Accountants Farnborough: Do you find that completing your annual self-assessment form is nothing but a headache? Plenty of people in Farnborough and throughout Great Britain have to cope with this every year. Is the answer perhaps to find yourself a local Farnborough professional to do this task on your behalf? Do you find self-assessment simply too taxing to tackle by yourself? You can normally get this done by Farnborough High Street accountants for something like £200-£300. Those looking for cheaper rates usually look to online tax return services.

But which accounting service is best for your requirements and how might you go about finding it? A long list of potential Farnborough accountants can be compiled with one swift search on the web. Though, making sure that you choose an accountant that you can trust might not be quite as straightforward. You should bear in mind that virtually anybody in Farnborough can advertise themselves as an accountant or bookkeeper. They don't have any legal requirement to obtain any qualifications for this work. Crazy as that sounds.

For completing your self-assessment forms in Farnborough you should find a properly qualified accountant. For basic tax returns an AAT qualified accountant should be sufficient. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Your accountant's fees are tax deductable.

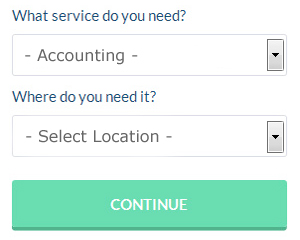

There is a unique online website called Bark which will actually find you a choice of accountants in the Farnborough area. You will quickly be able to complete the form and your search will begin. Then you just have to wait for some prospective accountants to contact you. You might as well try it because it's free.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. While not recommended in every case, it could be the ideal solution for you. Do a bit of research to find a reputable company. Study online reviews so that you can get an overview of the services available.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. These high achievers will hold qualifications like an ACA or an ICAEW. So, at the end of the day the choice is yours.

Although filling in your own tax return may seem too complicated, it is not actually that hard. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are BTCSoftware, Gbooks, Nomisma, Ajaccts, Basetax, Keytime, Forbes, Andica, Taxfiler, TaxCalc, GoSimple, Capium, ACCTAX, CalCal, 123 e-Filing, Xero, Ablegatio, Absolute Topup, Taxforward, Sage and Taxshield. You'll receive a fine if your self-assessment is late.

Forensic Accountant Farnborough

When you're on the lookout for an accountant in Farnborough you will doubtless run across the term "forensic accounting" and wonder what the differences are between a forensic accountant and a normal accountant. The clue for this is the actual word 'forensic', which essentially means "suitable for use in a court of law." Using investigative skills, accounting and auditing to identify inaccuracies in financial accounts which have contributed to theft or fraud, it is also sometimes referred to as 'forensic accountancy' or 'financial forensics'. A few of the larger accounting companies in the Farnborough area could even have specialist forensic accounting divisions with forensic accountants concentrating on specific sorts of fraud, and might be addressing personal injury claims, falsified insurance claims, money laundering, bankruptcy, tax fraud, professional negligence and insolvency.

Payroll Services Farnborough

For any company in Farnborough, from independent contractors to large scale organisations, staff payrolls can be tricky. The regulations regarding payrolls and the legal requirements for accuracy and openness means that dealing with a business's payroll can be a daunting task.

All small businesses don't have the help that a dedicated financial expert can provide, and the easiest way to deal with employee pay is to hire an outside Farnborough accountant. The accountant dealing with payrolls will work alongside HMRC and pension schemes, and deal with BACS payments to ensure accurate and timely payment to all employees.

It will also be a requirement for a qualified payroll accountant in Farnborough to prepare an accurate P60 declaration for all personnel after the end of the financial year (by 31st May). A P45 should also be given to any employee who stops working for the company, according to the current legislations. (Tags: Payroll Accountant Farnborough, Payroll Administrator Farnborough, Payroll Services Farnborough).

The Best Money Management Techniques for Business Self Improvement

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Still, this shouldn't deter you from going into business for yourself. You've got a number of things that can help you successfully manage the financial side of your business. Continue reading if you'd like to know how you can be a better money manager for your own business.

