Accountants Scunthorpe: Anyone operating a business in Scunthorpe, Lincolnshire will soon realise that there are numerous advantages to having an accountant at the end of the phone. By handling some of those mundane financial tasks such as bookkeeping and tax returns you accountant will be able to free up extra time for you to concentrate your attention on your main business. The importance of getting this kind of financial assistance cannot be overstated, especially for start-ups and fledgling businesses that are not yet established.

There are different types of accountants found in Scunthorpe. Consequently, it is vital to identify an accountant who can fulfil your requirements. You may prefer to pick one who works independently or one within a practice or firm. An accounting company will comprise accountants with varying fields of expertise. Some of the principal accountancy positions include the likes of: auditors, management accountants, chartered accountants, investment accountants, actuaries, accounting technicians, tax preparation accountants, forensic accountants, costing accountants, financial accountants and bookkeepers.

It is advisable for you to find an accountant in Scunthorpe who is properly qualified. The AAT qualification is the minimum you should look for. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. You will of course get a tax deduction on the costs involved in preparing your tax returns.

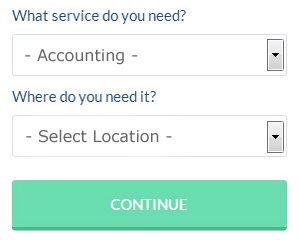

There is now a service available known as Bark, where you can look for local professionals including accountants. A couple of minutes is all that is needed to complete their simple and straighforward search form. Sometimes in as little as a couple of hours you will hear from prospective Scunthorpe accountants who are keen to get to work for you.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. An increasing number of self-employed people are plumping for this option. You still need to pick out a company offering a reliable and professional service. It should be a simple task to find some online reviews to help you make your choice. We are unable to advocate any individual accounting services on this site.

The cheapest option of all is to do your own self-assessment form. To make life even easier there is some intuitive software that you can use. Including BTCSoftware, Andica, Xero, Nomisma, Basetax, GoSimple, Absolute Topup, Gbooks, Sage, Ajaccts, Taxfiler, Forbes, TaxCalc, Taxshield, ACCTAX, Keytime, Capium, Ablegatio, 123 e-Filing, Taxforward and CalCal. You'll receive a fine if your self-assessment is late. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Forensic Accountant Scunthorpe

You could well encounter the term "forensic accounting" when you are looking for an accountant in Scunthorpe, and will perhaps be interested to know about the difference between forensic accounting and regular accounting. The hint for this is the word 'forensic', which essentially means "appropriate for use in a court of law." Using investigative skills, auditing and accounting to detect discrepancies in financial accounts that have lead to fraud or theft, it is also often referred to as 'financial forensics' or 'forensic accountancy'. Some of the bigger accountancy companies in and around Scunthorpe even have specialised sections addressing personal injury claims, tax fraud, professional negligence, money laundering, bankruptcy, insolvency and insurance claims.

How to Be a Better Money Manager for Your Business

Making a decision to put up your business is not hard, but knowing exactly how to start it is, and actually getting it up and running is much harder. During the course of your business, so many things can happen that can erode your business and self-confidence, and this is where many business owners have the hardest time. For instance, if you don't manage your finances properly, this can hurt you and your business. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

Offer your clients payment plans. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. This is easier to count on than money that comes in in giant bursts with long dry spells between them. If you have steady income coming in, you're in a better position to plan your budget, get your bills paid on time, and properly manage your money in general. If you're in control of your business finances, you'll feel more self-confident.

Be a prompt tax payer. Small business generally have to pay taxes every three months. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. The last thing you need is to have the IRS coming after you for tax evasion!

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. So keep in mind the tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Small Business Accountants Scunthorpe

Making sure your accounts are accurate and up-to-date can be a demanding job for anyone running a small business in Scunthorpe. A focused small business accountant in Scunthorpe will offer you a stress free approach to keep your annual accounts, tax returns and VAT in perfect order.

Offering guidance, making sure that your business follows the best fiscal practices and suggesting techniques to help your business to reach its full potential, are just some of the duties of an honest small business accountant in Scunthorpe. An accountancy firm in Scunthorpe should provide an allocated small business accountant and adviser who will clear away the haze that veils business taxation, so as to optimise your tax efficiences.

