Accountants Middleton: Few will argue that if you are a self-employed person or run a small business in Middleton, getting an accountant to do your books, brings a number of positive benefits. At the very minimum you can expect to have extra time freed up for your core business operation, while the accountant takes care of the mundane paperwork. Having access to this sort of advice and help can be crucial for smaller businesses and even more so for start-ups. In order for your Middleton business to prosper and expand, you're definitely going to require some help.

When hunting for a nearby Middleton accountant, you will notice that there are numerous different types available. A local accountant who perfectly matches your requirements is the one you should be looking for. It's not unusual for Middleton accountants to operate independently, others prefer being part of a larger accounting firm. An accounting firm will offer a broader range of services, while an independent accountant will offer a more personal service. Among the primary accountancy positions are: investment accountants, chartered accountants, actuaries, financial accountants, management accountants, tax preparation accountants, accounting technicians, forensic accountants, costing accountants, bookkeepers and auditors.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. For simple self-assessment work an AAT qualification is what you need to look for. A qualified accountant may cost a little more but in return give you peace of mind. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. A qualified bookkeeper will probably be just as suitable for sole traders and smaller businesses in Middleton.

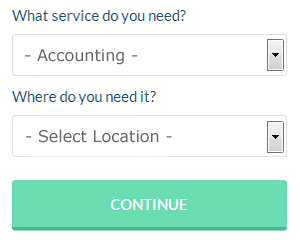

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. With Bark it is simply a process of ticking a few boxes and submitting a form. In no time at all you will get messages from accountants in the Middleton area. Why not give Bark a try since there is no charge for this useful service.

You could always try an online tax returns service if your needs are fairly simple. Over the last few years many more of these services have been appearing. Should you decide to go down this route, take care in choosing a legitimate company. Study online reviews so that you can get an overview of the services available.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. These high achievers will hold qualifications like an ACA or an ICAEW. Hiring the services of a chartered accountant means you will have the best that money can buy.

Maybe when you have looked all the options you will still decide to do your own tax returns. Available software that will also help includes Capium, Taxshield, ACCTAX, Taxfiler, 123 e-Filing, Gbooks, Andica, Keytime, Taxforward, GoSimple, Nomisma, Ablegatio, Ajaccts, Basetax, TaxCalc, Xero, CalCal, BTCSoftware, Sage, Forbes and Absolute Topup. You'll receive a fine if your self-assessment is late. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Payroll Services Middleton

For any company in Middleton, from large scale organisations down to independent contractors, dealing with staff payrolls can be stressful. The legislation regarding payroll for accuracy and transparency mean that processing a company's payroll can be a daunting task for the uninitiated.

Using a reputable accountant in Middleton, to handle your payroll needs is the simple way to minimise the workload of your own financial department. Your payroll service company will provide accurate BACS payments to your personnel, as well as working together with any pension providers your company might have, and follow the latest HMRC regulations for NI contributions and deductions.

A decent payroll management accountant in Middleton will also, in line with the current legislation, provide P60's at the end of the financial year for each of your workers. They'll also provide P45 tax forms at the end of a staff member's contract with your company. (Tags: Company Payrolls Middleton, Payroll Accountants Middleton, Payroll Services Middleton).

Staying on Top of Your Finances When You're a Business Owner

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. This, believe it or not, can keep you from reaching the level of success that you want to reach. Keep reading to learn a few tips you can use to help you manage your finances better.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. This way you get one payment, you won't pay interest and you build your credit rating.

Try to balance your books once every week. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. You need to keep track of all the payments you receive and payments you make out and make sure that the cash you have on hand or in your bank account matches with the numbers in your record. This will save you the trouble of tracking down discrepancies each month or each quarter. Besides, you will only need to devote a few minutes of your time to balancing your books if you do it regularly as opposed to doing it once in a while, which could take hours.

Be a responsible business owner by paying your taxes when they're due. Small business generally have to pay taxes every three months. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You can also seek the help of an accountant who specializes in small business accounting. He or she can ensure that you're following all the taxation laws as they relate to small businesses and that you're paying the right amount of taxes on time. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

Proper management of your business finances involves a lot of different things. It doesn't just involve listing the amount you spent and when you spent it. There are different things to keep track of and different ways to track them. We've shared some things in this article that should make tracking your money easier for you to do. As you work and learn more about how to practice self improvement for your business through money management, you'll come up with plenty of other methods for streamlining things.

Middleton accountants will help with employment law, accounting and auditing in Middleton, personal tax, accounting services for buy to let property rentals, business advisory services in Middleton, National Insurance numbers in Middleton, limited company accounting Middleton, company secretarial services in Middleton, cashflow projections, financial statements, partnership accounts in Middleton, year end accounts, accounting support services, bureau payroll services, small business accounting, consulting services, pension forecasts, accounting services for media companies in Middleton, tax preparation, payslips Middleton, business start-ups, general accounting services, corporation tax Middleton, VAT registrations, compliance and audit issues, business disposal and acquisition, capital gains tax, company formations Middleton, inheritance tax, taxation accounting services, PAYE, mergers and acquisitions and other accounting related services in Middleton, Greater Manchester. Listed are just a handful of the duties that are performed by nearby accountants. Middleton specialists will keep you informed about their whole range of accounting services.

Using the internet as an unlimited resource it is of course pretty easy to uncover plenty of useful inspiration and ideas regarding small business accounting, self-assessment help, personal tax assistance and accounting & auditing. For example, with a very quick search we came across this informative article outlining how to locate an accountant to do your annual tax return.

Middleton Accounting Services

- Middleton Bookkeeping Healthchecks

- Middleton Chartered Accountants

- Middleton Business Accounting

- Middleton Taxation Advice

- Middleton Tax Refunds

- Middleton Tax Planning

- Middleton Account Management

- Middleton PAYE Healthchecks

- Middleton Specialist Tax

- Middleton Tax Returns

- Middleton Personal Taxation

- Middleton Payroll Management

- Middleton Self-Assessment

- Middleton Forensic Accounting

Also find accountants in: Shevington, Ramsbottom, Radcliffe, Swinton, Dunham Town, Kearsley, Red Rock, Urmston, Lane Head, Ince In Makerfield, Hurst, Mottram In Longdendale, Golborne, Bardsley, Milnrow, Worsley, Shaw, Offerton, Woodford, Eagley, Summit, Salford, Cheesden, Greenmount, Whitefield, Altrincham, Haigh, Newton, Slattocks, Oldham, Mellor, Little Lever, Micklehurst, Hale, Heyside and more.

Accountant Middleton

Accountant Middleton Accountants Near Me

Accountants Near Me Accountants Middleton

Accountants MiddletonMore Greater Manchester Accountants: Stockport, Royton, Dukinfield, Swinton, Middleton, Whitefield, Walkden, Denton, Radcliffe, Stretford, Rochdale, Ashton-in-Makerfield, Bury, Stalybridge, Horwich, Farnworth, Chadderton, Salford, Ashton-under-Lyne, Heywood, Atherton, Bolton, Altrincham, Droylsden, Urmston, Gatley, Golborne, Hyde, Leigh, Manchester, Wigan, Irlam, Romiley, Westhoughton, Eccles, Oldham, Sale, Hindley and Cheadle Hulme.

TOP - Accountants Middleton - Financial Advisers

Cheap Accountant Middleton - Financial Accountants Middleton - Self-Assessments Middleton - Tax Preparation Middleton - Investment Accounting Middleton - Financial Advice Middleton - Auditing Middleton - Bookkeeping Middleton - Small Business Accountants Middleton