Accountants Bishop Auckland: Have you found that filling in your self-assessment form every year is a bit of a headache? A lot of people in Bishop Auckland have the same problem as you. Of course, you could always get yourself a local Bishop Auckland accountant to do this task instead. Is self-assessment just too complicated for you? The average Bishop Auckland accountant or bookkeeper will charge about £200-£300 for doing your tax returns. By utilizing an online service instead of a local Bishop Auckland accountant you can save quite a bit of cash.

When looking for an accountant in Bishop Auckland, you'll find there are different types. Therefore, picking the right one for your business is vital. You may choose to pick one who works alone or one within a larger firm or practice. Each field of accounting will have their own specialists within an accountancy firm. With an accountancy practice you will have the choice of: actuaries, accounting technicians, management accountants, forensic accountants, tax accountants, investment accountants, bookkeepers, chartered accountants, auditors, financial accountants and costing accountants.

You would be best advised to find a fully qualified Bishop Auckland accountant to do your tax returns. Ask if they at least have an AAT qualification or higher. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction.

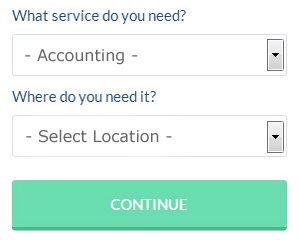

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You will quickly be able to complete the form and your search will begin. It is then simply a case of waiting for some suitable responses. At the time of writing this service was totally free.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. Services like this are convenient and cost effective. Should you decide to go down this route, take care in choosing a legitimate company. Be sure to study customer reviews and testimonials.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Ajaccts, Absolute Topup, Basetax, GoSimple, TaxCalc, ACCTAX, Xero, Keytime, Forbes, Ablegatio, Capium, BTCSoftware, Taxshield, Taxfiler, CalCal, Gbooks, Sage, 123 e-Filing, Nomisma, Taxforward and Andica. Whatever happens you need to get your self-assessment form in on time. Penalties start at £100 and rise considerably if you are more that 3 months late.

Developing Better Money Management Skills for Improving Yourself and Your Business

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. Being able to manage money may seem like a skill you should already possess before you go into business. The truth is that business budgeting and financial planning is quite a lot different from personal budgeting and financial planning (though having experience in the latter can help with the former). Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. Continue reading if you want to know how you can better manage your business finances.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. You may not have problems in the beginning, but you can expect to have a hard time down the road. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Make it easy on yourself (or your accountant) by having an account for your business and another for your personal expenses.

Track both your personal and business expenses down to the last penny. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you keep a detailed record of where you're spending your money, you'll be able to get a clear picture of your spending habits. Many people are earning decent money but they have poor money management skills that they often find themselves wondering where all their money has gone. If you keep a record of all your expenditures, you know exactly where you're spending your money. If your budget is a little too tight, you'll be able to identify expenditures that you can cut back on to save money. Then there's the benefit of streamlining things when you're completing tax forms.

Track every single penny you bring in. Whenever a client or customer pays you, record that payment. This is important for two reasons: one, you need to know how much money you have coming in, and two, you need to be able to track who has paid you and who still needs to pay you. This also helps you determine how much taxes you should pay, what salary you should pay yourself, and so on.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. These are a few of the tips and tricks that will help you better keep track of your financial situation. You're in a much better position for business and personal success when you know how to manage your finances better.

Financial Actuaries Bishop Auckland

Actuaries work alongside government departments and companies, to help them in forecasting long-term financial expenditure and investment risks. They apply their mathematical skills to estimate the risk and probability of future events and to estimate their financial effect on a business and their clientele. Actuaries deliver evaluations of financial security systems, with an emphasis on their mechanisms, complexity and mathematics.

Bishop Auckland accountants will help with sole traders, partnership accounts, mergers and acquisitions in Bishop Auckland, tax investigations, accounting and auditing Bishop Auckland, estate planning, limited company accounting, cashflow projections, general accounting services, consulting services, year end accounts, partnership registration in Bishop Auckland, accounting services for media companies in Bishop Auckland, inheritance tax in Bishop Auckland, PAYE Bishop Auckland, litigation support, charities, financial statements, accounting services for buy to let landlords, employment law, corporate tax Bishop Auckland, business planning and support, bookkeeping in Bishop Auckland, investment reviews in Bishop Auckland, corporate finance, personal tax, audit and compliance issues, business disposal and acquisition, tax preparation, monthly payroll, tax returns Bishop Auckland, VAT payer registration and other kinds of accounting in Bishop Auckland, County Durham. Listed are just some of the tasks that are accomplished by local accountants. Bishop Auckland providers will keep you informed about their whole range of accountancy services.

Bishop Auckland Accounting Services

- Bishop Auckland Bookkeepers

- Bishop Auckland Auditing

- Bishop Auckland Tax Investigations

- Bishop Auckland Tax Advice

- Bishop Auckland Tax Returns

- Bishop Auckland Specialist Tax

- Bishop Auckland Debt Recovery

- Bishop Auckland Tax Refunds

- Bishop Auckland PAYE Healthchecks

- Bishop Auckland Self-Assessment

- Bishop Auckland Tax Planning

- Bishop Auckland Personal Taxation

- Bishop Auckland Financial Advice

- Bishop Auckland Tax Services

Also find accountants in: Burnopfield, Middleton, Walworth, Trimdon Colliery, South Hetton, Ingleton, Seaton, Shotton Colliery, Brignall, Grassholme, Westgate, Wynyard, Byers Green, Whitton, Startforth, High Coniscliffe, Beamish, Medomsley, Haughton Le Skerne, Billingham, Wolviston, Cotherstone, Iveston, Witton Park, St Johns, Denton, Eggleston, Barningham, Kelloe, Stillington, Greencroft Hall, Wheatley Hill, Hury, Ushaw Moor, Ebchester and more.

Accountant Bishop Auckland

Accountant Bishop Auckland Accountants Near Bishop Auckland

Accountants Near Bishop Auckland Accountants Bishop Auckland

Accountants Bishop AucklandMore County Durham Accountants: Billingham, Durham, Stanley, Newton Aycliffe, Stockton-on-Tees, Seaham, Darlington, Consett, Hartlepool, Peterlee, Chester-le-Street and Bishop Auckland.

TOP - Accountants Bishop Auckland - Financial Advisers

Self-Assessments Bishop Auckland - Investment Accountant Bishop Auckland - Auditing Bishop Auckland - Online Accounting Bishop Auckland - Bookkeeping Bishop Auckland - Chartered Accountant Bishop Auckland - Affordable Accountant Bishop Auckland - Tax Accountants Bishop Auckland - Tax Preparation Bishop Auckland