Accountants Felixstowe: Filling in your self-assessment form each year can really put your head in a spin. Other small businesses and sole traders in the Felixstowe area are faced with the same challenge. Is the answer perhaps to find yourself a local Felixstowe professional to do this task on your behalf? Maybe self-assessment is simply too challenging for you? The cost of completing and sending in your self-assessment form is around £200-£300 if done by a regular Felixstowe accountant. Those looking for cheaper rates normally look to online tax return services.

Different types of accountant will be promoting their services in and around Felixstowe. Locating one that matches your precise needs should be a priority. You will come to realise that there are accountants who work alone and accountants who work for large accounting firms. An accountancy firm will offer a wider range of services, while an independent accountant will provide a more personal service. You'll possibly find chartered accountants, auditors, investment accountants, tax accountants, actuaries, bookkeepers, financial accountants, accounting technicians, forensic accountants, management accountants and costing accountants in a sizable accountants firm.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. Membership of the AAT shows that they hold the minimum recommended qualification. You can then be sure your tax returns are done correctly. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Local Felixstowe bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

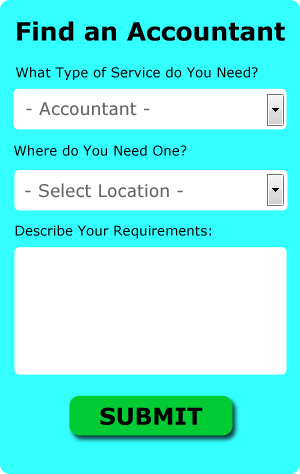

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Felixstowe accountant. You just have to fill in a simple form and answer some basic questions. In the next day or so you should be contacted by potential accountants in your local area.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. This kind of service may not suit everyone but could be the answer for your needs. There is no reason why this type of service will not prove to be as good as your average High Street accountant. Be sure to study customer reviews and testimonials. Apologies, but we do not endorse, recommend or advocate any specific company.

Going from the cheapest service to the most expensive, you could always use a chartered accountant if you are prepared to pay the price. These people are financial experts and are more commonly used by bigger companies. The choice, so they say, is all yours.

Maybe when you have looked all the options you will still decide to do your own tax returns. Available software that will also help includes BTCSoftware, Forbes, Gbooks, 123 e-Filing, Xero, Taxshield, Taxforward, Capium, Basetax, Ablegatio, Absolute Topup, Taxfiler, Keytime, TaxCalc, Andica, ACCTAX, Ajaccts, Nomisma, CalCal, Sage and GoSimple. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Be Better at Managing Your Money

Many people find that putting up a business is very exciting. When you're your own boss, you get to be in charge of basically everything. How scary is that? While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. In this article, we'll share a few tips proper money management.

Retain an accountant. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Each week, balance your books. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. Keep track of every payment received and every payment made, then at the end of the week, make sure that what you have on hand and in the bank actually matches what your numbers say you should have. When you do this, at the end of the month or every quarter, you're going to save yourself a lot of time and trouble trying to find where the discrepancies are if the numbers don't match up. Balancing regularly will only take a few minutes, while balancing only every so often could take hours.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

There are many things involved in the proper management of your money. It doesn't just involve listing the amount you spent and when you spent it. You have other things to track and many ways to do so. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Auditors Felixstowe

Auditors are specialists who evaluate the accounts of companies and organisations to verify the legality and validity of their current financial records. They offer companies from fraud, illustrate inconsistencies in accounting methods and, from time to time, work as consultants, helping organisations to identify ways to improve operational efficiency. For anybody to start working as an auditor they have to have certain specific qualifications and be certified by the regulating authority for accounting and auditing.

Felixstowe accountants will help with capital gains tax in Felixstowe, business acquisition and disposal, contractor accounts, assurance services in Felixstowe, payroll accounting Felixstowe, payslips, consultancy and systems advice, corporate tax in Felixstowe, tax preparation, accounting support services in Felixstowe, accounting services for start-ups Felixstowe, VAT returns, sole traders, partnership accounts, debt recovery, accounting services for the construction industry Felixstowe, business planning and support, business outsourcing, self-employed registrations, workplace pensions, estate planning in Felixstowe, cash flow Felixstowe, tax investigations in Felixstowe, partnership registrations, personal tax, investment reviews, general accounting services, limited company accounting, company secretarial services in Felixstowe, year end accounts, company formations, financial planning in Felixstowe and other kinds of accounting in Felixstowe, Suffolk. These are just a handful of the activities that are carried out by nearby accountants. Felixstowe specialists will let you know their whole range of accounting services.

By using the web as a powerful resource it is quite easy to find plenty of invaluable information and ideas concerning small business accounting, self-assessment help, accounting & auditing and personal tax assistance. For instance, with a brief search we located this enlightening article detailing how to choose an accountant to fill out your income tax return.

Felixstowe Accounting Services

- Felixstowe Debt Recovery

- Felixstowe Self-Assessment

- Felixstowe Chartered Accountants

- Felixstowe Tax Returns

- Felixstowe Specialist Tax

- Felixstowe Business Planning

- Felixstowe Personal Taxation

- Felixstowe VAT Returns

- Felixstowe PAYE Healthchecks

- Felixstowe Audits

- Felixstowe Payroll Management

- Felixstowe Account Management

- Felixstowe Bookkeepers

- Felixstowe Bookkeeping Healthchecks

Also find accountants in: Moulton, Thrandeston, Melton, Harkstead, Honington, Naughton, Worlington, Botesdale, Stonham Aspal, Ballingdon, Stowmarket, Cavendish, Burstall, Slaughden, Culford, Oulton Broad, Barking, Friston, Wenhaston, Hundon, Great Glemham, Bedfield, Kentford, North Cove, Peasenhall, Bures Green, Little Fakenham, Earls Green, Lowestoft End, Castle Hill, Gislingham, Monk Soham, Hargrave, Fornham St Martin, Tostock and more.

Accountant Felixstowe

Accountant Felixstowe Accountants Near Felixstowe

Accountants Near Felixstowe Accountants Felixstowe

Accountants FelixstoweMore Suffolk Accountants: Haverhill, Mildenhall, Lowestoft, Stowmarket, Newmarket, Sudbury, Beccles, Ipswich, Felixstowe and Bury St Edmunds.

TOP - Accountants Felixstowe - Financial Advisers

Small Business Accountants Felixstowe - Tax Return Preparation Felixstowe - Chartered Accountants Felixstowe - Cheap Accountant Felixstowe - Self-Assessments Felixstowe - Online Accounting Felixstowe - Investment Accountant Felixstowe - Financial Accountants Felixstowe - Bookkeeping Felixstowe