Accountants Romiley: Does filling out your annual self-assessment form give you a serious headache? You, along with lots of others who are self-employed in Romiley, face this annual trauma. But is there an easy way to find a local Romiley accountant to do this for you? This may be the best option if you consider self-assessment just too time-consuming. £200-£300 is the normal cost for such a service when using Romiley High St accountants. If this seems like a lot to you, then look at using an online service.

In the Romiley area you will find that there are various sorts of accountant. Your objective is to choose one that meets your exact requirements. You'll have to choose between an accountant working solo or one who is associated with an established accountancy firm. An accountancy firm will comprise accountants with different fields of expertise. You will probably find the likes of investment accountants, forensic accountants, management accountants, cost accountants, bookkeepers, tax accountants, accounting technicians, actuaries, financial accountants, chartered accountants and auditors in a large accountancy company.

Finding a properly qualified Romiley accountant should be your priority. The recommended minimum qualification you should look for is an AAT. Qualified accountants may come with higher costs but may also save you more tax. The cost of preparing your self-assessment form can be claimed back as a business expense.

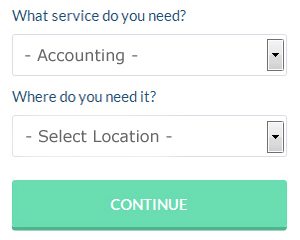

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Romiley accountant. A couple of minutes is all that is needed to complete their simple and straighforward search form. In no time at all you will get messages from accountants in the Romiley area. You can use Bark to find accountants and other similar services.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This type of service is growing in popularity. If you decide to go with this method, pick a company with a decent reputation. It should be a simple task to find some online reviews to help you make your choice. We feel it is not appropriate to list any individual services here.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. These high achievers will hold qualifications like an ACA or an ICAEW. If you want the best person for your business this might be an option.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! Available software that will also help includes Sage, 123 e-Filing, Nomisma, Taxshield, GoSimple, Ajaccts, BTCSoftware, Forbes, Taxforward, Gbooks, ACCTAX, Basetax, Andica, Xero, Capium, Ablegatio, Taxfiler, Absolute Topup, Keytime, CalCal and TaxCalc. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Small Business Accountants Romiley

Making certain that your accounts are accurate can be a stressful task for any small business owner in Romiley. If your accounts are getting you down and VAT and tax return issues are causing sleepless nights, it is advisable to use a dedicated small business accountant in Romiley.

Giving advice, ensuring that your business follows best fiscal practices and providing strategies to help your business to achieve its full potential, are just some of the responsibilities of an experienced small business accountant in Romiley. An accountancy firm in Romiley will provide an assigned small business accountant and mentor who will clear away the fog that veils business taxation, in order to enhance your tax efficiences.

To be able to do their job properly, a small business accountant in Romiley will want to know accurate details with regards to your current financial standing, business structure and any possible investment you may be thinking about, or already have put in place.

Auditors Romiley

An auditor is a company or person authorised to examine and authenticate the accuracy of accounts and make certain that companies conform to tax legislation. They protect businesses from fraud, highlight inaccuracies in accounting procedures and, from time to time, work on a consultancy basis, helping organisations to determine ways to boost efficiency. To work as an auditor, an individual has to be approved by the regulatory body for accounting and auditing and possess specific qualifications.

Payroll Services Romiley

A vital aspect of any business in Romiley, large or small, is having an accurate payroll system for its staff. The legislation relating to payroll for openness and accuracy mean that running a company's staff payroll can be a daunting task for those untrained in this discipline.

A small business may well not have the luxury of an in-house financial expert and a simple way to work with employee payrolls is to employ an external accountant in Romiley. Your chosen payroll service company will manage accurate BACS payments to your personnel, as well as working along with any pension schemes that your business may have, and use current HMRC legislation for deductions and NI contributions.

Adhering to the current regulations, a decent payroll accountant in Romiley will also present each of your staff members with a P60 tax form at the conclusion of each financial year. A P45 form will also be presented to any employee who stops working for your business, according to the current legislations. (Tags: Payroll Services Romiley, Payroll Outsourcing Romiley, Payroll Accountant Romiley).

