Accountants Pitsea: It will come as no real surprise if you're running your own business or are self-employed in Pitsea, that having an accountant can have considerable rewards. Among the many benefits are the fact that you'll have extra time to focus your attention on core business activities whilst time consuming and routine bookkeeping can be expertly dealt with by your accountant. Start-ups will discover that having access to this type of expertise is extremely beneficial.

With various different types of accountants advertising in Pitsea it can be baffling. Choosing the best one for your company is essential. Another decision you'll have to make is whether to go for an accountancy firm or a lone wolf accountant. Accountancy practices generally have experts in each primary field of accounting. The kinds of accountant you are likely to find within a practice could include: management accountants, cost accountants, tax preparation accountants, accounting technicians, actuaries, forensic accountants, auditors, chartered accountants, investment accountants, bookkeepers and financial accountants.

Find yourself a properly qualified one and don't take any chances. Ask if they at least have an AAT qualification or higher. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Your accountant's fees are tax deductable.

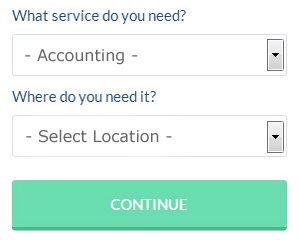

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. A couple of minutes is all that is needed to complete their simple and straighforward search form. Within a few hours you should hear from some local accountants who are willing to help you.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. A number of self-employed people in Pitsea prefer to use this simple and convenient alternative. If you decide to go with this method, pick a company with a decent reputation. A quick browse through some reviews online should give you an idea of the best and worse services.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. These highly motivated professionals will have all the answers but may be over the top for small businesses. All that remains is to make your final choice.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. It is also a good idea to make use of some self-assessment software such as 123 e-Filing, Capium, Taxshield, Sage, Nomisma, Absolute Topup, CalCal, ACCTAX, Ablegatio, Ajaccts, Forbes, Keytime, Gbooks, Andica, TaxCalc, BTCSoftware, GoSimple, Taxforward, Taxfiler, Basetax or Xero to simplify the process. You will get a penalty if your tax return isn't in on time.

How Proper Money Management Helps Your Business and Yourself

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. You won't reach the level of success you're aiming to reach when this happens. Use the following tips to help you manage your money better.

Find yourself an accountant who's competent. An accountant is well worth the business expense because she can manage your books for you full time. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. The great thing is that all the paperwork will be handled by your accountant. This frees you up and lets you concentrate on other aspects of your business. With an accountant, you'll save many hours (or even days) figuring out your books.

Consider offering clients payment plans. Not only will this drum up more business for you, this will ensure that money is coming in regularly. This is a lot better than having payments come in sporadically. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. This can actually help build your confidence.

Keep a complete accounting of how much business you generate down to the last penny. Keep a record of every payment you get from customers or clients. This way you know the amount of money your business is generating and you can also track the people who has already paid you and identify those whose payments are still pending. This money management strategy also makes it a lot easier on you to determine the amount of money you owe in taxes and even how much money you should pay yourself.

Proper money management involves a number of different things. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. One of the secrets to having a successful business is learning proper money management.

Financial Actuaries Pitsea

An actuary is a business professional who deals with the managing and measurement of uncertainty and risk. Actuaries use their mathematical skills to calculate the probability and risk of future happenings and to predict their effect on a business. An actuary uses statistics and math concepts to appraise the financial impact of uncertainties and help their customers limit risks. (Tags: Financial Actuaries Pitsea, Actuary Pitsea, Actuaries Pitsea)

Payroll Services Pitsea

For any company in Pitsea, from independent contractors to large scale organisations, payrolls for staff can be stressful. Dealing with staff payrolls requires that all legal obligations in relation to their exactness, openness and timings are followed to the minutest detail.

Not all small businesses have the help that a dedicated financial specialist can provide, and an easy way to deal with employee payrolls is to hire an outside Pitsea payroll service. The payroll service will work alongside HMRC and pension providers, and deal with BACS payments to ensure timely and accurate payment to all personnel.

Abiding by current regulations, a dedicated payroll management accountant in Pitsea will also provide each of your employees with a P60 tax form at the conclusion of each financial year. They will also provide P45 tax forms at the termination of a staff member's working contract.

Small Business Accountants Pitsea

Making sure that your accounts are accurate and up-to-date can be a challenging job for any small business owner in Pitsea. Using the services of a small business accountant in Pitsea will allow you to run your business safe in the knowledge that your tax returns, annual accounts and VAT, among many other business tax requirements, are being met.