You may think it's a good idea to wait to pay the taxes you owe until they're due. However, if you have poor money management skills, you may not have the money you need to pay your estimated tax and other related fees. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. You never want to be late in paying your taxes and this simple money management strategy will help you avoid paying late because you don't have the funds to make the payment on time.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have Paying yourself like you would a regular employee would make your business accounting so much easier. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. How much should you pay yourself? It's up to you. It can be a percentage of your business income or it can be an hourly rate.

Just as you should track every penny you spend, you should track every penny that goes in as well. Whenever a client or customer pays you, record that payment. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. Tracking your income helps you figure out your taxes, how much to pay yourself, etc.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. You'll benefit a great deal if you remember and put these tips we've shared to use. You're much more likely to experience business and personal success when you have your finances under control.

Auditors Farnborough

An auditor is a person or company authorised to evaluate and authenticate the accuracy of accounts and ensure that organisations or businesses comply with tax laws. They protect businesses from fraud, point out irregularities in accounting techniques and, now and again, work on a consultancy basis, helping firms to find solutions to boost efficiency. Auditors need to be approved by the regulatory authority for accounting and auditing and also have the required qualifications.

Farnborough accountants will help with partnership accounts, management accounts, accounting services for media companies, company secretarial services in Farnborough, financial statements, corporate finance, employment law Farnborough, PAYE, business advisory, bureau payroll services, HMRC submissions, accounting services for the construction sector in Farnborough, accounting and financial advice, monthly payroll in Farnborough, self-assessment tax returns Farnborough, investment reviews, tax investigations, small business accounting, National Insurance numbers, VAT registrations Farnborough, accounting services for start-ups in Farnborough, accounting services for buy to let rentals, personal tax, payslips, company formations Farnborough, cashflow projections, compliance and audit reports, HMRC liaison, capital gains tax, self-employed registration in Farnborough, assurance services, VAT returns Farnborough and other accounting related services in Farnborough, Hampshire. Listed are just a small portion of the tasks that are carried out by nearby accountants. Farnborough professionals will inform you of their full range of accounting services.

Farnborough Accounting Services

- Farnborough Business Accounting

- Farnborough Self-Assessment

- Farnborough Auditing

- Farnborough Payroll Services

- Farnborough Chartered Accountants

- Farnborough Tax Returns

- Farnborough Tax Refunds

- Farnborough Debt Recovery

- Farnborough Tax Advice

- Farnborough Tax Planning

- Farnborough Specialist Tax

- Farnborough Bookkeepers

- Farnborough Bookkeeping Healthchecks

- Farnborough Forensic Accounting

Also find accountants in: Liss Forest, Upper Street, Fox Lane, Leckford, Dogmersfield, Bolderwood, Stuckton, Rowner, Walhampton, Mattingley, Romsey, Houghton, Monkwood, Wonston, North Boarhunt, Fareham, Conford, Egypt, Carters Clay, Fullerton, Yateley, Portswood, Dean, Chilworth, North Street, Bickton, North Warnborough, Empshott, Coxford, Portmore, Frogmore, Upton, Fritham, Upham, Bishops Waltham and more.

Accountant Farnborough

Accountant Farnborough Accountants Near Farnborough

Accountants Near Farnborough Accountants Farnborough

Accountants FarnboroughMore Hampshire Accountants: Hythe, Stubbington, Fleet, Farnborough, Hedge End, Horndean, New Milton, Waterlooville, Havant, Southsea, Basingstoke, Portsmouth, Yateley, Aldershot, Winchester, Fareham, Eastleigh, Emsworth, Alton, Gosport, Totton, Southampton and Andover.

TOP - Accountants Farnborough - Financial Advisers

Investment Accountant Farnborough - Affordable Accountant Farnborough - Small Business Accountants Farnborough - Financial Advice Farnborough - Tax Return Preparation Farnborough - Online Accounting Farnborough - Bookkeeping Farnborough - Self-Assessments Farnborough - Financial Accountants Farnborough