Accountants Littlehampton: It will come as no real surprise if you are running your own business or are self-employed in Littlehampton, that having your own accountant can pay big dividends. You should at the very least have much more time to focus on your key business operations whilst the accountant handles the routine bookkeeping and paperwork. Start-ups will find that having access to this type of expertise is really beneficial. A lot of Littlehampton businesses have been able to prosper due to having this kind of professional help.

When hunting for a local Littlehampton accountant, you'll find there are numerous different types available. Finding one who dovetails neatly with your business is essential. Some Littlehampton accountants work within a larger business, while others work on their own. Accounting firms will generally have different departments each dealing with a certain field of accounting. Among the primary accountancy positions are: actuaries, accounting technicians, investment accountants, bookkeepers, management accountants, auditors, tax preparation accountants, financial accountants, costing accountants, forensic accountants and chartered accountants.

You would be best advised to find a fully qualified Littlehampton accountant to do your tax returns. You don't need a chartered accountant but should get one who is at least AAT qualified. Qualified Littlehampton accountants might charge a bit more but they may also get you the maximum tax savings. It should go without saying that accountants fees are tax deductable.

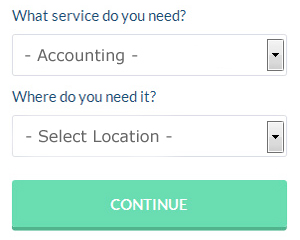

There is now a service available known as Bark, where you can look for local professionals including accountants. You only need to answer a few basic questions and complete a straightforward form. Just sit back and wait for the responses to roll in.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. For many self-employed people this is a convenient and time-effective solution. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It should be a simple task to find some online reviews to help you make your choice.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! It is also a good idea to make use of some self-assessment software such as Capium, Ablegatio, 123 e-Filing, Taxfiler, BTCSoftware, Xero, Sage, Taxforward, Keytime, GoSimple, Forbes, Ajaccts, TaxCalc, Absolute Topup, Gbooks, ACCTAX, Basetax, Taxshield, Andica, CalCal or Nomisma to simplify the process. Don't leave your self-assessment until the last minute, allow yourself plenty of time. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Forensic Accountant Littlehampton

You could well encounter the term "forensic accounting" when you're on the lookout for an accountant in Littlehampton, and will probably be interested to learn about the difference between standard accounting and forensic accounting. The word 'forensic' is the thing that gives you an idea, meaning basically "relating to or denoting the application of scientific techniques and methods for the investigation of crime." Using accounting, auditing and investigative skills to identify irregularities in financial accounts that have contributed to theft or fraud, it's also occasionally called 'forensic accountancy' or 'financial forensics'. Some of the larger accounting firms in the Littlehampton area may even have specialist forensic accounting divisions with forensic accountants targeting specific sorts of fraud, and may be dealing with professional negligence, tax fraud, insolvency, bankruptcy, personal injury claims, falsified insurance claims and money laundering. (Tags: Forensic Accountants Littlehampton, Forensic Accountant Littlehampton, Forensic Accounting Littlehampton)

Self Improvement for Your Business Through Proper Money Management

One of the best reasons to go into business for yourself is that doing so puts you completely in charge of your own income, as you get to control how much money comes in and how much money goes out. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. If you'd like to be able to manage your business funds, keep reading.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. It's better if you streamline your finances by separating your business expenses from your personal expenses.

Track your personal and business expenditures down to the last cent. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. This way, you'll be able to see your spending habits. You wouldn't want to be like those people who wonder where their money went. This is helpful when you're on a tight budget because you'll be able to see exactly which expenditures you can cut back on so you can save money. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. You'll be better off putting your money in the bank at the end of each work day.

You can improve yourself in many ways when you're managing your own business. You can be better at managing your business, for example. Everybody wishes that they could be better with money. When you know how to properly manage your money, your self-confidence will improve in the process. Moreover, your business and personal lives will be more organized. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Payroll Services Littlehampton

A vital aspect of any business in Littlehampton, small or large, is having an effective payroll system for its workers. Dealing with staff payrolls demands that all legal obligations regarding their openness, exactness and timing are followed to the finest detail.

A small business might not have the luxury of a dedicated financial specialist and a simple way to deal with the issue of staff payrolls is to retain the services of an outside accountant in Littlehampton. The accountant dealing with payrolls will work with HMRC and pension providers, and deal with BACS transfers to ensure accurate and timely wage payment to all personnel.

A certified payroll accountant in Littlehampton will also, in line with current legislations, organise P60's at the conclusion of the financial year for every member of staff. They'll also be responsible for providing P45 tax forms at the end of a staff member's contract with your company. (Tags: Payroll Accountant Littlehampton, Company Payrolls Littlehampton, Payroll Services Littlehampton).

Littlehampton accountants will help with mergers and acquisitions in Littlehampton, accounting services for buy to let landlords Littlehampton, accounting and financial advice, small business accounting, HMRC submissions Littlehampton, company secretarial services, accounting services for the construction industry in Littlehampton, employment law, capital gains tax, accounting and auditing, audit and compliance reporting, financial planning, VAT registration Littlehampton, pension forecasts, taxation accounting services, contractor accounts in Littlehampton, partnership accounts in Littlehampton, general accounting services, sole traders in Littlehampton, partnership registrations Littlehampton, accounting support services, National Insurance numbers, VAT returns, business start-ups in Littlehampton, business disposal and acquisition Littlehampton, accounting services for media companies Littlehampton, financial statements, double entry accounting Littlehampton, bureau payroll services, corporate tax, year end accounts Littlehampton, company formations and other types of accounting in Littlehampton, West Sussex. These are just a small portion of the tasks that are performed by local accountants. Littlehampton companies will tell you about their whole range of accountancy services.

Littlehampton Accounting Services

- Littlehampton Forensic Accounting

- Littlehampton Business Accounting

- Littlehampton Chartered Accountants

- Littlehampton Bookkeepers

- Littlehampton Tax Returns

- Littlehampton PAYE Healthchecks

- Littlehampton Specialist Tax

- Littlehampton Business Planning

- Littlehampton Tax Services

- Littlehampton Taxation Advice

- Littlehampton VAT Returns

- Littlehampton Personal Taxation

- Littlehampton Payroll Services

- Littlehampton Account Management

Also find accountants in: Buckman Corner, Horsted Keynes, Lowfield Heath, Pagham, Linchmere, Kingston By Sea, Itchingfield, Crabbet Park, Bramber, Street End, Stoughton, Horsham, Hassocks, Edburton, South Bersted, Muddleswood, Byworth, Mid Lavant, Thakeham, Loxwood, Donnington, Whitemans Green, Shipley, Iping, Wineham, Egdean, Boxgrove, Redford, Balcombe, Littlehampton, Codmore Hill, Twineham, Goring By Sea, West Itchenor, Sullington and more.

Accountant Littlehampton

Accountant Littlehampton Accountants Near Me

Accountants Near Me Accountants Littlehampton

Accountants LittlehamptonMore West Sussex Accountants: Littlehampton, Worthing, East Grinstead, Hurstpierpoint, Southwater, Chichester, Rustington, Horsham, Bognor Regis, Southwick, Shoreham-by-Sea, Burgess Hill, Crawley, Haywards Heath and Lancing.

TOP - Accountants Littlehampton - Financial Advisers

Auditing Littlehampton - Small Business Accountants Littlehampton - Affordable Accountant Littlehampton - Self-Assessments Littlehampton - Chartered Accountants Littlehampton - Bookkeeping Littlehampton - Financial Accountants Littlehampton - Financial Advice Littlehampton - Tax Accountants Littlehampton