Accountants Shepshed: Does filling in your annual self-assessment form cause you a lot of frustration? This is a common problem for lots of others in Shepshed, Leicestershire. Of course, you could always get yourself a local Shepshed accountant to do this job instead. Do you find self-assessment simply too time-consuming to tackle on your own? Small business accountants in Shepshed will probably charge about two to three hundred pounds for this service. It is possible to get it done for less than this, and using an online service might be worth considering.

So, what do you get for your hard earned cash and precisely what is the best way to locate an accountant in Shepshed, Leicestershire? Using your favourite internet search engine should swiftly present you with a substantial list of possibles. However, how do you know which accountant you can and can't trust with your annual tax returns? You should never forget that anyone in Shepshed can claim to be an accountant. They have no legal obligation to attain any qualifications for this sort of work. Which is unbelievable to put it mildly.

Finding an accountant in Shepshed who is qualified is generally advisable. The AAT qualification is the minimum you should look for. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. You will be able to claim the cost of your accountant as a tax deduction. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

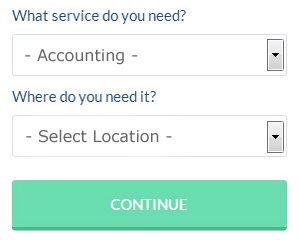

If you don't have the time to do a proper online search for local accountants, try using the Bark website. In no time at all you can fill out the job form and submit it with a single click. Sometimes in as little as a couple of hours you will hear from prospective Shepshed accountants who are keen to get to work for you. Make the most of this service because it is free.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This type of service is growing in popularity. It would be advisable to investigate that any online company you use is reputable. Study reviews and customer feedback.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. Their usual clients are big businesses and large limited companies. If you can afford one why not hire the best?

Although filling in your own tax return may seem too complicated, it is not actually that hard. Software programs like Taxshield, Xero, TaxCalc, Gbooks, Ajaccts, Nomisma, Keytime, Basetax, Andica, Taxfiler, Absolute Topup, Taxforward, 123 e-Filing, BTCSoftware, GoSimple, Ablegatio, Sage, CalCal, Forbes, ACCTAX and Capium have been developed to help the self-employed do their own tax returns. In any event the most important thing is to get your self-assessment set in before the deadline. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Tips for Better Money Management

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Don't worry, though, because there are a few things you can do to make sure you properly manage the financial side of your business. If you'd like to be able to manage your business funds, keep reading.

Retain an accountant. Don't neglect the importance of having an accountant managing your books full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This will actually help you organize and manage your business and personal finances better. Send all of the payments you receive for your goods and services into your business account then every week or every two weeks or even every month, pay yourself out of that account. How much should you pay yourself? It's up to you. Your salary can be an hourly rate or a portion of your business income.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. You'll be better off putting your money in the bank at the end of each work day.

There are so many different things that go into helping you properly manage your money. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. Use the tips in this article to help you keep track of everything. If you want your business to be profitable, you need to stay on top of your finances.

Shepshed accountants will help with cash flow, investment reviews Shepshed, partnership registrations, accounting services for start-ups in Shepshed, bureau payroll services, HMRC submissions, corporation tax, tax investigations Shepshed, tax preparation, company secretarial services, VAT returns, self-employed registration, monthly payroll in Shepshed, accounting services for media companies in Shepshed, small business accounting Shepshed, mergers and acquisitions, PAYE in Shepshed, taxation accounting services in Shepshed, financial planning in Shepshed, accounting services for buy to let rentals in Shepshed, consulting services, double entry accounting, financial statements, inheritance tax, litigation support, tax returns, estate planning Shepshed, payslips, capital gains tax, year end accounts in Shepshed, limited company accounting, HMRC liaison in Shepshed and other kinds of accounting in Shepshed, Leicestershire. Listed are just a few of the tasks that are handled by nearby accountants. Shepshed companies will tell you about their whole range of accountancy services.

When you are looking for inspiration and advice for auditing & accounting, self-assessment help, small business accounting and personal tax assistance, you don't need to look any further than the internet to find all the information that you need. With such a wide range of meticulously researched blog posts and webpages on offer, you will pretty quickly be deluged with amazing ideas for your upcoming project. Last week we noticed this interesting article on choosing the right accountant.

Shepshed Accounting Services

- Shepshed Bookkeeping Healthchecks

- Shepshed Bookkeepers

- Shepshed Account Management

- Shepshed Tax Returns

- Shepshed Tax Planning

- Shepshed Tax Advice

- Shepshed Debt Recovery

- Shepshed Personal Taxation

- Shepshed Self-Assessment

- Shepshed Payroll Services

- Shepshed Auditing

- Shepshed Tax Services

- Shepshed VAT Returns

- Shepshed Tax Refunds

Also find accountants in: Donisthorpe, Croft, Cold Newton, Bringhurst, Drayton, Donington Le Heath, Holwell, Woodhouse Eaves, Frolesworth, Sewstern, Freeby, Kilby, Thringstone, Long Clawson, Great Glen, Laughton, Normanton Le Heath, Kegworth, Norris Hill, Illston On The Hill, Thorpe Satchville, Thrussington, Worthington, Kirkby Bellars, Nanpantan, Glen Parva, Rothley, Mowsley, Swannington, Scraptoft, Ellistown, Frisby On The Wreake, Church Langton, Tilton On The Hill, Scalford and more.

Accountant Shepshed

Accountant Shepshed Accountants Near Me

Accountants Near Me Accountants Shepshed

Accountants ShepshedMore Leicestershire Accountants: Loughborough, Market Harborough, Wigston, Shepshed, Leicester, Oadby, Coalville, Earl Shilton, Melton Mowbray and Hinckley.

TOP - Accountants Shepshed - Financial Advisers

Investment Accounting Shepshed - Affordable Accountant Shepshed - Tax Return Preparation Shepshed - Chartered Accountant Shepshed - Bookkeeping Shepshed - Small Business Accountant Shepshed - Online Accounting Shepshed - Tax Accountants Shepshed - Auditing Shepshed