Accountants Wigston: Does filling out your self-assessment tax form give you nightmares every year? This will be a challenge for you, along with numerous other people in Wigston, Leicestershire. But how can you track down a local accountant in Wigston to do it for you? If self-assessment is too complex for you, this might be the way forward. You can typically get this done by Wigston High Street accountants for something like £200-£300. If you're looking for a cheaper option you might find the solution online.

But what do you get for your money, how much will you need to pay and where do you find the best Wigston accountant for your needs? Any good quality internet search engine will soon provide you with a substantial shortlist of local Wigston accountants, who'll be glad to help. Yet, how do you verify which of these accountants are trustworthy? You shouldn't forget that advertising as an accountant or bookkeeper is something that almost anyone in Wigston can do if they are so inclined. No formal qualifications are legally required in order to do this. This can result in inexperienced people entering this profession.

If you want your tax returns to be correct and error free it might be better to opt for a professional Wigston accountant who is appropriately qualified. Ask if they at least have an AAT qualification or higher. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

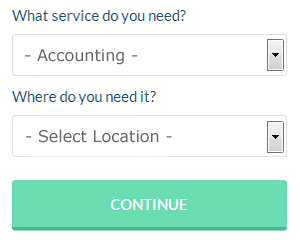

There is now a service available known as Bark, where you can look for local professionals including accountants. They provide an easy to fill in form that gives an overview of your requirements. Sometimes in as little as a couple of hours you will hear from prospective Wigston accountants who are keen to get to work for you. Bark offer this service free of charge.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. The popularity of these services has been increasing in recent years. Should you decide to go down this route, take care in choosing a legitimate company. Have a good look at customer testimonials and reviews both on the company website and on independent review websites.

The real professionals in the field are chartered accountants. Their usual clients are big businesses and large limited companies. So, at the end of the day the choice is yours.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Sage, ACCTAX, BTCSoftware, Nomisma, Andica, Basetax, Keytime, Forbes, 123 e-Filing, Taxshield, Gbooks, Absolute Topup, GoSimple, Xero, Taxforward, CalCal, Ajaccts, Taxfiler, TaxCalc, Capium and Ablegatio. In any event the most important thing is to get your self-assessment set in before the deadline.

Learning the Top Money Management Strategies for Business Success

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. Failing to manage your money properly is one of the things that can contribute to this. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can certainly help your memory because you only have one payment to make each month instead of several. Still, there's the risk that with a credit card, you'll be paying interest if you carry a balance each month. If this happens regularly, you'll be better off paying each of your monthly expenditures directly from your business bank account. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. This way you get one payment, you won't pay interest and you build your credit rating.

Learn how to keep your books. Having a system in place for your business and personal finance is crucial. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. There are also other online tools you can use, like Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. It's also a good idea to take a couple of classes on basic accounting and bookkeeping, particularly if you're not in a position yet to hire a bookkeeper full-time.

Control your spending. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. You should, however, spend money on things that will benefit your business. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. You should also try buying your business supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. You'll also need to be careful about how much money you spend on entertainment.

Proper money management is something that everyone should develop, no matter if they own a business or not. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. So make sure you use the tips on proper money management that we mentioned in this article. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Payroll Services Wigston

A crucial aspect of any business in Wigston, large or small, is having a reliable payroll system for its workers. The laws relating to payroll requirements for transparency and accuracy mean that running a business's staff payroll can be a daunting task.

Small businesses may not have their own in-house financial specialists, and the easiest way to manage employee pay is to use an independent Wigston accountant. Working along with HMRC and pension providers, a payroll service accountant will also manage BACS payments to staff, making certain that they are paid on time each month, and that all deductions are done correctly.

A qualified payroll management accountant in Wigston will also, in accordance with current legislations, provide P60's at the conclusion of the financial year for every staff member. A P45 form will also be provided for any member of staff who stops working for the company, according to the current regulations.

Small Business Accountants Wigston

Company accounting and bookkeeping can be a fairly stressful experience for any small business owner in Wigston. Employing a small business accountant in Wigston will permit you to operate your business knowing that your VAT, tax returns and annual accounts, and various other business tax requirements, are being met.

Helping you to grow your business, and providing sound financial advice relating to your specific situation, are just a couple of the means by which a small business accountant in Wigston can be of benefit to you. An effective accounting firm in Wigston will be able to give proactive small business guidance to maximise your tax efficiency while minimising business costs; essential in the sometimes murky field of business taxation.

It is also crucial that you explain your company's financial situation, the structure of your business and your plans for the future accurately to your small business accountant. (Tags: Small Business Accountants Wigston, Small Business Accountant Wigston, Small Business Accounting Wigston).

Auditors Wigston

An auditor is an individual appointed to review and verify the reliability of financial records to make sure that organisations comply with tax laws. Auditors examine the financial actions of the firm that employs them and make certain of the consistent operation of the organisation. To become an auditor, a person should be authorised by the regulating body for accounting and auditing and have certain specific qualifications. (Tags: Auditor Wigston, Auditors Wigston, Auditing Wigston)

Wigston accountants will help with assurance services Wigston, management accounts, accounting support services, tax returns, investment reviews, company secretarial services Wigston, bureau payroll services Wigston, sole traders in Wigston, small business accounting, business disposal and acquisition in Wigston, financial and accounting advice Wigston, financial statements, inheritance tax, workplace pensions in Wigston, personal tax, accounting services for media companies, taxation accounting services in Wigston, business support and planning Wigston, business advisory services, pension advice, company formations, consultancy and systems advice Wigston, VAT payer registration, general accounting services Wigston, consulting services, double entry accounting, VAT returns, debt recovery, accounting and auditing in Wigston, estate planning in Wigston, business start-ups, National Insurance numbers and other forms of accounting in Wigston, Leicestershire. Listed are just a small portion of the activities that are undertaken by nearby accountants. Wigston specialists will be happy to tell you about their entire range of accountancy services.

Wigston Accounting Services

- Wigston Chartered Accountants

- Wigston Tax Refunds

- Wigston Account Management

- Wigston Tax Planning

- Wigston Tax Returns

- Wigston Bookkeeping Healthchecks

- Wigston VAT Returns

- Wigston Tax Services

- Wigston Payroll Services

- Wigston Tax Investigations

- Wigston Self-Assessment

- Wigston Tax Advice

- Wigston Debt Recovery

- Wigston Business Accounting

Also find accountants in: Botcheston, Newbold, Great Bowden, Tugby, Hemington, Bardon, Withcote, Cold Overton, Countes Thorpe, Burbage, Bilstone, Peatling Magna, Medbourne, Walton On The Wolds, Barlestone, Higham On The Hill, Houghton On The Hill, Ratcliffe On The Wreake, Kirkby Bellars, Rearsby, Stoneygate, Oakthorpe, Prestwold, Goadby, Saltby, Thurmaston, Huncote, Chilcote, Redmile, Kibworth Harcourt, Kegworth, South Kilworth, Burton On The Wolds, Frolesworth, Stapleford and more.

Accountant Wigston

Accountant Wigston Accountants Near Wigston

Accountants Near Wigston Accountants Wigston

Accountants WigstonMore Leicestershire Accountants: Hinckley, Melton Mowbray, Loughborough, Earl Shilton, Leicester, Coalville, Oadby, Market Harborough, Shepshed and Wigston.

TOP - Accountants Wigston - Financial Advisers

Financial Advice Wigston - Online Accounting Wigston - Tax Advice Wigston - Affordable Accountant Wigston - Bookkeeping Wigston - Chartered Accountants Wigston - Self-Assessments Wigston - Financial Accountants Wigston - Investment Accountant Wigston