Accountants Westham: Having a qualified accountant to keep an eye on your finances brings many benefits to anyone running a business in Westham or for that matter anywhere else in Great Britain. One of the main advantages will be that with your accountant taking care of the routine paperwork and bookkeeping, you should have more free time to spend on what you do best, the actual operation of your core business. For those who've just started in business it may be vitally important to have somebody on hand who can provide financial advice.

There are lots of accountants around, so you won't have that much difficulty finding a good one. Most Westham accountants have their own dedicated websites, therefore browsing the internet is a good starting place for your search. However, which of these prospects will you be able to put your trust in? You should bear in mind that virtually anybody in Westham can promote themselves as a bookkeeper or accountant. There is no legal requirements that say they have to have certain qualifications or accreditations. Which, considering the importance of the work would appear a little bizarre.

To get the job done correctly you should search for a local accountant in Westham who has the right qualifications. At the very least you should look for somebody with an AAT qualification. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form.

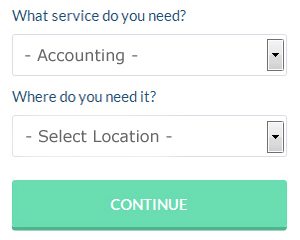

If you want to reach out to a number of local Westham accountants, you could always use a service called Bark. You only need to answer a few basic questions and complete a straightforward form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

You could always try an online tax returns service if your needs are fairly simple. While not recommended in every case, it could be the ideal solution for you. Even if you do decide to go down this route, take some time in singling out a trustworthy company. Be sure to study customer reviews and testimonials. We cannot endorse or recommend any of the available services here.

If you really want the best you could go with a chartered accountant. The services these specialists provide are perhaps beyond the needs of the smaller business in Westham. Having the best person for the job may appeal to many.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. You could even use a software program like Sage, 123 e-Filing, TaxCalc, Capium, Nomisma, Taxshield, Ajaccts, Gbooks, Taxforward, Andica, BTCSoftware, Basetax, GoSimple, Xero, Forbes, Absolute Topup, Taxfiler, Keytime, CalCal, Ablegatio or ACCTAX to make life even easier. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

Forensic Accountant Westham

Whilst conducting your search for a qualified accountant in Westham there is a good chance that you'll stumble on the term "forensic accounting" and be wondering what that is, and how it differs from normal accounting. The hint for this is the word 'forensic', which essentially means "suitable for use in a law court." Sometimes also known as 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to examine financial accounts so as to identify fraud and criminal activity. There are a few bigger accountants firms in East Sussex who've got dedicated divisions for forensic accounting, dealing with personal injury claims, insurance claims, money laundering, bankruptcy, tax fraud, professional negligence and insolvency.

Payroll Services Westham

A vital component of any business enterprise in Westham, large or small, is having a reliable payroll system for its workforce. The laws regarding payroll for accuracy and transparency mean that processing a company's payroll can be a formidable task for those not trained in this discipline.

All small businesses don't have the help that a dedicated financial specialist can provide, and an easy way to handle employee pay is to hire an outside Westham payroll company. Your payroll accounting company will provide accurate BACS payments to your personnel, as well as working together with any pension providers that your business might have, and use current HMRC legislation for tax deductions and NI contributions.

It will also be necessary for a payroll management service in Westham to prepare an accurate P60 tax form for each staff member at the conclusion of the financial year (by May 31st). They will also provide P45 tax forms at the termination of a staff member's working contract.

Westham accountants will help with contractor accounts, debt recovery, company formations, personal tax, VAT registration, audit and compliance reporting Westham, double entry accounting, accounting services for buy to let property rentals, charities, limited company accounting, accounting and auditing, payroll accounting, corporate finance, business acquisition and disposal, bookkeeping in Westham, assurance services in Westham, accounting support services in Westham, company secretarial services, payslips in Westham, partnership registration, corporate tax Westham, management accounts, business planning and support in Westham, inheritance tax Westham, employment law in Westham, pension planning, financial and accounting advice, accounting services for start-ups, bureau payroll services, PAYE in Westham, tax investigations, partnership accounts and other types of accounting in Westham, East Sussex. Listed are just a few of the duties that are performed by local accountants. Westham professionals will inform you of their full range of services.

Westham Accounting Services

- Westham Specialist Tax

- Westham Chartered Accountants

- Westham Tax Refunds

- Westham Tax Returns

- Westham Forensic Accounting

- Westham Tax Advice

- Westham VAT Returns

- Westham Bookkeepers

- Westham Self-Assessment

- Westham Business Accounting

- Westham Bookkeeping Healthchecks

- Westham Personal Taxation

- Westham Financial Advice

- Westham Payroll Management

Also find accountants in: Wivelsfield, West Firle, Sedlescombe, Hamsey, Sedlescombe Street, Bishopstone, Dallington, Udimore, Friday Street, Preston, Beddingham, Hollingbury, Friars Gate, Jevington, High Hurstwood, Lower Dicker, Kemp Town, Pett, Westham, Rye, Burlow, Sharpthorne, Cripps Corner, Bevendean, Rottingdean, South Common, Framfield, Halland, Little London, Hollington, Guestling Thorn, Cliff End, Burwash Weald, Staple Cross, Eridge Green and more.

Accountant Westham

Accountant Westham Accountants Near Me

Accountants Near Me Accountants Westham

Accountants WesthamMore East Sussex Accountants: Hastings, Uckfield, Forest Row, Heathfield, Ore, Portslade, Westham, Hailsham, Newhaven, Ringmer, Wadhurst, Brighton, Bexhill-on-Sea, Peacehaven, Lewes, Battle, Crowborough, Polegate, Willingdon, Seaford, Telscombe, Rye, Eastbourne and Hove.

TOP - Accountants Westham - Financial Advisers

Online Accounting Westham - Chartered Accountants Westham - Bookkeeping Westham - Financial Accountants Westham - Investment Accounting Westham - Self-Assessments Westham - Affordable Accountant Westham - Small Business Accountants Westham - Financial Advice Westham