Accountants Bilston: Having an accountant on board can be extremely beneficial to anybody running a business or being self-employed in Bilston. Among the many benefits are the fact that you should have extra time to concentrate on core business operations while routine and time consuming bookkeeping can be expertly dealt with by your accountant. The importance of having a qualified accountant at your side cannot be overstated. Many Bilston businesses have been able to prosper through having this sort of expert help.

You'll find many different kinds of accountants in the Bilston area. Picking out the right one for your business is crucial. Some Bilston accountants work within a larger business, whilst others work independently. In the case of accountancy firms, there'll be a number of accountants, each having their own field of expertise. Most accounting companies will be able to provide: chartered accountants, tax accountants, actuaries, accounting technicians, auditors, investment accountants, bookkeepers, cost accountants, management accountants, financial accountants and forensic accountants.

Therefore you should check that your chosen Bilston accountant has the appropriate qualifications to do the job competently. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Qualified accountants may come with higher costs but may also save you more tax. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat.

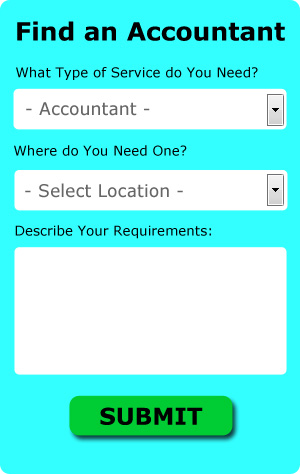

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Bilston accountant. Filling in a clear and simple form is all that you need to do to set the process in motion. Then you just have to wait for some prospective accountants to contact you.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. The popularity of these services has been increasing in recent years. It would be advisable to investigate that any online company you use is reputable. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. We will not be recommending any individual online accounting service in this article.

The very best in this profession are chartered accountants, they will also be the most expensive. While such specialists can deal with all aspects of finance, they may be over qualified for your modest needs. All that remains is to make your final choice.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Taxshield, Gbooks, Nomisma, GoSimple, Forbes, Absolute Topup, Capium, Taxfiler, Keytime, Taxforward, Andica, TaxCalc, Xero, Ablegatio, ACCTAX, Ajaccts, Basetax, Sage, CalCal, 123 e-Filing and BTCSoftware. Getting your self-assessment form submitted on time is the most important thing.

How to Manage Your Finances Better If Your a Small Business Owner

Making a decision to put up your business is not hard, but knowing exactly how to start it is, and actually getting it up and running is much harder. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. If you don't properly manage your money, for example, you and your business will suffer. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Retain an accountant. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. With an accountant on board, you can easily monitor your cash flow and more importantly pay the right amount of taxes you owe on time. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. What happens is that you can focus more on building your business, including marketing and getting more clients. An accountant can save you days of time and quite a lot of headaches.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This way, you won't have a hard time keeping track of your business and personal finances. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. You decide the salary for yourself. It can be a percentage of your business income or it can be an hourly rate.

Keep a tight lid on your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. It's best if you spend money on things that will benefit your business. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. You'll also be able to save money on office supplies if you buy in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. Avoid spending too much on your entertainment as well; be moderate instead.

There are so many little things that go into properly managing your money. It's not only about keeping a record of when you spent what. There are different things to keep track of and different ways to track them. With the tips above, you'll have an easier time tracking your money. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Financial Actuaries Bilston

Analysts and actuaries are specialists in the management of risk. They use their wide-ranging knowledge of economics and business, combined with their understanding of investment theory, probability theory and statistics, to provide financial, commercial and strategic advice. Actuaries provide assessments of fiscal security systems, with a focus on their mathematics, their mechanisms and their complexity.

Forensic Accounting Bilston

You may well come across the expression "forensic accounting" when you are searching for an accountant in Bilston, and will probably be wondering what is the difference between regular accounting and forensic accounting. With the word 'forensic' literally meaning "relating to or denoting the application of scientific methods and techniques to the investigation of crime", you should get a hint as to exactly what is involved. Using auditing, investigative skills and accounting to identify discrepancies in financial accounts which have lead to theft or fraud, it's also sometimes known as 'financial forensics' or 'forensic accountancy'. Some of the bigger accountancy firms in and near to Bilston even have specialised departments investigating personal injury claims, insolvency, tax fraud, professional negligence, bankruptcy, false insurance claims and money laundering.

Bilston accountants will help with charities in Bilston, investment reviews, limited company accounting, accounting services for the construction industry, accounting services for buy to let landlords, HMRC liaison, employment law, management accounts, business start-ups Bilston, accounting and auditing in Bilston, year end accounts, business disposal and acquisition Bilston, accounting services for media companies, financial and accounting advice, bookkeeping in Bilston, small business accounting Bilston, accounting support services, corporate tax, cashflow projections in Bilston, business support and planning, PAYE, assurance services in Bilston, bureau payroll services Bilston, mergers and acquisitions, financial statements in Bilston, workplace pensions, VAT returns Bilston, business advisory in Bilston, monthly payroll in Bilston, taxation accounting services in Bilston, company secretarial services Bilston, VAT registrations and other accounting related services in Bilston, West Midlands. Listed are just some of the activities that are accomplished by nearby accountants. Bilston providers will keep you informed about their full range of services.

Using the internet as a powerful resource it is quite simple to find lots of valuable information and ideas relating to accounting & auditing, self-assessment help, personal tax assistance and accounting for small businesses. For example, with a quick search we discovered this compelling article covering 5 tips for selecting the best accountant.

Bilston Accounting Services

- Bilston Financial Audits

- Bilston Tax Planning

- Bilston Chartered Accountants

- Bilston Tax Refunds

- Bilston Bookkeeping Healthchecks

- Bilston Payroll Management

- Bilston Debt Recovery

- Bilston Tax Services

- Bilston Bookkeepers

- Bilston VAT Returns

- Bilston Personal Taxation

- Bilston Audits

- Bilston Forensic Accounting

- Bilston Business Accounting

Also find accountants in: Brownshill Green, Queslett, Blossomfield, Perry Barr, Dudley, Woodside, Hampton In Arden, Castle Bromwich, Foleshill, Harborne, Quinton, Old Hill, Hasbury, Wordsley, Knowle, Yardley, Bird End, Bentley Heath, Ettingshall, Blackheath, Kirby Corner, West Bromwich, Tile Hill, Great Barr, Longbridge, Pickford Green, Brierley Hill, Walsall, Upper Gornal, Moxley, Lye, Rednal, Handsworth, Bradmore, Brownhills and more.

Accountant Bilston

Accountant Bilston Accountants Near Me

Accountants Near Me Accountants Bilston

Accountants BilstonMore West Midlands Accountants: Sutton Coldfield, Dudley, Aldridge, Coventry, Bilston, Wednesbury, Tipton, Kingswinford, Smethwick, Coseley, West Bromwich, Brierley Hill, Darlaston, Wednesfield, Brownhills, Oldbury, Bloxwich, Rowley Regis, Blackheath, Solihull, Wolverhampton, Birmingham, Willenhall, Halesowen, Sedgley, Stourbridge and Walsall.

TOP - Accountants Bilston - Financial Advisers

Financial Accountants Bilston - Tax Advice Bilston - Bookkeeping Bilston - Tax Preparation Bilston - Financial Advice Bilston - Online Accounting Bilston - Chartered Accountants Bilston - Investment Accountant Bilston - Small Business Accountants Bilston