Accountants Birkenhead: Do you find that filling out your annual self-assessment form gives you a headache? Many folks in Birkenhead are in the same predicament as you. Is it easy to track down a local professional in Birkenhead to manage this for you? This could be the best alternative if you consider self-assessment just too time-consuming. You can normally get this done by Birkenhead High Street accountants for something in the region of £200-£300. Online accounting services are available more cheaply than this.

Different types of accountant will be promoting their services in Birkenhead. Finding one who dovetails perfectly with your business is crucial. Certain accountants work as part of an accountancy practice, while some work solo. When it comes to accountancy companies, there'll be several accountants, each with their own specialities. Usually accounting firms will employ: cost accountants, financial accountants, accounting technicians, investment accountants, forensic accountants, chartered accountants, auditors, actuaries, tax preparation accountants, bookkeepers and management accountants.

Find yourself a properly qualified one and don't take any chances. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. A qualified accountant may cost a little more but in return give you peace of mind. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. A bookkeeper may be qualified enough to do your tax returns unless you are a large Limited Company.

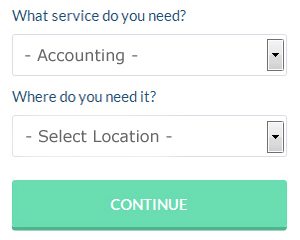

If you want to reach out to a number of local Birkenhead accountants, you could always use a service called Bark. In no time at all you can fill out the job form and submit it with a single click. Then you just have to wait for some prospective accountants to contact you. Try this free service because you've got nothing to lose.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. A number of self-employed people in Birkenhead prefer to use this simple and convenient alternative. It would be advisable to investigate that any online company you use is reputable. Study online reviews so that you can get an overview of the services available. We will not be recommending any individual online accounting service in this article.

The cheapest option of all is to do your own self-assessment form. Available software that will also help includes Taxforward, Forbes, Ajaccts, CalCal, Taxshield, Keytime, Nomisma, TaxCalc, Basetax, BTCSoftware, Ablegatio, Taxfiler, Absolute Topup, Xero, Gbooks, Sage, GoSimple, 123 e-Filing, Capium, ACCTAX and Andica. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

Proper Money Management for Improving Your Business and Yourself

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Money management seems like one of those things that you should have the ability to do already. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. Keep reading to learn some of the things that you can do to practice better money management for your business.

Get yourself an accountant. This is one of those expenses that is absolutely worth it, as an accountant will manage your books full time. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. What happens is that you can focus more on building your business, including marketing and getting more clients. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Each week, balance your books. If your business is a traditional store wherein you use registers or you have multiple payments coming in each day, you may be better off balancing your books at the end of each business day. It's important that you keep track of the money coming in and the money you're spending. At the end of each business day or business week, tally it all up and the amount you come up with should match the amount you should have in the bank or on hand. This will save you the trouble of tracking down discrepancies each month or each quarter. You won't have to spend a long time balancing your books if you do it on a regular basis.

Make sure you're prompt in paying your taxes. Small businesses typically pay file taxes quarterly. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. The last thing you need is to have the IRS coming after you for tax evasion!

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. When you know how your money is being used, where it is going, how much is coming in, and so on, you're going to be able to run a more successful business and your confidence level will be high. You can get started with the money management tips we've shared. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Forensic Accountant Birkenhead

When you happen to be hunting for an accountant in Birkenhead you'll undoubtedly notice the term "forensic accounting" and be curious about what the differences are between a forensic accountant and a regular accountant. With the actual word 'forensic' meaning literally "denoting or relating to the application of scientific methods and techniques to the investigation of crime", you ought to get an idea as to what's involved. Occasionally also referred to as 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to examine financial accounts in order to discover fraud and criminal activity. There are even some bigger accountants firms in Merseyside who have got specialised divisions for forensic accounting, investigating money laundering, insolvency, professional negligence, personal injury claims, bankruptcy, false insurance claims and tax fraud.

