Accountants Hersham: Do you find that filling out your annual self-assessment form gives you a headache? This is a common problem for many others in Hersham, Surrey. Is finding a local Hersham accountant to do it for you a better option? If self-assessment is too complex for you, this might be the way forward. You can normally get this done by regular Hersham accountants for something like £200-£300. By utilizing an online service rather than a local Hersham accountant you can save a certain amount of cash.

But exactly what will you need to pay, what standard of service should you expect and where can you uncover the best person? An internet search engine will pretty quickly provide a list of possible candidates in Hersham. Yet, how do you ascertain which accountants are trustworthy? The fact that almost anybody in Hersham can claim to be an accountant is a fact that you need to keep in mind. They do not even need to have any qualifications. This can lead to abuse.

Finding a properly qualified Hersham accountant should be your priority. You don't need a chartered accountant but should get one who is at least AAT qualified. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. You will of course get a tax deduction on the costs involved in preparing your tax returns. Hersham sole traders often opt to use bookkeeper rather than accountants for their tax returns.

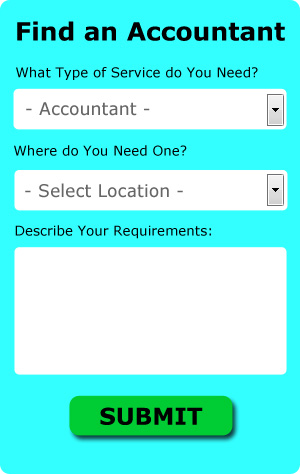

By using an online service such as Bark.com you could be put in touch with a number of local accountants. You'll be presented with a simple form which can be completed in a minute or two. Within a few hours you should hear from some local accountants who are willing to help you. You can use Bark to find accountants and other similar services.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This type of service is growing in popularity. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. We prefer not to recommend any particular online accounting company here.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You could even use a software program like BTCSoftware, Sage, Xero, Capium, Ablegatio, ACCTAX, Nomisma, TaxCalc, Taxforward, Basetax, GoSimple, CalCal, Keytime, 123 e-Filing, Absolute Topup, Forbes, Taxfiler, Taxshield, Ajaccts, Andica or Gbooks to make life even easier. You will get a penalty if your tax return isn't in on time.

Proper Money Management Tips for Small Business Owners

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. When you're a business owner, you're your own boss and in control of your income. That sounds a little scary, doesn't it? While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. In this article, we'll share a few tips proper money management.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. But beware of credit cards. If you keep a balance there every month, you're going to be paying interest and it can actually cost you more than if you just went ahead and paid for your expenses directly from your bank account. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

You may want to offer payment plans to clients. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. This can certainly boost your self-confidence.

Do not forget to pay your taxes on time. In general, small businesses pay taxes on a quarterly basis. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. Having the IRS at your doorstep isn't something you'd want, believe me!

Proper money management is a skill that every adult needs to develop. When you know how your money is being used, where it is going, how much is coming in, and so on, you're going to be able to run a more successful business and your confidence level will be high. So keep in mind the tips we've shared. In truth, if you want to improve yourself as you relate to your business, learning proper money management is crucial.

Actuaries Hersham

Actuaries work with businesses and government departments, to help them forecast long-term investment risks and fiscal expenditure. These risks can impact on both sides of a company's balance sheet and call for valuation, liability management and asset management skills. An actuary uses mathematics and statistical concepts to assess the fiscal impact of uncertainty and help clients cut down on potential risks. (Tags: Actuary Hersham, Financial Actuaries Hersham, Actuaries Hersham)

Forensic Accounting Hersham

During your search for an experienced accountant in Hersham there is a pretty good chance that you will happen on the phrase "forensic accounting" and be curious about what that is, and how it is different from regular accounting. The word 'forensic' is the thing that gives it away, meaning "relating to or denoting the application of scientific techniques and methods to the investigation of a crime." Also referred to as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to identify inaccuracies in financial accounts that have resulted in fraud or theft. A few of the larger accounting companies in the Hersham area might even have independent forensic accounting divisions with forensic accountants focusing on particular sorts of fraud, and might be addressing bankruptcy, personal injury claims, insolvency, money laundering, false insurance claims, professional negligence and tax fraud.

