Accountants Sale: Completing your self-assessment form every year can really give you a headache. A lot of folks in Sale are in the same predicament as you. Is tracking down a local Sale accountant to do this for you a better alternative? Do you find self-assessment way too confusing? Usually regular Sale accountants will do this for approximately £220-£300. Those looking for cheaper rates usually look to online tax return services.

There are different kinds of accountants found in Sale. Therefore, identify your precise requirements and choose an accountant that fits those needs. You might choose to pick one who works independently or one within a firm or practice. Accounting companies will have experts in each specific accounting department. The types of accountant that you're likely to find within a company could include: financial accountants, forensic accountants, tax accountants, bookkeepers, management accountants, investment accountants, chartered accountants, accounting technicians, auditors, cost accountants and actuaries.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. The extra peace of mind should compensate for any higher costs. Your accountant's fees are tax deductable. Only larger Limited Companies are actually required by law to use a trained accountant.

If you want to reach out to a number of local Sale accountants, you could always use a service called Bark. You just have to fill in a simple form and answer some basic questions. Your details will be sent out to potential accountants and they will contact you directly with details and prices. And the great thing about Bark is that it is completely free to use.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. This kind of service may not suit everyone but could be the answer for your needs. Even if you do decide to go down this route, take some time in singling out a trustworthy company. A good method for doing this is to check out any available customer reviews and testimonials. It is beyond the scope of this article to recommend any specific service.

The real professionals in the field are chartered accountants. The services these specialists provide are perhaps beyond the needs of the smaller business in Sale. Some people might say, you should hire the best you can afford.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! There is also lots of software available to help you with your returns. These include Ajaccts, 123 e-Filing, Sage, Taxshield, Taxfiler, Nomisma, Keytime, Ablegatio, ACCTAX, CalCal, Xero, TaxCalc, Gbooks, GoSimple, Forbes, BTCSoftware, Absolute Topup, Capium, Taxforward, Basetax and Andica. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. The standard fine for being up to three months late is £100.

Be Better at Managing Your Money

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. If you don't properly manage your money, for example, you and your business will suffer. You might not think that there is much to money management because in the beginning it might be pretty simple. However, as the business grows, its finances will become complicated, so keep these tips in mind for when you need them.

Your invoices must be numbered. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. If you have an invoicing system, it won't be hard to track of them. You're able to track people who still owe you and for how much and even quickly find out who have already paid. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. In business, errors will happen and numbered invoices is one simple strategy to identify those problems when they take place.

Track your expenditures to the penny, and do this in both your personal and professional life. You might balk at the idea of this but it does present a number of advantages. When you keep a detailed record of where you're spending your money, you'll be able to get a clear picture of your spending habits. You wouldn't want to be like those people who wonder where their money went. When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. And when you're filling out tax forms, it's less harder to identify your business expenses from your personal expenses and you know exactly how much you spent on business related stuff.

It's a good idea to keep your receipts. If the IRS ever demands proof of your business expenses, receipts will come in handy. These receipts are also a record of your business expenditures. Make sure you keep your receipts together in one place. Tracking your expenses becomes easy if you have all your receipts in one place. Get yourself a small accordion file and keep your receipt there. Have this file easily accessible too.

Proper money management is a skill that every adult needs to develop. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. You can get started with the money management tips we've shared. If you want your business to be a success, it's important that you develop money management skills.

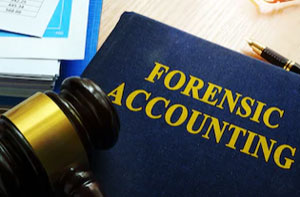

Forensic Accountant Sale

When you're hunting for an accountant in Sale you will possibly run across the term "forensic accounting" and wonder what the differences are between a forensic accountant and a regular accountant. The word 'forensic' is the thing that gives a clue, meaning literally "appropriate for use in a law court." Sometimes also known as 'forensic accountancy' or 'financial forensics', it uses investigative skills, auditing and accounting to sift through financial accounts so as to discover fraud and criminal activity. Some bigger accounting companies in the Sale area may even have independent forensic accounting divisions with forensic accountants concentrating on particular kinds of fraud, and may be addressing tax fraud, insolvency, money laundering, insurance claims, bankruptcy, professional negligence and personal injury claims. (Tags: Forensic Accountant Sale, Forensic Accountants Sale, Forensic Accounting Sale)

Small Business Accountants Sale

Company accounting and bookkeeping can be a pretty stressful experience for any small business owner in Sale. A decent small business accountant in Sale will offer you a hassle-free approach to keep your tax returns, VAT and annual accounts in the best possible order.

