Accountants Shoeburyness: Do you find it a bit of a headache filling out your self-assessment form year after year? Don't fret, you are not the only one, plenty of others in Shoeburyness are faced with the same problems. But is there a simple way to find a local Shoeburyness accountant to do it for you? This might be the best alternative if you consider self-assessment just too taxing. The cost of completing and submitting your self-assessment form is approximately £200-£300 if carried out by a regular Shoeburyness accountant. You will be able to get this done a lot cheaper by making use of one of the various online services.

In the Shoeburyness area you'll find that there are a number of different types of accountant. Choosing one who dovetails neatly with your business is essential. Yet another decision that you'll need to make is whether to go for an accounting company or an independent accountant. Accountancy practices will have experts in each specific accounting discipline. Expect to find accounting technicians, financial accountants, management accountants, bookkeepers, actuaries, investment accountants, chartered accountants, tax accountants, costing accountants, auditors and forensic accountants within a decent sized accounting firm.

Therefore you should check that your chosen Shoeburyness accountant has the appropriate qualifications to do the job competently. An AAT qualified accountant should be adequate for sole traders and small businesses. A certified Shoeburyness accountant might be more costly than an untrained one, but should be worth the extra expense. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs.

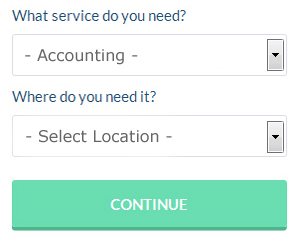

If you want to reach out to a number of local Shoeburyness accountants, you could always use a service called Bark. You simply answer a few relevant questions so that they can find the most suitable person for your needs. It is then simply a case of waiting for some suitable responses.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. More accountants are offering this modern alternative. If you decide to go with this method, pick a company with a decent reputation. It should be a simple task to find some online reviews to help you make your choice. Apologies, but we do not endorse, recommend or advocate any specific company.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. Bigger limited companies are more likely to use these high achievers. If you want the best person for your business this might be an option.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Taxfiler, ACCTAX, Ablegatio, Ajaccts, Taxforward, Keytime, Gbooks, Nomisma, GoSimple, CalCal, 123 e-Filing, Sage, Basetax, Taxshield, Forbes, Absolute Topup, BTCSoftware, TaxCalc, Xero, Capium and Andica. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Forensic Accountant Shoeburyness

Whilst conducting your search for a certified accountant in Shoeburyness there's a fair chance that you'll stumble upon the term "forensic accounting" and be wondering what it is, and how it is different from regular accounting. The clue for this is the word 'forensic', which essentially means "relating to or denoting the application of scientific techniques and methods for the investigation of crime." Also called 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to detect irregularities in financial accounts which have resulted in theft or fraud. There are even a few bigger accountants firms in Essex who have specialised divisions for forensic accounting, investigating professional negligence, money laundering, personal injury claims, insolvency, bankruptcy, false insurance claims and tax fraud.

Payroll Services Shoeburyness

A crucial element of any business in Shoeburyness, small or large, is having an accurate payroll system for its personnel. Managing staff payrolls requires that all legal obligations in relation to their exactness, timings and openness are observed to the finest detail.

Using a reliable accountant in Shoeburyness, to take care of your payroll needs is the simple way to minimise the workload of yourself or your financial team. A managed payroll service accountant will work with HMRC, with pensions schemes and oversee BACS payments to ensure your employees are always paid promptly, and that all required deductions are accurate.

A genuine payroll management accountant in Shoeburyness will also, in line with current legislations, organise P60's after the end of the financial year for every staff member. Upon the termination of a staff member's contract with your company, the payroll accountant will provide an updated P45 form relating to the tax paid during the previous financial period.

