Accountants Bury St Edmunds: If you've got your own small business or are a self-employed person in Bury St Edmunds, Suffolk, you will soon realise that there are several benefits to be gained from using a qualified accountant. Among the many benefits are the fact that you'll have extra time to focus your attention on core business operations while time consuming and routine bookkeeping can be confidently managed by your accountant. This sort of financial assistance is vital for any business, but is especially beneficial for start-up businesses.

So, where's the best place to locate a professional Bury St Edmunds accountant and what kind of service might you expect to receive? At one time the local newspaper or Yellow Pages would have been the first place to look, but today the internet is a lot more popular. However, it is difficult to spot the gems from the scoundrels. You must always remember that it's possible for anybody in Bury St Edmunds to say that they're an accountant. They don't need to have any specific qualifications. This can of course lead to abuse.

Finding an accountant in Bury St Edmunds who is qualified is generally advisable. For simple self-assessment work an AAT qualification is what you need to look for. A qualified accountant may cost a little more but in return give you peace of mind. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

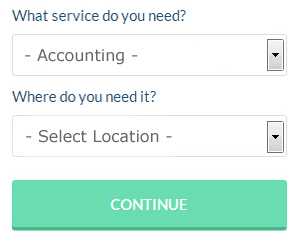

If you want to reach out to a number of local Bury St Edmunds accountants, you could always use a service called Bark. In no time at all you can fill out the job form and submit it with a single click. Just sit back and wait for the responses to roll in.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. It could be that this solution will be more appropriate for you. Even if you do decide to go down this route, take some time in singling out a trustworthy company. There are resources online that will help you choose, such as review websites. If you are looking for individual recommendations, this website is not the place to find them.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. If you want the best person for your business this might be an option.

The cheapest option of all is to do your own self-assessment form. Available software that will also help includes GoSimple, Forbes, Ablegatio, CalCal, Xero, ACCTAX, Ajaccts, Nomisma, TaxCalc, Sage, Taxshield, BTCSoftware, Keytime, Capium, Taxfiler, 123 e-Filing, Basetax, Gbooks, Absolute Topup, Taxforward and Andica. In any event the most important thing is to get your self-assessment set in before the deadline. Penalties start at £100 and rise considerably if you are more that 3 months late.

Forensic Accountant Bury St Edmunds

When you're searching for an accountant in Bury St Edmunds you will undoubtedly run into the phrase "forensic accounting" and wonder what the differences are between a standard accountant and a forensic accountant. The word 'forensic' is the thing that gives you an idea, meaning literally "denoting or relating to the application of scientific methods and techniques to the investigation of crime." Sometimes also known as 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to examine financial accounts so as to identify criminal activity and fraud. There are a few bigger accountants firms in Suffolk who have got specialist sections for forensic accounting, investigating professional negligence, insolvency, bankruptcy, false insurance claims, money laundering, personal injury claims and tax fraud.

Self Improvement for Business Through Better Money Management

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. For example, failure on your part to properly manage your finances will contribute to this. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. It's better if you streamline your finances by separating your business expenses from your personal expenses.

Offer your clients payment plans. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. This is a lot better than having payments come in sporadically. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. This is a great boost to your confidence.

Control your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. Buy your office supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. Avoid spending too much on your entertainment as well; be moderate instead.

There are so many little things that go into properly managing your money. It's more than listing what you spend and when. You have other things to track and many ways to do so. We've shared some things in this article that should make tracking your money easier for you to do. As you work and learn more about how to practice self improvement for your business through money management, you'll come up with plenty of other methods for streamlining things.

Bury St Edmunds accountants will help with self-employed registration, business planning and support Bury St Edmunds, debt recovery in Bury St Edmunds, litigation support, monthly payroll, bookkeeping, limited company accounting, VAT registration, PAYE, auditing and accounting, general accounting services in Bury St Edmunds, estate planning, corporate finance, cashflow projections, financial statements, capital gains tax, accounting services for buy to let rentals Bury St Edmunds, accounting services for the construction industry Bury St Edmunds, pension forecasts in Bury St Edmunds, financial planning in Bury St Edmunds, double entry accounting, inheritance tax, financial and accounting advice Bury St Edmunds, consultancy and systems advice in Bury St Edmunds, payslips, workplace pensions, mergers and acquisitions, business outsourcing, small business accounting, company formations in Bury St Edmunds, corporate tax, taxation accounting services and other kinds of accounting in Bury St Edmunds, Suffolk. These are just a small portion of the duties that are accomplished by local accountants. Bury St Edmunds professionals will be delighted to keep you abreast of their entire range of accounting services.

You do, of course have the very best resource at your fingertips in the shape of the net. There is such a lot of information and inspiration available online for things like small business accounting, personal tax assistance, auditing & accounting and self-assessment help, that you'll soon be swamped with ideas for your accounting needs. A good example could be this enlightening article detailing 5 tips for choosing a decent accountant.

Bury St Edmunds Accounting Services

- Bury St Edmunds Specialist Tax

- Bury St Edmunds Business Accounting

- Bury St Edmunds Auditing Services

- Bury St Edmunds Tax Advice

- Bury St Edmunds Business Planning

- Bury St Edmunds Account Management

- Bury St Edmunds Personal Taxation

- Bury St Edmunds Bookkeeping Healthchecks

- Bury St Edmunds Financial Advice

- Bury St Edmunds PAYE Healthchecks

- Bury St Edmunds VAT Returns

- Bury St Edmunds Tax Returns

- Bury St Edmunds Bookkeepers

- Bury St Edmunds Forensic Accounting

Also find accountants in: Sternfield, Holbrook, Great Wratting, Thwaite, Oulton, Redlingfield, Wilby, Stoke By Clare, Beck Row, Laxfield, Kennyhill, Haughley, Newton, Thornham Magna, Chickering, Martlesham Heath, Wixoe, Clopton Green, Mount Pleasant, Old Newton, Ampton, Thorns, Great Thurlow, Little Finborough, Great Bradley, Tuddenham, Halesworth, Stuston, Cross Green, Barnby, Herringswell, Flowton, Lowestoft End, Knettishall, Iken and more.

Accountant Bury St Edmunds

Accountant Bury St Edmunds Accountants Near Bury St Edmunds

Accountants Near Bury St Edmunds Accountants Bury St Edmunds

Accountants Bury St EdmundsMore Suffolk Accountants: Lowestoft, Stowmarket, Sudbury, Haverhill, Beccles, Bury St Edmunds, Felixstowe, Ipswich, Newmarket and Mildenhall.

TOP - Accountants Bury St Edmunds - Financial Advisers

Financial Advice Bury St Edmunds - Tax Return Preparation Bury St Edmunds - Online Accounting Bury St Edmunds - Small Business Accountants Bury St Edmunds - Investment Accountant Bury St Edmunds - Tax Accountants Bury St Edmunds - Auditing Bury St Edmunds - Chartered Accountants Bury St Edmunds - Financial Accountants Bury St Edmunds