A knowledgeable small business accountant in Pitsea will regard it as their responsibility to develop your business, and offer you sound financial guidance for peace of mind and security in your specific situation. The fluctuating and complex field of business taxation will be clearly explained to you so as to lower your business expenses, while at the same time maximising tax efficiency.

It is also crucial that you explain your plans for the future, your current financial circumstances and your business structure truthfully to your small business accountant. (Tags: Small Business Accountant Pitsea, Small Business Accounting Pitsea, Small Business Accountants Pitsea).

Pitsea accountants will help with assurance services, workplace pensions, accounting services for buy to let property rentals, financial planning in Pitsea, business advisory, double entry accounting, business support and planning, compliance and audit reporting, financial statements Pitsea, business outsourcing, HMRC liaison in Pitsea, PAYE Pitsea, small business accounting, taxation accounting services, tax investigations, charities Pitsea, payslips, National Insurance numbers, contractor accounts, mergers and acquisitions, capital gains tax, HMRC submissions, consulting services, debt recovery Pitsea, bookkeeping in Pitsea, accounting support services Pitsea, company formations, business acquisition and disposal Pitsea, investment reviews, corporate finance in Pitsea, business start-ups, partnership accounts Pitsea and other types of accounting in Pitsea, Essex. These are just a small portion of the duties that are carried out by local accountants. Pitsea providers will be happy to inform you of their full range of accountancy services.

Pitsea Accounting Services

- Pitsea Chartered Accountants

- Pitsea Self-Assessment

- Pitsea Business Planning

- Pitsea Bookkeepers

- Pitsea Taxation Advice

- Pitsea Debt Recovery

- Pitsea Personal Taxation

- Pitsea Financial Advice

- Pitsea Tax Returns

- Pitsea Tax Refunds

- Pitsea Business Accounting

- Pitsea Tax Services

- Pitsea Payroll Management

- Pitsea PAYE Healthchecks

Also find accountants in: Little Yeldham, Blacksmiths Corner, Stambourne, Wethersfield, Bournebridge, Starlings Green, Copford Green, Great Wigborough, Ashen, Vange, Baker Street, Lindsell, Rudley Green, Fordstreet, Churchgate Street, Mayland, Mill Green, Crix, Heckfordbridge, Wickford, Purfleet, Ugley Green, Great Henny, Lambourne End, Silver End, Jaspers Green, Deal Hall, Weir, Gestingthorpe, Southend On Sea, Rayne, Laindon, Chappel, Debden Green, Rawreth and more.

Accountant Pitsea

Accountant Pitsea Accountants Near Me

Accountants Near Me Accountants Pitsea

Accountants PitseaMore Essex Accountants: Chipping Ongar, Waltham Abbey, Manningtree, Witham, Canvey Island, Southminster, Chigwell, Chelmsford, Romford, Holland-on-Sea, Wivenhoe, Stanway, Barking, South Ockendon, Hockley, Chafford Hundred, Ilford, Buckhurst Hill, Danbury, Harwich, Laindon, Southend-on-Sea, Hornchurch, Westcliff-on-Sea, South Benfleet, Tilbury, Ingatestone, Langdon Hills, Halstead, Epping, Clacton-on-Sea, Frinton-on-Sea, South Woodham Ferrers, Heybridge, North Weald Bassett, Pitsea, Chingford, Leigh-on-Sea, Hullbridge, Saffron Walden, Harlow, Grays, Writtle, Coggeshall, Rochford, Rayleigh, Basildon, Great Wakering, Rainham, Loughton, Galleywood, Corringham, Burnham-on-Crouch, Braintree, Stansted Mountfitchet, Upminster, Hadleigh, Brightlingsea, Maldon, Brentwood, West Thurrock, Hawkwell, Purfleet, Walton-on-the-Naze, Shoeburyness, Tiptree, Parkeston, Dagenham, Stanford-le-Hope, Great Baddow, Great Dunmow, Southchurch, Billericay, West Mersea, Wickford and Colchester.

TOP - Accountants Pitsea - Financial Advisers

Tax Accountants Pitsea - Bookkeeping Pitsea - Affordable Accountant Pitsea - Financial Accountants Pitsea - Financial Advice Pitsea - Investment Accountant Pitsea - Online Accounting Pitsea - Chartered Accountants Pitsea - Small Business Accountant Pitsea