Financial Actuaries Shoeburyness

An actuary is a professional person who deals with the management and measurement of uncertainty and risk. They use their mathematical knowledge to measure the probability and risk of future occurrences and to estimate their impact (financially) on a business. To work as an actuary it's necessary to possess a statistical, mathematical and economic knowledge of everyday situations in the world of business finance. (Tags: Financial Actuaries Shoeburyness, Actuaries Shoeburyness, Actuary Shoeburyness)

Shoeburyness accountants will help with business disposal and acquisition, partnership registration, charities in Shoeburyness, bookkeeping, workplace pensions, cash flow in Shoeburyness, VAT returns Shoeburyness, taxation accounting services in Shoeburyness, capital gains tax, investment reviews, payslips Shoeburyness, accounting and auditing, accounting services for media companies, sole traders, self-assessment tax returns, assurance services, accounting services for property rentals, retirement planning, audit and compliance issues, corporation tax Shoeburyness, corporate finance in Shoeburyness, tax investigations, estate planning, litigation support, financial and accounting advice, company secretarial services, double entry accounting, contractor accounts, consultancy and systems advice, business planning and support, consulting services, limited company accounting in Shoeburyness and other forms of accounting in Shoeburyness, Essex. Listed are just some of the tasks that are undertaken by local accountants. Shoeburyness providers will be happy to tell you about their entire range of accounting services.

Shoeburyness Accounting Services

- Shoeburyness Tax Planning

- Shoeburyness Self-Assessment

- Shoeburyness Bookkeepers

- Shoeburyness Specialist Tax

- Shoeburyness Tax Services

- Shoeburyness Personal Taxation

- Shoeburyness VAT Returns

- Shoeburyness Payroll Management

- Shoeburyness Forensic Accounting

- Shoeburyness Business Accounting

- Shoeburyness Account Management

- Shoeburyness Financial Advice

- Shoeburyness Taxation Advice

- Shoeburyness Tax Returns

Also find accountants in: Great Oakley, Elmstead Market, South Fambridge, Kelvedon Hatch, Little Sampford, Abridge, White Notley, Ulting, Fyfield, Doddinghurst, Ovington, Chignall St James, Coblers Green, Crockleford Heath, Willingale, Bowers Gifford, Maldon, Prittlewell, Courtsend, Rickling, Moreton, Layer Breton, Battlesbridge, Passingford Bridge, Sheering, Ardleigh, North Weald Bassett, Great Totham, Runwell, Beauchamp Roding, Broadgroves, Sandon, Downham, Norton Heath, Thorpe Le Soken and more.

Accountant Shoeburyness

Accountant Shoeburyness Accountants Near Shoeburyness

Accountants Near Shoeburyness Accountants Shoeburyness

Accountants ShoeburynessMore Essex Accountants: Great Dunmow, North Weald Bassett, Grays, South Ockendon, Hullbridge, Great Baddow, Coggeshall, Southminster, Laindon, Rochford, Wickford, Canvey Island, Chafford Hundred, Clacton-on-Sea, Ingatestone, Chigwell, Heybridge, Romford, Galleywood, West Mersea, Westcliff-on-Sea, Stanway, Colchester, Harlow, South Woodham Ferrers, Barking, Hockley, Stansted Mountfitchet, Witham, Basildon, Loughton, Southend-on-Sea, Purfleet, Epping, Hornchurch, Billericay, Danbury, Harwich, Wivenhoe, Leigh-on-Sea, Chipping Ongar, Waltham Abbey, Dagenham, Great Wakering, Hadleigh, Upminster, Saffron Walden, Shoeburyness, Manningtree, Brentwood, Chelmsford, Parkeston, Maldon, Holland-on-Sea, West Thurrock, Pitsea, Halstead, South Benfleet, Southchurch, Burnham-on-Crouch, Rainham, Writtle, Tiptree, Stanford-le-Hope, Buckhurst Hill, Ilford, Hawkwell, Langdon Hills, Tilbury, Chingford, Brightlingsea, Frinton-on-Sea, Corringham, Walton-on-the-Naze, Braintree and Rayleigh.

TOP - Accountants Shoeburyness - Financial Advisers

Investment Accountant Shoeburyness - Online Accounting Shoeburyness - Financial Accountants Shoeburyness - Financial Advice Shoeburyness - Cheap Accountant Shoeburyness - Auditing Shoeburyness - Self-Assessments Shoeburyness - Chartered Accountant Shoeburyness - Bookkeeping Shoeburyness