Accountants Chigwell: Having a qualified accountant to keep an eye on your finances brings several advantages to anybody running a small business in Chigwell or for that matter anywhere else in the United Kingdom. At the very least your accountant can handle important tasks like completing your tax returns and keeping your books up to date, giving you more hours to concentrate on your business. The importance of having a qualified accountant by your side cannot be overstated. The wellbeing and prosperity of your company in Chigwell could be influenced by you getting the correct help and advice.

With various different types of accountants working in Chigwell it can be baffling. Your aim is to choose one that matches your exact requirements. Some accountants in the Chigwell area work independently, whilst others might be part of a larger accounting business. With an accountancy firm there should always be someone on hand to handle any field of accounting. With an accounting practice you'll have the choice of: cost accountants, accounting technicians, financial accountants, bookkeepers, actuaries, management accountants, forensic accountants, tax accountants, chartered accountants, investment accountants and auditors.

To get the job done correctly you should search for a local accountant in Chigwell who has the right qualifications. An AAT qualified accountant should be adequate for sole traders and small businesses. Qualified Chigwell accountants might charge a bit more but they may also get you the maximum tax savings. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. A lot of smaller businesses in Chigwell choose to use bookkeepers rather than accountants.

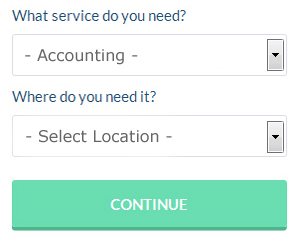

There is now a service available known as Bark, where you can look for local professionals including accountants. In no time at all you can fill out the job form and submit it with a single click. Just sit back and wait for the responses to roll in.

If you prefer the cheaper option of using an online tax returns service there are several available. An increasing number of self-employed people are plumping for this option. Make a short list of such companies and do your homework to find the most reputable. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Sage, Capium, Nomisma, Absolute Topup, Forbes, Ablegatio, GoSimple, Taxforward, ACCTAX, CalCal, Taxshield, Basetax, Xero, Taxfiler, Andica, Keytime, Gbooks, BTCSoftware, 123 e-Filing, TaxCalc and Ajaccts. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Forensic Accounting Chigwell

You may well run into the term "forensic accounting" when you are looking for an accountant in Chigwell, and will probably be interested to know about the distinction between normal accounting and forensic accounting. The clue for this is the actual word 'forensic', which essentially means "appropriate for use in a court of law." Also called 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to detect discrepancies in financial accounts that have lead to fraud or theft. There are even a few bigger accountants firms throughout Essex who have specialist departments for forensic accounting, addressing professional negligence, insolvency, bankruptcy, money laundering, falsified insurance claims, personal injury claims and tax fraud. (Tags: Forensic Accountant Chigwell, Forensic Accounting Chigwell, Forensic Accountants Chigwell)

Tips to Help You Manage Your Money Better

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Nonetheless, this aspect of business is something that people find overwhelming despite the fact that many of them have successfully used a budget in managing their personal finances. Luckily there are plenty of things that you can do to make it easier on yourself. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. To prevent yourself from coming up short, set money aside with every payment your receive. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You never want to be late in paying your taxes and this simple money management strategy will help you avoid paying late because you don't have the funds to make the payment on time.

Give your clients the choice to pay in installments. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. This is a lot better than having payments come in sporadically. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. This is a great boost to your confidence.

Control your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. Buy your office supplies in bulk. When it comes to your business equipment, you will save more by investing in quality machines even if they may require a huge cash outlay from you in the beginning. The savings will come in the form of not having to buy a new one or replace parts frequently. You'll also need to be careful about how much money you spend on entertainment.

You can improve yourself in many ways when you're managing your own business. For one, you can improve how you manage your money. Everybody wishes that they could be better with money. Your confidence stands to gain a lot when you get better at managing your finances. You'll also be able to organize many aspects of your business and personal life. Implement the tips we shared in this article and you're sure to see good results in the long run.

Small Business Accountants Chigwell

Making certain that your accounts are accurate and up-to-date can be a stressful job for any small business owner in Chigwell. If your annual accounts are getting on top of you and VAT and tax return issues are causing you sleepless nights, it is wise to employ a decent small business accountant in Chigwell.