Actuary Romiley

Actuaries and analysts are specialists in risk management. An actuary employs financial and statistical concepts to evaluate the odds of a particular event occurring and its possible monetary costs. An actuary uses statistics and math to determine the financial impact of uncertainties and help their clients cut down on possible risks. (Tags: Actuary Romiley, Financial Actuary Romiley, Actuaries Romiley)

Boost Your Confidence and Your Business By Learning Better Money Management

In the last several years, thousands of people have discovered one great thing about starting their own business: they completely control their income potential. They are in control of the amount of money they spend and if they're wise, the only limit to their earning potential is their willingness to put in the work. However, proper management of business finances isn't always easy, and many people tend to get overwhelmed with this aspect of the business. Lucky for you, there are several things that can help you with this. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

Don't mix your business and personal expenses by having just one account. If you do, you run the risk of confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

Balance your books at least once a week. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. Besides, you will only need to devote a few minutes of your time to balancing your books if you do it regularly as opposed to doing it once in a while, which could take hours.

Your receipts are important so don't throw them away. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. These receipts are also a record of your business expenditures. Keep them all in one central location. This will make it easy for you to track down certain amounts for expenditures you may not recognize in your bank account because you didn't write them down. The easiest way to keep track of them is with a small accordion file that you keep in your desk drawer.

There are many things you can do to help you manage your money the right way. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. Make sure that you use the suggestions we've provided to help you track and manage your finances better. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

Romiley accountants will help with tax preparation in Romiley, corporate tax, compliance and audit reports, bookkeeping, estate planning, assurance services in Romiley, VAT registrations, debt recovery in Romiley, double entry accounting Romiley, self-assessment tax returns, HMRC liaison, capital gains tax, accounting services for property rentals, charities, workplace pensions Romiley, accounting support services in Romiley, accounting and financial advice Romiley, company secretarial services Romiley, partnership accounts, investment reviews, cashflow projections, accounting services for media companies Romiley, PAYE, personal tax, National Insurance numbers, HMRC submissions in Romiley, self-employed registration in Romiley, limited company accounting, company formations, payslips Romiley, business start-ups, bureau payroll services and other accounting related services in Romiley, Greater Manchester. These are just a few of the tasks that are handled by nearby accountants. Romiley companies will tell you about their whole range of accounting services.

Romiley Accounting Services

- Romiley Self-Assessment

- Romiley Forensic Accounting

- Romiley Tax Refunds

- Romiley Tax Returns

- Romiley Financial Advice

- Romiley Financial Audits

- Romiley Bookkeeping

- Romiley Taxation Advice

- Romiley PAYE Healthchecks

- Romiley Chartered Accountants

- Romiley Account Management

- Romiley Tax Services

- Romiley Payroll Management

- Romiley Tax Planning

Also find accountants in: Orrell, Manchester, Kenyon, Sale, Eagley, Broughton, Tyldesley, Failsworth, Bradshaw, Bramhall, Heyside, Levenshulme, Shevington Moor, Newhey, Chorlton Cum Hardy, Clough, Didsbury, Gatley, Radcliffe, Shawclough, Astley Green, Bury, Walmersley, Abram, Cadishead, Littleborough, Denshaw, Micklehurst, Salford, Atherton, Bryn Gates, Grasscroft, Leigh, Limefield, Cheadle and more.

Accountant Romiley

Accountant Romiley Accountants Near Romiley

Accountants Near Romiley Accountants Romiley

Accountants RomileyMore Greater Manchester Accountants: Farnworth, Stalybridge, Hyde, Ashton-in-Makerfield, Sale, Bury, Chadderton, Atherton, Gatley, Wigan, Hindley, Royton, Middleton, Ashton-under-Lyne, Leigh, Altrincham, Romiley, Salford, Radcliffe, Heywood, Droylsden, Walkden, Westhoughton, Denton, Rochdale, Eccles, Bolton, Dukinfield, Horwich, Stretford, Swinton, Irlam, Whitefield, Stockport, Oldham, Manchester, Urmston, Cheadle Hulme and Golborne.

TOP - Accountants Romiley - Financial Advisers

Chartered Accountant Romiley - Financial Accountants Romiley - Small Business Accountant Romiley - Online Accounting Romiley - Bookkeeping Romiley - Investment Accounting Romiley - Affordable Accountant Romiley - Self-Assessments Romiley - Tax Accountants Romiley