Accountants Skelmersdale: Few will argue that if you operate a business or are a self-employed person in Skelmersdale, getting an accountant to do your books, brings a variety of positive rewards. You should at the very least have much more time to concentrate on your key business operations while your accountant deals with the routine financial paperwork and bookkeeping. Start-ups will discover that having access to this kind of expertise is really beneficial.

You might be confused when you find that accountants don't just do taxes, they've got many different roles. Check that any potential Skelmersdale accountant is suitable for the services that you need. Many accountants work independently, while others are part of a larger practice. Accountancy practices will have experts in each specific accounting sector. Accountancy practices will normally offer the professional services of management accountants, accounting technicians, investment accountants, bookkeepers, forensic accountants, financial accountants, tax preparation accountants, cost accountants, auditors, actuaries and chartered accountants.

Find yourself a properly qualified one and don't take any chances. Look for an AAT qualified accountant in the Skelmersdale area. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Local Skelmersdale bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

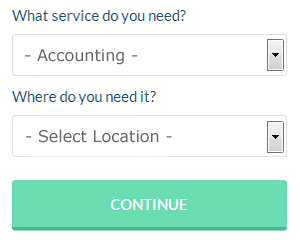

There is now a service available known as Bark, where you can look for local professionals including accountants. You simply answer a few relevant questions so that they can find the most suitable person for your needs. You should start getting responses from local Skelmersdale accountants within the next 24 hours. And the great thing about Bark is that it is completely free to use.

You could always try an online tax returns service if your needs are fairly simple. This may save time and be more cost-effective for self-employed people in Skelmersdale. Do a bit of research to find a reputable company. The easiest way to do this is by studying online reviews.

Although filling in your own tax return may seem too complicated, it is not actually that hard. Software is also available to make doing your self-assessment even easier. Some of the best ones include BTCSoftware, Taxforward, CalCal, Sage, Nomisma, Absolute Topup, GoSimple, Keytime, Basetax, Gbooks, TaxCalc, Andica, Xero, Ablegatio, Forbes, Capium, Ajaccts, Taxshield, ACCTAX, Taxfiler and 123 e-Filing. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

Be a Better Small Business Owner By Learning Proper Money Management

One of the hardest aspects of starting a business is learning the proper use of money management strategies. You may be thinking that money management is something that you should already be able to do. But managing your business finances is a lot different from managing your personal finances. It will help, though, if you are already experienced in the latter. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. Keep reading to learn some of the things that you can do to practice better money management for your business.

Find yourself an accountant who's competent. This is a business expense that will pay for itself a hundredfold because you know your books will be in order. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Try to learn bookkeeping. It's important that you have a system in place for your money -- both for your personal and business finances. You can either use basic spreadsheet or software such as QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. There are a lot of free resources online to help small business owners better manage their bookkeeping. Keeping your books organized and up to date will help you understand your finances better. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Don't throw away your receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. These receipts are also a record of your business expenditures. It's better if you keep all your receipts in one drawer. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

When it comes to managing your money properly, there are so many things that go into it. It's more than listing what you spend and when. When you're in business, you have several things you need to keep track of. With the tips above, you'll have an easier time tracking your money. As you work and learn more about how to practice self improvement for your business through money management, you'll come up with plenty of other methods for streamlining things.

Auditors Skelmersdale

An auditor is an individual or a firm appointed by a company to conduct an audit, which is an official evaluation of an organisation's financial accounts, generally by an impartial entity. They also sometimes undertake a consultative role to recommend possible risk prevention measures and the application of cost efficiency. To act as an auditor, a person must be authorised by the regulating body of auditing and accounting or possess specific qualifications.

Financial Actuaries Skelmersdale

Analysts and actuaries are experts in the management of risk. An actuary employs statistical and financial hypotheses to measure the chances of a particular event happening and the possible financial impact. An actuary uses mathematics and statistics to determine the fiscal effect of uncertainty and help their clients lessen potential risks.