Offering advice, making sure that your business adheres to the best financial practices and suggesting techniques to help your business reach its full potential, are just some of the duties of a reputable small business accountant in Chigwell. A decent accounting firm in Chigwell will give proactive small business guidance to optimise your tax efficiency while at the same time lowering costs; crucial in the sometimes shadowy sphere of business taxation.

You should also be offered a dedicated accountancy manager who has a deep understanding of your plans for the future, your company's circumstances and the structure of your business.

Chigwell accountants will help with debt recovery, cash flow, accounting services for buy to let property rentals, bureau payroll services Chigwell, small business accounting, business advisory services Chigwell, auditing and accounting in Chigwell, accounting services for media companies, general accounting services, bookkeeping, consulting services in Chigwell, HMRC submissions, tax preparation in Chigwell, company secretarial services Chigwell, consultancy and systems advice, pension advice, PAYE, self-employed registrations Chigwell, company formations, accounting services for the construction industry, estate planning, sole traders in Chigwell, business support and planning, corporation tax, employment law, VAT returns Chigwell, partnership registration Chigwell, corporate finance, business start-ups, tax returns, tax investigations, workplace pensions and other accounting services in Chigwell, Essex. Listed are just some of the activities that are undertaken by nearby accountants. Chigwell specialists will be happy to tell you about their whole range of accounting services.

Chigwell Accounting Services

- Chigwell Business Accounting

- Chigwell Bookkeeping

- Chigwell PAYE Healthchecks

- Chigwell Chartered Accountants

- Chigwell Personal Taxation

- Chigwell Payroll Management

- Chigwell Auditing Services

- Chigwell Tax Services

- Chigwell Account Management

- Chigwell Debt Recovery

- Chigwell Tax Planning

- Chigwell Tax Returns

- Chigwell Specialist Tax

- Chigwell Business Planning

Also find accountants in: Feering, Oxen End, Black Notley, Shotgate, Layer De La Haye, Battlesbridge, Little Thurrock, Tiptree Heath, Wickham St Paul, Rochford, Little Parndon, Epping Green, Little Baddow, Layer Breton, Eight Ash Green, Hatfield Heath, Potter Street, Castle Hedingham, Langley, Althorne, North Stifford, Fordham, Birdbrook, Bocking Churchstreet, Hadstock, Cold Norton, Tolleshunt Darcy, Little Tey, Hutton, Monk Street, Wicken Bonhunt, Great Tey, Basildon, Dengie, Little Horkesley and more.

Accountant Chigwell

Accountant Chigwell Accountants Near Me

Accountants Near Me Accountants Chigwell

Accountants ChigwellMore Essex Accountants: Chelmsford, Harlow, Corringham, Stanway, South Benfleet, Walton-on-the-Naze, Frinton-on-Sea, South Woodham Ferrers, Danbury, Coggeshall, Rochford, Galleywood, Rainham, Great Wakering, Billericay, Parkeston, Witham, Maldon, Langdon Hills, Tilbury, Rayleigh, Heybridge, Upminster, Chafford Hundred, Waltham Abbey, Colchester, West Thurrock, South Ockendon, Manningtree, Hadleigh, Clacton-on-Sea, Romford, Tiptree, Saffron Walden, Brentwood, Southend-on-Sea, Pitsea, Stansted Mountfitchet, Canvey Island, North Weald Bassett, Ingatestone, Southchurch, Great Dunmow, Great Baddow, Loughton, West Mersea, Hockley, Stanford-le-Hope, Buckhurst Hill, Westcliff-on-Sea, Barking, Burnham-on-Crouch, Wickford, Dagenham, Chipping Ongar, Hornchurch, Leigh-on-Sea, Brightlingsea, Purfleet, Hawkwell, Shoeburyness, Epping, Chigwell, Hullbridge, Grays, Ilford, Holland-on-Sea, Southminster, Wivenhoe, Basildon, Laindon, Writtle, Chingford, Harwich, Braintree and Halstead.

TOP - Accountants Chigwell - Financial Advisers

Bookkeeping Chigwell - Financial Advice Chigwell - Self-Assessments Chigwell - Tax Advice Chigwell - Tax Preparation Chigwell - Auditing Chigwell - Affordable Accountant Chigwell - Online Accounting Chigwell - Investment Accountant Chigwell