Accountants Waltham Abbey: Having an accountant on board can be extremely beneficial to anyone who is self-employed or running a business in Waltham Abbey. You should at the very least have much more time to concentrate on your key business activities whilst your accountant deals with the routine bookkeeping and paperwork. This kind of assistance can be especially vital to small start-up businesses, and those who have not run a business before. In order for your Waltham Abbey business to expand and prosper, you're definitely going to require some help.

You will quickly discover that there are various categories of accountant. Check that any potential Waltham Abbey accountant is suitable for what you need. You will come to realise that there are accountants who work alone and accountants who work for large accounting companies. Each field of accounting will have their own specialists within an accounting company. The key positions which will be covered by an accountancy firm include: management accountants, financial accountants, accounting technicians, auditors, cost accountants, actuaries, forensic accountants, tax accountants, investment accountants, bookkeepers and chartered accountants.

Therefore you should check that your chosen Waltham Abbey accountant has the appropriate qualifications to do the job competently. An AAT qualified accountant should be adequate for sole traders and small businesses. A qualified accountant may cost a little more but in return give you peace of mind. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs.

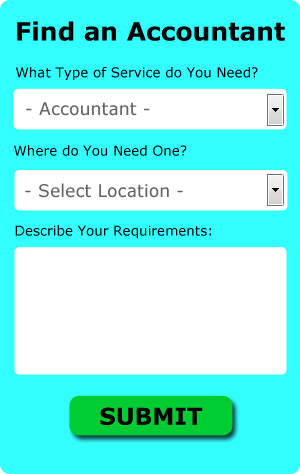

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Filling in a clear and simple form is all that you need to do to set the process in motion. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. While not recommended in every case, it could be the ideal solution for you. Should you decide to go down this route, take care in choosing a legitimate company. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. Their expertise is better suited to high finance and bigger businesses. With a chartered accountant you will certainly have the best on your side.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? You could even use a software program like Nomisma, 123 e-Filing, Forbes, CalCal, Ajaccts, GoSimple, BTCSoftware, Taxforward, Gbooks, Taxshield, TaxCalc, Xero, Absolute Topup, Sage, Keytime, Andica, Capium, Taxfiler, ACCTAX, Basetax or Ablegatio to make life even easier. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. You can expect to pay a minimum penalty of £100 for being late.

Auditors Waltham Abbey

An auditor is an individual or company brought in to assess and authenticate the correctness of accounts and make sure that organisations abide by tax legislation. They sometimes also act as advisors to recommend possible the prevention of risk and the introduction of financial savings. For anybody to become an auditor they should have certain qualifications and be licensed by the regulatory body for accounting and auditing.

Waltham Abbey accountants will help with audit and auditing, accounting services for media companies in Waltham Abbey, compliance and audit reporting, sole traders in Waltham Abbey, business advisory services, pension advice Waltham Abbey, accounting services for start-ups, accounting support services, partnership registration, double entry accounting, consultancy and systems advice, limited company accounting in Waltham Abbey, tax preparation, workplace pensions in Waltham Abbey, annual tax returns in Waltham Abbey, HMRC liaison, assurance services, payslips in Waltham Abbey, taxation accounting services, mergers and acquisitions, business disposal and acquisition in Waltham Abbey, year end accounts Waltham Abbey, investment reviews in Waltham Abbey, VAT returns in Waltham Abbey, company formations Waltham Abbey, business outsourcing in Waltham Abbey, HMRC submissions, VAT payer registration, financial and accounting advice, monthly payroll, accounting services for the construction sector in Waltham Abbey, litigation support and other professional accounting services in Waltham Abbey, Essex. These are just a few of the activities that are performed by local accountants. Waltham Abbey providers will inform you of their whole range of accounting services.

Using the internet as a resource it is quite simple to uncover a whole host of invaluable inspiration and ideas about self-assessment help, accounting for small businesses, accounting & auditing and personal tax assistance. For instance, with a very quick search we found this informative article outlining how to track down a reliable accountant.

Waltham Abbey Accounting Services

- Waltham Abbey Payroll Management

- Waltham Abbey Tax Services

- Waltham Abbey Bookkeeping Healthchecks

- Waltham Abbey PAYE Healthchecks

- Waltham Abbey Account Management

- Waltham Abbey Specialist Tax

- Waltham Abbey Chartered Accountants

- Waltham Abbey Audits

- Waltham Abbey Debt Recovery

- Waltham Abbey Business Accounting

- Waltham Abbey Tax Advice

- Waltham Abbey Bookkeepers

- Waltham Abbey VAT Returns

- Waltham Abbey Personal Taxation

Also find accountants in: Ramsey, Hockley, Causeway End, Hare Green, Churchgate Street, Abridge, Latchingdon, Molehill Green, Great Parndon, Stapleford Tawney, Stebbing Green, Foster Street, Little Bentley, Aldham, White Colne, Great Oxney Green, Lambourne End, Great Saling, Daws Heath, Thorrington, Broadgroves, Keeres Green, Little Leighs, Little Tey, Ashen, Ramsden Heath, Colchester, Earls Colne, Margaretting, Tendring, East Tilbury, Holland On Sea, Messing, Heckfordbridge, Great Tey and more.

Accountant Waltham Abbey

Accountant Waltham Abbey Accountants Near Waltham Abbey

Accountants Near Waltham Abbey Accountants Waltham Abbey

Accountants Waltham AbbeyMore Essex Accountants: Rainham, Epping, Clacton-on-Sea, Westcliff-on-Sea, Writtle, Harlow, Wickford, Canvey Island, Harwich, West Mersea, Burnham-on-Crouch, Barking, Rayleigh, Tiptree, Upminster, Witham, Braintree, Loughton, Tilbury, Parkeston, Dagenham, Southchurch, Hockley, Purfleet, Corringham, Manningtree, Ingatestone, Halstead, Stansted Mountfitchet, Waltham Abbey, Langdon Hills, Billericay, Stanford-le-Hope, Brightlingsea, Laindon, Walton-on-the-Naze, Heybridge, Southminster, Buckhurst Hill, Chigwell, Colchester, Hawkwell, Grays, Holland-on-Sea, Hullbridge, Chipping Ongar, Chelmsford, Leigh-on-Sea, Hornchurch, Great Dunmow, Southend-on-Sea, Frinton-on-Sea, Maldon, Saffron Walden, South Ockendon, South Benfleet, Wivenhoe, Stanway, Great Baddow, Chafford Hundred, Rochford, Great Wakering, Basildon, Pitsea, South Woodham Ferrers, North Weald Bassett, West Thurrock, Danbury, Shoeburyness, Hadleigh, Chingford, Brentwood, Ilford, Romford, Coggeshall and Galleywood.

TOP - Accountants Waltham Abbey - Financial Advisers

Tax Preparation Waltham Abbey - Bookkeeping Waltham Abbey - Investment Accounting Waltham Abbey - Cheap Accountant Waltham Abbey - Online Accounting Waltham Abbey - Tax Advice Waltham Abbey - Auditing Waltham Abbey - Financial Advice Waltham Abbey - Chartered Accountants Waltham Abbey