Helping you to expand your business, and providing sound financial advice for your particular situation, are just two of the means by which a small business accountant in Sale can be of benefit to you. A responsible accounting firm in Sale should be able to offer proactive small business guidance to optimise your tax efficiency while at the same time minimising business expenditure; critical in the sometimes murky world of business taxation.

It is critical that you explain your business structure, your plans for the future and your company's financial circumstances truthfully to your small business accountant. (Tags: Small Business Accounting Sale, Small Business Accountant Sale, Small Business Accountants Sale).

Payroll Services Sale

For any business enterprise in Sale, from large scale organisations down to independent contractors, staff payrolls can be challenging. Dealing with staff payrolls requires that all legal obligations in relation to their timings, exactness and transparency are observed in all cases.

Not all small businesses have their own in-house financial experts, and a simple way to take care of employee payrolls is to employ an outside Sale accounting firm. The accountant dealing with payrolls will work with HMRC and pension scheme administrators, and set up BACS payments to guarantee timely and accurate payment to all employees.

A dedicated payroll accountant in Sale will also, in line with current legislations, organise P60's at the end of the financial year for every member of staff. A P45 should also be given to any member of staff who finishes working for your business, in line with current legislations. (Tags: Payroll Services Sale, Payroll Outsourcing Sale, Payroll Accountants Sale).

Sale accountants will help with business acquisition and disposal in Sale, payslips, accounting services for the construction industry Sale, consulting services in Sale, assurance services, sole traders Sale, capital gains tax Sale, contractor accounts, estate planning, inheritance tax Sale, year end accounts, debt recovery Sale, payroll accounting, accounting services for start-ups, self-assessment tax returns in Sale, accounting and financial advice, HMRC submissions, litigation support, partnership registration Sale, tax investigations, accounting support services, personal tax, mergers and acquisitions, audit and auditing, corporate tax in Sale, partnership accounts, business support and planning, management accounts, cash flow Sale, VAT returns Sale, company secretarial services Sale, HMRC submissions in Sale and other kinds of accounting in Sale, Greater Manchester. Listed are just some of the tasks that are carried out by local accountants. Sale providers will let you know their full range of services.

With the web as a useful resource it is of course quite simple to find plenty of invaluable ideas and inspiration relating to auditing & accounting, personal tax assistance, self-assessment help and small business accounting. For instance, with a brief search we located this compelling article on choosing the right accountant for your business.

Sale Accounting Services

- Sale Specialist Tax

- Sale Tax Services

- Sale Debt Recovery

- Sale Forensic Accounting

- Sale Audits

- Sale Chartered Accountants

- Sale Payroll Services

- Sale Account Management

- Sale Bookkeeping Healthchecks

- Sale Tax Returns

- Sale Tax Refunds

- Sale Financial Audits

- Sale Self-Assessment

- Sale Tax Planning

Also find accountants in: Warburton, Didsbury, Partington, Reddish, Wingates, Gathurst, Calderbrook, Droylsden, Royton, Daubhill, Gee Cross, Cadishead, Failsworth, Manchester, Shawclough, Standish, Trafford Park, Bredbury, Shevington, Irlam, Summerseat, Rochdale, Westhoughton, Cheadle, Lately Common, Grasscroft, Salford, Eccles, Egerton, Denton, Dunham Town, Astley Green, Bolton, Sale, Shaw and more.

Accountant Sale

Accountant Sale Accountants Near Me

Accountants Near Me Accountants Sale

Accountants SaleMore Greater Manchester Accountants: Urmston, Dukinfield, Rochdale, Oldham, Droylsden, Hyde, Romiley, Eccles, Salford, Whitefield, Irlam, Cheadle Hulme, Ashton-in-Makerfield, Gatley, Swinton, Atherton, Leigh, Sale, Chadderton, Walkden, Manchester, Denton, Stretford, Stockport, Horwich, Hindley, Heywood, Farnworth, Bolton, Golborne, Stalybridge, Altrincham, Wigan, Radcliffe, Westhoughton, Royton, Middleton, Ashton-under-Lyne and Bury.

TOP - Accountants Sale - Financial Advisers

Chartered Accountant Sale - Small Business Accountants Sale - Affordable Accountant Sale - Online Accounting Sale - Investment Accounting Sale - Tax Preparation Sale - Auditors Sale - Bookkeeping Sale - Financial Accountants Sale