Small Business Accountants Skelmersdale

Managing a small business in Skelmersdale is stressful enough, without needing to worry about preparing your accounts and similar bookkeeping duties. If your annual accounts are getting on top of you and tax returns and VAT issues are causing sleepless nights, it is wise to employ a focused small business accountant in Skelmersdale.

An experienced small business accountant in Skelmersdale will consider that it is their responsibility to develop your business, and offer you reliable financial advice for peace of mind and security in your specific circumstances. An accountancy firm in Skelmersdale should provide a dedicated small business accountant and adviser who will clear the fog that veils business taxation, in order to maximise your tax efficiences.

It is also crucial that you explain your company's financial situation, your business structure and your plans for the future accurately to your small business accountant. (Tags: Small Business Accountant Skelmersdale, Small Business Accounting Skelmersdale, Small Business Accountants Skelmersdale).

Skelmersdale accountants will help with assurance services, cashflow projections Skelmersdale, HMRC submissions in Skelmersdale, audit and auditing Skelmersdale, financial planning, payroll accounting Skelmersdale, self-employed registration, bookkeeping Skelmersdale, financial statements, HMRC submissions in Skelmersdale, pension forecasts, self-assessment tax returns, tax investigations, management accounts in Skelmersdale, National Insurance numbers, estate planning, year end accounts, VAT returns Skelmersdale, payslips Skelmersdale, business support and planning, tax preparation Skelmersdale, consultancy and systems advice, sole traders Skelmersdale, limited company accounting, bureau payroll services, accounting support services Skelmersdale, corporate finance, taxation accounting services in Skelmersdale, charities, VAT payer registration in Skelmersdale, company formations, business start-ups and other accounting related services in Skelmersdale, Lancashire. These are just a small portion of the duties that are carried out by local accountants. Skelmersdale companies will inform you of their whole range of services.

Skelmersdale Accounting Services

- Skelmersdale Tax Investigations

- Skelmersdale Financial Advice

- Skelmersdale Forensic Accounting

- Skelmersdale Taxation Advice

- Skelmersdale Auditing Services

- Skelmersdale Bookkeeping Healthchecks

- Skelmersdale Bookkeepers

- Skelmersdale Tax Refunds

- Skelmersdale Specialist Tax

- Skelmersdale Account Management

- Skelmersdale PAYE Healthchecks

- Skelmersdale Tax Planning

- Skelmersdale VAT Returns

- Skelmersdale Personal Taxation

Also find accountants in: Newsholme, Walker Fold, Limbrick, Padiham, Accrington, Oswaldtwistle, Greenhalgh, Healey, Moor Cock, Borwick, Lytham, Roseacre, Wheelton, Goosnargh, Hurstwood, Langho, Street, Tarnbrook, New Longton, Newburgh, Downholland Cross, Staining, Hapton, Walton Le Dale, Dunsop Bridge, Lytham St Annes, Stake Pool, Bashall Eaves, Barrow Nook, Higham, Elswick, Whittle Le Woods, Eagland Hill, Wharles, Saltcotes and more.

Accountant Skelmersdale

Accountant Skelmersdale Accountants Near Skelmersdale

Accountants Near Skelmersdale Accountants Skelmersdale

Accountants SkelmersdaleMore Lancashire Accountants: Fleetwood, Fulwood, Preston, Rawtenstall, Ormskirk, Lancaster, Skelmersdale, Colne, Blackburn, Chorley, Morecambe, Lytham St Annes, Accrington, Darwen, Clitheroe, Heysham, Blackpool, Burnley, Leyland, Poulton, Haslingden, Penwortham, Bacup and Nelson.

TOP - Accountants Skelmersdale - Financial Advisers

Self-Assessments Skelmersdale - Chartered Accountants Skelmersdale - Investment Accounting Skelmersdale - Affordable Accountant Skelmersdale - Bookkeeping Skelmersdale - Tax Preparation Skelmersdale - Small Business Accountant Skelmersdale - Auditing Skelmersdale - Online Accounting Skelmersdale