Mickleham, New Haw, Lower Bourne, Shipley Bridge, Smallfield, Ash, Spreakley, Stanwell, South Holmwood, Shere, Chelsham, Caterham, Salfords, Busbridge, Dormansland, Esher, Laleham, Ramsnest Common, Nutfield, Normandy, Charleshill, Holland, Sutton, Chobham, Camelsdale, Hindhead, Albury, Puttenham, Fetcham, Hurst Green, Alfold, Weston Green, Elstead, North Holmwood, Wonersh and more.

Accountant Horley

Accountant Horley Accountants Near Me

Accountants Near Me Accountants Horley

Accountants HorleyMore Surrey Accountants: Dorking, Addlestone, Horley, Godalming, Redhill, Sunbury-on-Thames, Reigate, Chertsey, Ash, Caterham, Banstead, Camberley, Ewell, Leatherhead, Hersham, Woking, Staines, Guildford, Esher, Windlesham, Molesey, Walton-on-Thames, Cranleigh, Weybridge, Haslemere, Epsom and Farnham.

TOP - Accountants Horley - Financial Advisers

Auditors Horley - Financial Accountants Horley - Small Business Accountant Horley - Bookkeeping Horley - Chartered Accountant Horley - Cheap Accountant Horley - Investment Accountant Horley - Online Accounting Horley - Tax Preparation Horley