Accountants Woking: You can take away a certain amount of of the stress of running a business in Woking, by retaining the expert services of a qualified accountant. One of the major advantages will be that with your accountant handling the routine paperwork and bookkeeping, you should have a lot more free time to devote to what you do best, the actual operation of your business. The benefits of this type of professional help far exceeds the extra costs involved.

There are several different disciplines of accounting. A local accountant who perfectly matches your requirements is the one you should be searching for. It is possible that you may opt to work with an accountant who's working within a local Woking accountancy firm, rather than one that works by himself/herself. Having several accounting experts together within a practice can have many benefits. Among the key accounting jobs are: tax preparation accountants, financial accountants, cost accountants, bookkeepers, chartered accountants, auditors, accounting technicians, actuaries, investment accountants, management accountants and forensic accountants.

Finding an accountant in Woking who is qualified is generally advisable. An AAT qualified accountant should be adequate for sole traders and small businesses. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant's fees are tax deductable.

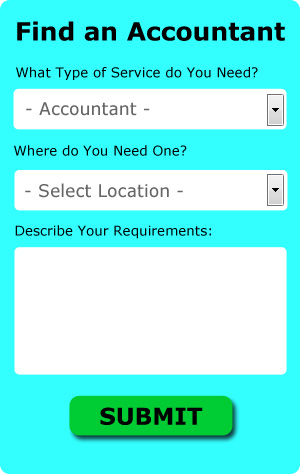

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. A couple of minutes is all that is needed to complete their simple and straighforward search form. Sometimes in as little as a couple of hours you will hear from prospective Woking accountants who are keen to get to work for you. Why not give Bark a try since there is no charge for this useful service.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. More accountants are offering this modern alternative. You still need to pick out a company offering a reliable and professional service. Study online reviews so that you can get an overview of the services available. We will not be recommending any individual online accounting service in this article.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! You could even use a software program like Taxforward, Basetax, Andica, BTCSoftware, ACCTAX, Sage, Ajaccts, CalCal, Xero, Keytime, 123 e-Filing, Absolute Topup, Taxfiler, Capium, Forbes, Gbooks, Taxshield, TaxCalc, Ablegatio, GoSimple or Nomisma to make life even easier. The most important thing is to make sure your self-assessment is sent in promptly.

How Managing Your Money Better Makes You a Better Business Owner

It's not so hard to make a decision to start your own business. However, it's not so easy to start it up if you don't know how to, and it's even harder to get it up and running actually. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This way, you won't have a hard time keeping track of your business and personal finances. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. Just how much money you pay yourself is completely up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Don't be late in paying your taxes. Small business generally have to pay taxes every three months. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. The only way you won't get that dreaded visit from the IRS is if you're paying your taxes.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. If you want your business to be profitable, you need to stay on top of your finances.

Actuary Woking

Analysts and actuaries are business professionals in the management of risk. They employ their wide-ranging knowledge of economics and business, along with their understanding of statistics, investment theory and probability theory, to provide strategic, financial and commercial advice. To work as an actuary it is important to have a statistical, economic and mathematical awareness of everyday scenarios in the world of business finance. (Tags: Actuary Woking, Financial Actuary Woking, Actuaries Woking)

Auditors Woking

Auditors are professionals who assess the accounts of organisations and businesses to verify the legality and validity of their financial reports. Auditors assess the fiscal actions of the firm that employs them and make certain of the constant running of the organisation. To become an auditor, an individual must be certified by the regulating body for auditing and accounting and possess certain specific qualifications. (Tags: Auditing Woking, Auditors Woking, Auditor Woking)

Woking accountants will help with partnership registration, workplace pensions, taxation accounting services Woking, litigation support Woking, small business accounting Woking, company formations, HMRC submissions, payslips in Woking, HMRC submissions, employment law, compliance and audit reporting Woking, accounting services for media companies, National Insurance numbers Woking, tax investigations, consulting services in Woking, self-employed registrations, accounting services for landlords, business planning and support, bookkeeping in Woking, payroll accounting, year end accounts, financial planning, business disposal and acquisition, tax preparation, accounting and financial advice Woking, investment reviews, pension planning, accounting services for the construction sector, corporate finance, inheritance tax, contractor accounts, double entry accounting Woking and other kinds of accounting in Woking, Surrey. These are just a selection of the activities that are handled by local accountants. Woking providers will be happy to inform you of their entire range of services.

Woking Accounting Services

- Woking VAT Returns

- Woking Payroll Management

- Woking Business Accounting

- Woking Financial Audits

- Woking PAYE Healthchecks

- Woking Tax Refunds

- Woking Tax Advice

- Woking Account Management

- Woking Bookkeeping Healthchecks

- Woking Tax Planning

- Woking Forensic Accounting

- Woking Chartered Accountants

- Woking Personal Taxation

- Woking Audits

Also find accountants in: Byfleet, Smallfield, Shipley Bridge, Lingfield, Sutton, Newlands Corner, Reigate, Farncombe, Mayford, Brook, Camelsdale, Sandhills, Shottermill, Walton On Thames, Wheelerstreet, Weybridge, Egham, East Clandon, The Sands, Millbridge, Godstone, Alfold, Heath End, Hambledon, Pyrford, Woodham, Wonersh, East Horsley, Stroud Common, Tadworth, Chobham, Leigh, Compton, Esher, Hurtmore and more.

Accountant Woking

Accountant Woking Accountants Near Woking

Accountants Near Woking Accountants Woking

Accountants WokingMore Surrey Accountants: Ash, Guildford, Epsom, Dorking, Farnham, Woking, Ewell, Haslemere, Staines, Sunbury-on-Thames, Banstead, Horley, Cranleigh, Walton-on-Thames, Redhill, Chertsey, Leatherhead, Caterham, Molesey, Godalming, Esher, Windlesham, Camberley, Weybridge, Hersham, Reigate and Addlestone.

TOP - Accountants Woking - Financial Advisers

Investment Accounting Woking - Auditors Woking - Chartered Accountants Woking - Online Accounting Woking - Tax Return Preparation Woking - Self-Assessments Woking - Tax Accountants Woking - Small Business Accountant Woking - Financial Advice Woking