Accountants Haywards Heath: Do you seem to get little else but a headache when you're filling out your yearly self-assessment form? You and countless other self-employed Haywards Heath people will have to tackle this every 12 months. Tracking down a local Haywards Heath professional to accomplish this task for you might be the solution. Is self-assessment a tad too complicated for you to do by yourself? A regular Haywards Heath accountant will probably charge you about £200-£300 for filling in these forms. If you're looking for a cheaper option you might find the answer online.

You'll find many different kinds of accountants in the Haywards Heath area. So, it is essential that you pick one that suits your specific needs. Another decision you will have to make is whether to go for an accounting company or a lone wolf accountant. An accountancy company will offer a broader range of services, while a lone accountant will provide a more personal service. It is likely that chartered accountants, tax preparation accountants, actuaries, costing accountants, financial accountants, management accountants, bookkeepers, auditors, forensic accountants, accounting technicians and investment accountants will be available within an accountancy firm of any note.

You should take care to find a properly qualified accountant in Haywards Heath to complete your self-assessment forms correctly and professionally. Look for an AAT qualified accountant in the Haywards Heath area. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Accounting fees are of course a business expense and can be included as such on your tax return.

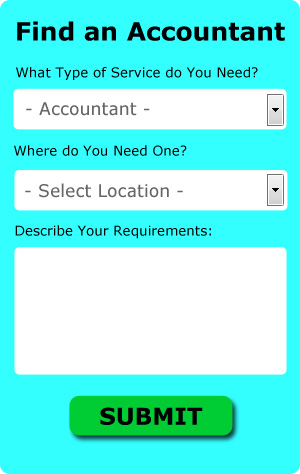

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Haywards Heath accountant. They provide an easy to fill in form that gives an overview of your requirements. Then you just have to wait for some prospective accountants to contact you. Try this free service because you've got nothing to lose.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. While not recommended in every case, it could be the ideal solution for you. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It should be a simple task to find some online reviews to help you make your choice.

In the final analysis you may decide to do your own tax returns. To make life even easier there is some intuitive software that you can use. Including BTCSoftware, Keytime, CalCal, Taxfiler, Basetax, Andica, Xero, Taxforward, Capium, Taxshield, ACCTAX, Ajaccts, Forbes, Sage, TaxCalc, Absolute Topup, 123 e-Filing, Gbooks, Ablegatio, Nomisma and GoSimple. In any event the most important thing is to get your self-assessment set in before the deadline. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

How Managing Your Money Better Makes You a Better Business Owner

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. But beware of credit cards. If you keep a balance there every month, you're going to be paying interest and it can actually cost you more than if you just went ahead and paid for your expenses directly from your bank account. To avoid this, make sure you pay your credit card balance in full every month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. Send all of the payments you receive for your goods and services into your business account then every week or every two weeks or even every month, pay yourself out of that account. It's up to you how much salary you want to give yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Keep a tight lid on your spending. It is tempting, when you have money coming in, to start spending money on the things that you've wanted for a long time but couldn't afford. It's best if you spend money on things that will benefit your business. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. In addition, buying your office supplies in bulk will save you money. When it comes to your business equipment, you will save more by investing in quality machines even if they may require a huge cash outlay from you in the beginning. The savings will come in the form of not having to buy a new one or replace parts frequently. As for your entertainment expenses, you need to be smart about it as well.

A lot of things go into proper money management. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. It's crucial that you stay on top of your business finances.

Auditors Haywards Heath

An auditor is a person or company selected by a firm or organisation to undertake an audit, which is the official evaluation of the accounts, normally by an impartial body. They may also act as consultants to advocate possible the prevention of risk and the introduction of cost reductions. For anybody to become an auditor they have to have specific qualifications and be licensed by the regulating body for auditing and accounting. (Tags: Auditors Haywards Heath, Auditor Haywards Heath, Auditing Haywards Heath)

Actuaries Haywards Heath

An actuary is a business professional who studies the measurement and managing of risk and uncertainty. They apply their mathematical expertise to calculate the risk and probability of future happenings and to estimate their financial ramifications for a business. Actuaries deliver evaluations of fiscal security systems, with an emphasis on their complexity, their mathematics, and their mechanisms. (Tags: Financial Actuary Haywards Heath, Actuaries Haywards Heath, Actuary Haywards Heath)

Haywards Heath accountants will help with VAT payer registration Haywards Heath, monthly payroll, payslips, business planning and support, business acquisition and disposal, estate planning in Haywards Heath, accounting services for start-ups, accounting services for buy to let property rentals, partnership accounts, tax investigations in Haywards Heath, double entry accounting, assurance services in Haywards Heath, bookkeeping, employment law in Haywards Heath, partnership registrations, tax preparation Haywards Heath, accounting support services, limited company accounting, general accounting services Haywards Heath, VAT returns, charities, tax returns, year end accounts in Haywards Heath, corporate finance, accounting and auditing, HMRC submissions, PAYE, financial planning, management accounts in Haywards Heath, contractor accounts in Haywards Heath, small business accounting, company secretarial services and other accounting related services in Haywards Heath, West Sussex. These are just a small portion of the tasks that are undertaken by local accountants. Haywards Heath specialists will be happy to inform you of their entire range of services.

By using the web as a powerful resource it is quite simple to uncover a whole host of invaluable inspiration and ideas about self-assessment help, small business accounting, auditing & accounting and personal tax assistance. For instance, with a brief search we came across this interesting article on the subject of choosing the right accountant.

Haywards Heath Accounting Services

- Haywards Heath Account Management

- Haywards Heath Tax Planning

- Haywards Heath Forensic Accounting

- Haywards Heath Specialist Tax

- Haywards Heath Personal Taxation

- Haywards Heath Payroll Management

- Haywards Heath Tax Refunds

- Haywards Heath Chartered Accountants

- Haywards Heath VAT Returns

- Haywards Heath Tax Returns

- Haywards Heath Tax Services

- Haywards Heath Financial Audits

- Haywards Heath Debt Recovery

- Haywards Heath PAYE Healthchecks

Also find accountants in: West Hoathly, Broadwater, Nuthurst, East Dean, Crawley, Hammer, Sompting, Wineham, Poling Corner, South Mundham, Haywards Heath, Chichester, Upperton, Whitemans Green, Graffham, Blackstone, Nyton, Walberton, Petworth, Birdham, Middleton On Sea, Stoughton, Warminghurst, Billingshurst, Lickfold, Tillington, Copsale, Small Dole, Three Bridges, Bosham, Iping, Selham, Slindon, Hambrook, South Ambersham and more.

Accountant Haywards Heath

Accountant Haywards Heath Accountants Near Haywards Heath

Accountants Near Haywards Heath Accountants Haywards Heath

Accountants Haywards HeathMore West Sussex Accountants: Chichester, Shoreham-by-Sea, Southwater, Littlehampton, Hurstpierpoint, Worthing, Burgess Hill, Lancing, Southwick, Crawley, Horsham, Bognor Regis, East Grinstead, Haywards Heath and Rustington.

TOP - Accountants Haywards Heath - Financial Advisers

Self-Assessments Haywards Heath - Tax Advice Haywards Heath - Online Accounting Haywards Heath - Auditors Haywards Heath - Chartered Accountants Haywards Heath - Financial Advice Haywards Heath - Affordable Accountant Haywards Heath - Tax Preparation Haywards Heath - Investment Accounting Haywards Heath