Small Business Accountants Hersham

Making certain that your accounts are accurate can be a challenging task for any small business owner in Hersham. A dedicated small business accountant in Hersham will offer you a stress free approach to keep your VAT, annual accounts and tax returns in perfect order.

An experienced small business accountant in Hersham will consider that it is their responsibility to help develop your business, and offer you reliable financial advice for security and peace of mind in your specific circumstances. The capricious and sometimes complex world of business taxation will be clearly laid out for you so as to lower your business expenses, while at the same time maximising tax efficiency.

You should also be provided with an assigned accountancy manager who understands your company's circumstances, your plans for the future and your business structure. (Tags: Small Business Accounting Hersham, Small Business Accountants Hersham, Small Business Accountant Hersham).

Payroll Services Hersham

Dealing with staff payrolls can be a stressful part of running a company in Hersham, irrespective of its size. The legislation relating to payroll requirements for transparency and accuracy mean that processing a company's payroll can be an intimidating task for those untrained in this discipline.

Using a reputable accountant in Hersham, to take care of your payroll needs is the easiest way to reduce the workload of your financial department. A managed payroll service accountant will work alongside HMRC, work with pensions providers and take care of BACS payments to make sure your staff are always paid promptly, and that all mandatory deductions are correct.

It will also be necessary for a payroll management company in Hersham to provide a P60 declaration for all employees at the conclusion of the financial year (by May 31st). A P45 tax form must also be presented to any member of staff who finishes working for your company, in keeping with current legislations. (Tags: Payroll Outsourcing Hersham, Payroll Services Hersham, Payroll Accountants Hersham).

Hersham accountants will help with VAT registrations, charities, capital gains tax in Hersham, accounting and auditing in Hersham, consultancy and systems advice, annual tax returns Hersham, taxation accounting services, financial statements, accounting and financial advice, bureau payroll services, bookkeeping, sole traders, cash flow, business support and planning, small business accounting Hersham, limited company accounting, accounting support services in Hersham, corporation tax, HMRC submissions, accounting services for buy to let property rentals, assurance services in Hersham, National Insurance numbers Hersham, general accounting services Hersham, HMRC submissions in Hersham, partnership accounts in Hersham, personal tax Hersham, mergers and acquisitions, audit and compliance issues Hersham, workplace pensions, financial planning, company formations Hersham, payslips and other kinds of accounting in Hersham, Surrey. These are just some of the activities that are accomplished by nearby accountants. Hersham providers will inform you of their entire range of services.

Hersham Accounting Services

- Hersham Specialist Tax

- Hersham Tax Planning

- Hersham Financial Advice

- Hersham VAT Returns

- Hersham Self-Assessment

- Hersham Business Accounting

- Hersham Account Management

- Hersham PAYE Healthchecks

- Hersham Debt Recovery

- Hersham Audits

- Hersham Personal Taxation

- Hersham Chartered Accountants

- Hersham Bookkeeping Healthchecks

- Hersham Bookkeeping

Also find accountants in: Little Bookham, West Molesey, The Bourne, Puttenham, The Hermitage, Horley, Pyrford, Hascombe, Busbridge, Long Ditton, Merstham, Peper Harow, Donkey Town, Lythe Hill, Chobham, Ewhurst Green, Hale, Old Woking, Newdigate, Oxted, Henley Park, Alfold, Thorpe, Kingswood, Brook, Burstow, Abinger Common, Stanwell Moor, Tongham, Row Town, Send Marsh, Stoke Dabernon, Salfords, Batts Corner, East Molesey and more.

Accountant Hersham

Accountant Hersham Accountants Near Hersham

Accountants Near Hersham Accountants Hersham

Accountants HershamMore Surrey Accountants: Epsom, Caterham, Leatherhead, Farnham, Chertsey, Esher, Weybridge, Cranleigh, Camberley, Sunbury-on-Thames, Hersham, Reigate, Staines, Ewell, Haslemere, Woking, Guildford, Addlestone, Ash, Redhill, Godalming, Horley, Molesey, Dorking, Banstead, Walton-on-Thames and Windlesham.

TOP - Accountants Hersham - Financial Advisers

Affordable Accountant Hersham - Auditing Hersham - Financial Advice Hersham - Self-Assessments Hersham - Online Accounting Hersham - Tax Return Preparation Hersham - Tax Advice Hersham - Chartered Accountant Hersham - Investment Accounting Hersham