Accountants Mildenhall: It will come as no real surprise if you are running your own business or are self-employed in Mildenhall, that having your own accountant can pay big dividends. You should at the very least have much more time to focus your attention on your key business activities while the accountant takes care of the routine financial paperwork and bookkeeping. This kind of help can be especially crucial to small start-up businesses, and those who've not run a business before.

But exactly what will you have to pay, what standard of service should you expect to receive and where can you locate the right individual? Tracking down several local Mildenhall accountants ought to be fairly easy by doing a a short search on the internet. However, which of these Mildenhall accountants is the best choice for you and which ones can be trusted? The truth of the matter is that in Great Britain anybody can start up in business as an accountant or bookkeeper. It's not even neccessary for them to have any qualifications. Which, like me, you might find incredible.

To get the job done correctly you should search for a local accountant in Mildenhall who has the right qualifications. The AAT qualification is the minimum you should look for. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Sole traders in Mildenhall may find that qualified bookkeepers are just as able to do their tax returns.

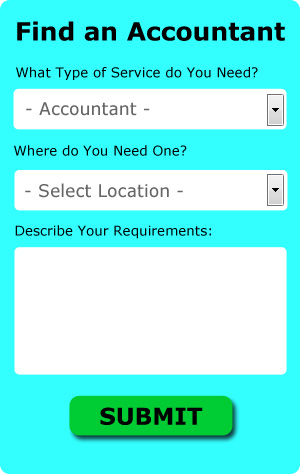

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You will quickly be able to complete the form and your search will begin. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. A number of self-employed people in Mildenhall prefer to use this simple and convenient alternative. Do some homework to single out a company with a good reputation. The better ones can soon be singled out by carefully studying reviews online. Recommending any specific services is beyond the scope of this short article.

At the end of the day you could always do it yourself and it will cost you nothing but time. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Sage, Andica, Keytime, Basetax, Taxshield, GoSimple, Taxfiler, Ablegatio, Gbooks, Taxforward, ACCTAX, CalCal, BTCSoftware, TaxCalc, Xero, Capium, Absolute Topup, Ajaccts, Forbes, 123 e-Filing and Nomisma. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. A £100 fine is levied for late self-assessments up to 3 months, more if later.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. It isn't that simple nor painless to get your business at a profitable level because there are things that will affect both your business and self-confidence. Failing to manage your money properly is one of the things that can contribute to this. Money management may not be something you've really given much thought too because figuring out your finances is pretty simple -- in the beginning stages of your business. Over time, though, as you earn more money, it can become quite complicated, so use these tips to help you out.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

Think about setting up payment plans for your clients. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. This can actually help build your confidence.

Control your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. Rather than going on a buying spree, spend wisely, which means spend only on those things that will help your business. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. Buy your office supplies in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. You'll also need to be careful about how much money you spend on entertainment.

Every adult should learn the proper way of managing their money. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. You can get started with the money management tips we've shared. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Small Business Accountants Mildenhall

Managing a small business in Mildenhall is stressful enough, without needing to worry about doing your accounts and similar bookkeeping tasks. If your annual accounts are getting on top of you and tax returns and VAT issues are causing sleepless nights, it is a good idea to hire a decent small business accountant in Mildenhall.

Giving advice, making sure that your business adheres to the best financial practices and providing methods to help your business to achieve its full potential, are just a sample of the duties of a reputable small business accountant in Mildenhall. A decent accounting firm in Mildenhall will offer practical small business advice to maximise your tax efficiency while at the same time reducing business expenditure; essential in the sometimes shady world of business taxation.

You also ought to be supplied with an assigned accountancy manager who understands your future plans, your business structure and your company's circumstances. (Tags: Small Business Accounting Mildenhall, Small Business Accountant Mildenhall, Small Business Accountants Mildenhall).

Forensic Accounting Mildenhall

You may well run across the phrase "forensic accounting" when you are looking for an accountant in Mildenhall, and will undoubtedly be wondering what is the difference between normal accounting and forensic accounting. The actual word 'forensic' is the thing that gives it away, meaning literally "suitable for use in a court of law." Using accounting, investigative skills and auditing to detect discrepancies in financial accounts that have been involved in fraud or theft, it is also sometimes known as 'forensic accountancy' or 'financial forensics'. Some of the larger accountancy firms in and around Mildenhall even have specialised divisions dealing with money laundering, personal injury claims, insolvency, bankruptcy, professional negligence, falsified insurance claims and tax fraud. (Tags: Forensic Accountant Mildenhall, Forensic Accounting Mildenhall, Forensic Accountants Mildenhall)

Mildenhall accountants will help with National Insurance numbers Mildenhall, estate planning Mildenhall, limited company accounting, audit and compliance reports in Mildenhall, small business accounting, sole traders in Mildenhall, business start-ups, self-employed registrations, business acquisition and disposal Mildenhall, consultancy and systems advice in Mildenhall, pension forecasts in Mildenhall, mergers and acquisitions, general accounting services, financial statements Mildenhall, company secretarial services, HMRC submissions Mildenhall, personal tax Mildenhall, accounting services for media companies, contractor accounts, corporate tax, business advisory services, accounting services for the construction industry, corporate finance, capital gains tax, accounting services for buy to let landlords in Mildenhall, management accounts in Mildenhall, payslips, partnership registration, bookkeeping, company formations, HMRC submissions, cashflow projections and other accounting related services in Mildenhall, Suffolk. These are just an example of the tasks that are performed by local accountants. Mildenhall providers will be happy to tell you about their whole range of accountancy services.

You do, in fact have the very best resource close at hand in the form of the internet. There's such a lot of information and inspiration available online for things like self-assessment help, accounting for small businesses, personal tax assistance and accounting & auditing, that you'll pretty quickly be brimming with suggestions for your accounting requirements. A good example could be this article about how to find a quality accountant.

Mildenhall Accounting Services

- Mildenhall Tax Investigations

- Mildenhall Specialist Tax

- Mildenhall Tax Returns

- Mildenhall Account Management

- Mildenhall Self-Assessment

- Mildenhall PAYE Healthchecks

- Mildenhall Bookkeepers

- Mildenhall Business Accounting

- Mildenhall Taxation Advice

- Mildenhall VAT Returns

- Mildenhall Bookkeeping Healthchecks

- Mildenhall Tax Refunds

- Mildenhall Chartered Accountants

- Mildenhall Tax Planning

Also find accountants in: Letheringham, Shimpling, Lidgate, Thorington Street, Baylham, Lound, Peasenhall, Boxford, Offton, Great Saxham, Newton, Great Green, Charles Tye, Haughley New Street, Barnby, Monewden, Haverhill, Stone Street, Ellough, Kersey, Sibton, Framsden, Aldeburgh, Hopton, Monks Eleigh, Lackford, Great Wenham, Fornham St Martin, Wetherden, Shelley, Westhall, Brandeston, Grundisburgh, Forward Green, Ilketshall St Lawrence and more.

Accountant Mildenhall

Accountant Mildenhall Accountants Near Me

Accountants Near Me Accountants Mildenhall

Accountants MildenhallMore Suffolk Accountants: Stowmarket, Ipswich, Felixstowe, Newmarket, Beccles, Haverhill, Sudbury, Mildenhall, Lowestoft and Bury St Edmunds.

TOP - Accountants Mildenhall - Financial Advisers

Tax Accountants Mildenhall - Online Accounting Mildenhall - Auditors Mildenhall - Small Business Accountant Mildenhall - Chartered Accountant Mildenhall - Cheap Accountant Mildenhall - Investment Accounting Mildenhall - Self-Assessments Mildenhall - Financial Accountants Mildenhall