It is crucial that you clarify your plans for the future, your current financial situation and the structure of your business accurately to your small business accountant. (Tags: Small Business Accounting Scunthorpe, Small Business Accountants Scunthorpe, Small Business Accountant Scunthorpe).

Actuaries Scunthorpe

Analysts and actuaries are professionals in risk management. They employ their knowledge of economics and business, in conjunction with their expertise in probability theory, statistics and investment theory, to provide strategic, commercial and financial guidance. An actuary uses statistics and math to appraise the financial effect of uncertainty and help their customers limit risk. (Tags: Financial Actuary Scunthorpe, Actuaries Scunthorpe, Actuary Scunthorpe)

Auditors Scunthorpe

Auditors are professionals who review the accounts of businesses and organisations to ascertain the legality and validity of their financial records. They also sometimes take on an advisory role to suggest possible risk prevention measures and the application of cost savings. For anyone to become an auditor they should have certain specified qualifications and be certified by the regulating body for auditing and accounting. (Tags: Auditing Scunthorpe, Auditor Scunthorpe, Auditors Scunthorpe)

Scunthorpe accountants will help with accounting services for media companies, tax preparation, management accounts, employment law in Scunthorpe, capital gains tax, accounting services for start-ups in Scunthorpe, partnership registration, VAT returns, year end accounts in Scunthorpe, payroll accounting, mergers and acquisitions in Scunthorpe, tax investigations, assurance services in Scunthorpe, general accounting services, payslips, company secretarial services, financial and accounting advice in Scunthorpe, taxation accounting services, investment reviews, accounting services for buy to let landlords, financial statements Scunthorpe, personal tax in Scunthorpe, litigation support, consulting services in Scunthorpe, business planning and support in Scunthorpe, sole traders, pension planning Scunthorpe, bureau payroll services in Scunthorpe, annual tax returns, financial planning, corporate tax in Scunthorpe, inheritance tax Scunthorpe and other types of accounting in Scunthorpe, Lincolnshire. Listed are just an example of the duties that are undertaken by local accountants. Scunthorpe professionals will be happy to inform you of their entire range of services.

Scunthorpe Accounting Services

- Scunthorpe Debt Recovery

- Scunthorpe Tax Advice

- Scunthorpe Tax Refunds

- Scunthorpe Payroll Services

- Scunthorpe PAYE Healthchecks

- Scunthorpe Bookkeeping Healthchecks

- Scunthorpe Tax Returns

- Scunthorpe Tax Services

- Scunthorpe Personal Taxation

- Scunthorpe Account Management

- Scunthorpe Specialist Tax

- Scunthorpe Tax Planning

- Scunthorpe VAT Returns

- Scunthorpe Business Accounting

Also find accountants in: Sutton On Sea, Scawby, Wilsthorpe, Bitchfield, Brattleby, Silk Willoughby, East Keal, Grimsby, Strubby, Washingborough, High Toynton, Great Steeping, Barnoldby Le Beck, Broughton, Old Somerby, Hainton, South Witham, Surfleet Seas End, Ancaster, Welbourn, Bracebridge Heath, Horncastle, Stainby, Scothern, Swayfield, Skeldyke, Thornton Le Moor, Horkstow, Trusthorpe, Brigg, Martin, Burringham, Doddington, Dembleby, Ewerby Thorpe and more.

Accountant Scunthorpe

Accountant Scunthorpe Accountants Near Scunthorpe

Accountants Near Scunthorpe Accountants Scunthorpe

Accountants ScunthorpeMore Lincolnshire Accountants: Boston, Grantham, Stamford, Gainsborough, Grimsby, Sleaford, Cleethorpes, Lincoln, Spalding, Scunthorpe and Skegness.

TOP - Accountants Scunthorpe - Financial Advisers

Self-Assessments Scunthorpe - Financial Accountants Scunthorpe - Investment Accountant Scunthorpe - Chartered Accountants Scunthorpe - Online Accounting Scunthorpe - Small Business Accountants Scunthorpe - Financial Advice Scunthorpe - Cheap Accountant Scunthorpe - Tax Preparation Scunthorpe