Actuaries Birkenhead

An actuary is a professional who evaluates the measurement and managing of risk and uncertainty. An actuary employs statistical and financial practices to evaluate the possibility of a specific event happening and the potential monetary impact. To work as an actuary it's important to have a statistical, economic and mathematical understanding of everyday situations in the financial world.

Small Business Accountants Birkenhead

Doing the accounts can be a stressful experience for any owner of a small business in Birkenhead. A focused small business accountant in Birkenhead will provide you with a hassle-free method to keep your VAT, tax returns and annual accounts in perfect order.

A qualified small business accountant in Birkenhead will regard it as their responsibility to help develop your business, and offer you reliable financial advice for peace of mind and security in your specific circumstances. An accountancy firm in Birkenhead will provide an allocated small business accountant and consultant who will remove the fog that shrouds business taxation, so as to optimise your tax efficiency.

So as to do their job properly, a small business accountant in Birkenhead will need to know precise details regarding your present financial standing, business structure and any potential investment that you might be considering, or have set up. (Tags: Small Business Accountant Birkenhead, Small Business Accountants Birkenhead, Small Business Accounting Birkenhead).

Birkenhead accountants will help with consulting services, accounting services for property rentals, financial planning, taxation accounting services, contractor accounts, monthly payroll, bookkeeping, litigation support, investment reviews, HMRC liaison, self-employed registration, partnership registration, double entry accounting, assurance services, sole traders, year end accounts, tax returns, corporate tax, small business accounting, business outsourcing, limited company accounting, general accounting services, HMRC submissions in Birkenhead, company secretarial services Birkenhead, audit and compliance issues Birkenhead, corporate finance, business start-ups, VAT registration, consultancy and systems advice, company formations, business planning and support, personal tax and other forms of accounting in Birkenhead, Merseyside. Listed are just a selection of the duties that are conducted by nearby accountants. Birkenhead specialists will keep you informed about their full range of services.

You do, in fact have the best resource at your fingertips in the form of the net. There is such a lot of information and inspiration available online for stuff like small business accounting, self-assessment help, personal tax assistance and auditing & accounting, that you will pretty quickly be deluged with suggestions for your accounting needs. An example might be this interesting article describing choosing an accountant.

Birkenhead Accounting Services

- Birkenhead Tax Services

- Birkenhead Tax Returns

- Birkenhead Debt Recovery

- Birkenhead Bookkeeping Healthchecks

- Birkenhead Tax Investigations

- Birkenhead VAT Returns

- Birkenhead Tax Planning

- Birkenhead Self-Assessment

- Birkenhead Payroll Management

- Birkenhead Auditing

- Birkenhead Bookkeepers

- Birkenhead Tax Advice

- Birkenhead Business Accounting

- Birkenhead PAYE Healthchecks

Also find accountants in: Melling Mount, Moss Bank, West Kirby, Oxton, Hunts Cross, Liverpool, Prenton, Brimstage, Caldy, Thornton Hough, Birkenhead, Aigburth, Great Crosby, Sefton, Haydock, Grassendale, Port Sunlight, Melling, Whiston, Crosby, Saughall Massie, Hightown, West Park, Bebington, Irby, Gateacre, Litherland, Wirral, Raby, Walton, Clock Face, Bold Heath, Barnston, Pensby, Seacombe and more.

Accountant Birkenhead

Accountant Birkenhead Accountants Near Birkenhead

Accountants Near Birkenhead Accountants Birkenhead

Accountants BirkenheadMore Merseyside Accountants: St Helens, Formby, Kirkby, Maghull, Newton-le-Willows, Wallasey, Bootle, Halewood, Litherland, Crosby, Heswall, Haydock, Southport, Liverpool, Bebington, Birkenhead and Prescot.

TOP - Accountants Birkenhead - Financial Advisers

Auditors Birkenhead - Financial Accountants Birkenhead - Financial Advice Birkenhead - Tax Return Preparation Birkenhead - Small Business Accountants Birkenhead - Affordable Accountant Birkenhead - Chartered Accountants Birkenhead - Bookkeeping Birkenhead - Tax Accountants Birkenhead