Accountants Southwick: There are plenty of positive benefits to be had from hiring the services of a professional accountant if you operate a business or are self-employed in Southwick, West Sussex. Your accountant should at the minimum be able to free up a bit of time for you by dealing with areas like self-assessment tax returns, payroll and bookkeeping. This kind of help can be particularly crucial to small start-up businesses, and those who haven't run a business previously. This kind of expert help will enable your Southwick business to grow and prosper.

So, what is the best way to find an accountant in Southwick, and what type of service should you be expecting? Most Southwick accountants have their own websites, therefore browsing the internet is a good starting place for your search. Knowing just who you can trust is of course not quite so simple. The fact that almost any individual in Southwick can call themselves an accountant is something you need to keep in mind. They don't need a degree or even applicable qualifications like A Levels or BTEC's. Which is surprising to say the least.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. The extra peace of mind should compensate for any higher costs. Your accountant will add his/her fees as tax deductable. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

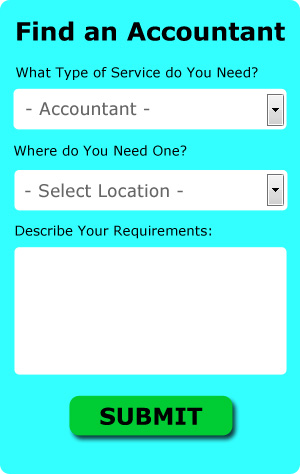

There is now a service available known as Bark, where you can look for local professionals including accountants. They provide an easy to fill in form that gives an overview of your requirements. As soon as this form is submitted, your requirements will be forwarded to local accountants. There is no fee for this service.

If you prefer the cheaper option of using an online tax returns service there are several available. This may save time and be more cost-effective for self-employed people in Southwick. Picking a reputable company is important if you choose to go with this option. The better ones can soon be singled out by carefully studying reviews online. We will not be recommending any individual online accounting service in this article.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. However, as a sole trader or smaller business in Southwick using one of these specialists may be a bit of overkill. So, at the end of the day the choice is yours.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. You could even use a software program like CalCal, Gbooks, GoSimple, Taxshield, Keytime, Nomisma, Basetax, Taxfiler, Ajaccts, TaxCalc, BTCSoftware, Capium, Sage, Forbes, Absolute Topup, 123 e-Filing, ACCTAX, Andica, Taxforward, Xero or Ablegatio to make life even easier. Whatever happens you need to get your self-assessment form in on time.

How Money Management Helps with Self Improvement and Business

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Still, this shouldn't deter you from going into business for yourself. You've got a number of things that can help you successfully manage the financial side of your business. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

Have an account that's just for your business expenses and another for your personal expenses. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

Learn how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. You could also try to use a personal budgeting tool like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. You'll know exactly what's happening to your business and personal finances when you've got your books in order. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Fight the urge to spend unnecessarily. It is tempting, when you have money coming in, to start spending money on the things that you've wanted for a long time but couldn't afford. You should, however, spend money on things that will benefit your business. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. Buy your office supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. While it's a good idea to spend on your entertainment, be careful that you spend too much on it.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. Use the tips in this article to help you keep track of everything. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

Small Business Accountants Southwick

Operating a small business in Southwick is stressful enough, without having to fret about doing your accounts and similar bookkeeping duties. Using the services of a small business accountant in Southwick will allow you to operate your business with the knowledge that your VAT, tax returns and annual accounts, and various other business tax requirements, are being met.

A competent small business accountant in Southwick will consider that it is their responsibility to develop your business, and offer you sound financial advice for peace of mind and security in your specific circumstances. A responsible accounting firm in Southwick will be able to give proactive small business guidance to maximise your tax efficiency while at the same time minimising business expenditure; crucial in the sometimes murky world of business taxation.

It is also essential that you clarify the structure of your business, your company's situation and your plans for the future truthfully to your small business accountant.

Payroll Services Southwick

For any company in Southwick, from large scale organisations down to independent contractors, payrolls for staff can be stressful. The legislation relating to payroll for accuracy and transparency mean that running a company's payroll can be a daunting task.

All small businesses don't have the help that a dedicated financial specialist can provide, and an easy way to take care of employee pay is to use an external Southwick accounting firm. The payroll management service will work along with HMRC and pension providers, and deal with BACS payments to guarantee timely and accurate wage payment to all staff.

A genuine payroll accountant in Southwick will also, in line with current legislations, organise P60 tax forms after the end of the financial year for every member of staff. They will also be responsible for providing P45 tax forms at the end of a staff member's contract. (Tags: Payroll Outsourcing Southwick, Payroll Accountant Southwick, Payroll Services Southwick).

Southwick accountants will help with general accounting services in Southwick, consultancy and systems advice, inheritance tax in Southwick, monthly payroll, employment law, business disposal and acquisition, cashflow projections in Southwick, partnership registrations, management accounts, assurance services, company formations, accounting support services Southwick, bureau payroll services, pension forecasts Southwick, capital gains tax Southwick, double entry accounting, accounting and financial advice, business start-ups, limited company accounting in Southwick, accounting services for media companies Southwick, accounting services for buy to let landlords in Southwick, company secretarial services in Southwick, debt recovery in Southwick, sole traders, business advisory services Southwick, contractor accounts, litigation support, small business accounting, taxation accounting services, VAT registrations, payslips, mergers and acquisitions and other forms of accounting in Southwick, West Sussex. These are just an example of the duties that are undertaken by nearby accountants. Southwick providers will keep you informed about their entire range of accounting services.

You do, of course have the perfect resource at your fingertips in the form of the net. There's such a lot of inspiration and information available online for such things as small business accounting, accounting & auditing, self-assessment help and personal tax assistance, that you'll pretty soon be bursting with ideas for your accounting needs. A good example may be this informative article outlining five tips for selecting a reliable accountant.

Southwick Accounting Services

- Southwick Tax Planning

- Southwick Debt Recovery

- Southwick Tax Refunds

- Southwick PAYE Healthchecks

- Southwick Bookkeepers

- Southwick Financial Audits

- Southwick Audits

- Southwick Specialist Tax

- Southwick Chartered Accountants

- Southwick Taxation Advice

- Southwick Forensic Accounting

- Southwick Payroll Management

- Southwick Tax Returns

- Southwick VAT Returns

Also find accountants in: Warningcamp, Coultershaw Bridge, Ansty, Paxhill Park, Upperton, Hambrook, Whitemans Green, Warnham, Sandrocks, Adversane, Clapham, Findon, Slindon, West Hoathly, East Dean, Three Bridges, Oreham Common, Birdham, Pound Hill, Cowfold, Southwater, Bepton, Newpound Common, Muddleswood, Cocking, Kirdford, Norton, Selsfield Common, The Bar, West Marden, Merston, Small Dole, Worthing, Sullington, Ifield and more.

Accountant Southwick

Accountant Southwick Accountants Near Southwick

Accountants Near Southwick Accountants Southwick

Accountants SouthwickMore West Sussex Accountants: Worthing, Lancing, East Grinstead, Crawley, Chichester, Littlehampton, Bognor Regis, Haywards Heath, Burgess Hill, Southwick, Horsham, Hurstpierpoint, Shoreham-by-Sea, Rustington and Southwater.

TOP - Accountants Southwick - Financial Advisers

Bookkeeping Southwick - Chartered Accountant Southwick - Online Accounting Southwick - Cheap Accountant Southwick - Auditors Southwick - Financial Accountants Southwick - Investment Accounting Southwick - Self-Assessments Southwick - Financial Advice Southwick