Accountants Greenwich: Do you get little else but a headache when completing your yearly tax self-assessment form? Other sole traders and small businesses in the Greenwich area face the same challenge. But is there a simple way to find a local Greenwich accountant to do this job for you? Perhaps it is simply the case that self-assessment is too complex for you to do by yourself. This service will generally cost about £200-£300 if you use a High Street accountant in Greenwich. If you don't mind using an online service rather than somebody local to Greenwich, you may be able to get this done for much less.

There are plenty of accountants around, so you should not have that much trouble finding a good one. Nowadays the go to place for acquiring local services is the internet, and accountants are certainly no exception, with plenty promoting their services on the web. But, precisely who can you trust? The fact that almost anyone in Greenwich can claim to be an accountant is something you need to keep in mind. Qualifications aren't even a necessity.

Finding an accountant in Greenwich who is qualified is generally advisable. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. The extra peace of mind should compensate for any higher costs. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat.

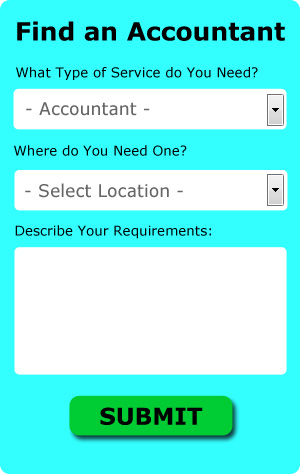

You could use an online service like Bark who will help you find an accountant. You'll be presented with a simple form which can be completed in a minute or two. Just sit back and wait for the responses to roll in. Why not give Bark a try since there is no charge for this useful service.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. A number of self-employed people in Greenwich prefer to use this simple and convenient alternative. Choose a company with a history of good service. Study online reviews so that you can get an overview of the services available.

If you really want the best you could go with a chartered accountant. Bigger limited companies are more likely to use these high achievers. With a chartered accountant you will certainly have the best on your side.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You could even use a software program like Absolute Topup, Ablegatio, CalCal, Capium, BTCSoftware, Andica, Nomisma, GoSimple, Gbooks, Taxfiler, Sage, 123 e-Filing, Basetax, Ajaccts, ACCTAX, Forbes, TaxCalc, Xero, Taxshield, Keytime or Taxforward to make life even easier. Don't leave your self-assessment until the last minute, allow yourself plenty of time.

Boost Your Confidence and Your Business By Learning Better Money Management

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. For example, failure on your part to properly manage your finances will contribute to this. You might not think that there is much to money management because in the beginning it might be pretty simple. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Number your invoices. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. Numbering your invoices helps you keep track of them. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Track your personal and business expenditures down to the last cent. It's actually helpful when you know where each penny is being spent. When you keep a detailed record of where you're spending your money, you'll be able to get a clear picture of your spending habits. No one likes to have that feeling of "I'm making decent money, but where is it?" Writing it down helps you see exactly where it is going, and if you are on a tight budget, it can help you identify areas in which you have the potential to save quite a lot. And when you're filling out tax forms, it's less harder to identify your business expenses from your personal expenses and you know exactly how much you spent on business related stuff.

Don't throw away your receipt. For one thing, you are going to need them if the IRS ever wants to see proof of what you have been spending and where. For another, they act as a record of all of your expenditures. Make sure you keep your receipts together in one place. Tracking your expenses becomes easy if you have all your receipts in one place. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. The ones we've mentioned in this article are only a few of many other proper money management tips out there that will help you in keeping track of your finances better. When you've got your finances under control, you can expect your business and personal life to be a success.

Payroll Services Greenwich

Payrolls for staff can be a complicated part of running a business enterprise in Greenwich, regardless of its size. Controlling payrolls demands that all legal requirements regarding their transparency, timings and accuracy are followed in all cases.

A small business may well not have the advantage of its own financial specialist and the simplest way to work with staff payrolls is to hire an independent accounting company in Greenwich. The accountant dealing with payrolls will work with HMRC and pension schemes, and take care of BACS payments to guarantee accurate and timely wage payment to all personnel.

Abiding by current regulations, a decent payroll management accountant in Greenwich will also provide each of your staff members with a P60 tax form at the conclusion of each financial year. A P45 must also be provided for any staff member who finishes working for your business, in line with current legislations.

Greenwich accountants will help with partnership registrations, employment law, payroll accounting, bureau payroll services, corporate finance, company secretarial services, audit and compliance issues, payslips Greenwich, litigation support in Greenwich, assurance services, accounting services for start-ups in Greenwich, PAYE Greenwich, accounting services for the construction sector, capital gains tax in Greenwich, retirement advice, tax returns, auditing and accounting, bookkeeping, business outsourcing, financial planning, taxation accounting services in Greenwich, accounting services for buy to let landlords in Greenwich, VAT returns, debt recovery in Greenwich, VAT payer registration, estate planning in Greenwich, partnership accounts, personal tax Greenwich, general accounting services, year end accounts, management accounts, business acquisition and disposal and other accounting services in Greenwich, Greater London. Listed are just an example of the activities that are carried out by local accountants. Greenwich companies will keep you informed about their whole range of accounting services.

Greenwich Accounting Services

- Greenwich Specialist Tax

- Greenwich Audits

- Greenwich Debt Recovery

- Greenwich Tax Refunds

- Greenwich Payroll Management

- Greenwich Personal Taxation

- Greenwich Self-Assessment

- Greenwich Tax Planning

- Greenwich Business Planning

- Greenwich Chartered Accountants

- Greenwich Taxation Advice

- Greenwich Bookkeeping

- Greenwich Account Management

- Greenwich Financial Advice

Also find accountants in: Denmark Hill, Somers Town, Sipson, South Hornchurch, Oval, Mayfair, Docklands, Barnsbury, Muswell Hill, Mill Hill, Hammersmith And Fulham, West Wickham, Leicester Square, Raynes Park, Tower Hamlets, Soho, Cuddington, South Ealing, Regent Street, Tufnell Park, Greenford, Totteridge, East Ham, New Cross, South Beddington, Chislehurst, Wandsworth Common, Worcester Park, Turnpike Lane, Morden, Poplar, Colliers Wood, North Cray, High Holborn, Brent and more.

Accountant Greenwich

Accountant Greenwich Accountants Near Me

Accountants Near Me Accountants Greenwich

Accountants GreenwichMore Greater London Accountants: London, Bromley, Richmond upon Thames, Enfield, Greenwich, Harrow, Croydon, Ealing, Kingston upon Thames, Barnet, Hounslow and Bexley.

TOP - Accountants Greenwich - Financial Advisers

Online Accounting Greenwich - Tax Accountants Greenwich - Investment Accountant Greenwich - Financial Accountants Greenwich - Self-Assessments Greenwich - Tax Preparation Greenwich - Cheap Accountant Greenwich - Bookkeeping Greenwich - Auditors Greenwich