Accountants Romford: If you have your own business or are a self-employed person in Romford, Essex, you will soon realise that there are lots of benefits to be gained from using a competent accountant. One of the principal advantages will be that with your accountant handling the routine paperwork and bookkeeping, you should have more free time to devote to what you do best, the actual running of your business. The importance of having a qualified accountant at your side cannot be exaggerated.

Different kinds of accountant will be advertising their services in and around Romford. Therefore, it's essential that you pick one that matches your exact needs. It isn't unusual for Romford accountants to work independently, others prefer being part of a larger accounting firm. Accountancy firms usually have specialists in each main field of accounting. The types of accountant that you are likely to find within a firm may include: bookkeepers, tax preparation accountants, auditors, investment accountants, costing accountants, management accountants, financial accountants, actuaries, forensic accountants, accounting technicians and chartered accountants.

If you want your tax returns to be correct and error free it might be better to opt for a professional Romford accountant who is appropriately qualified. Look for an AAT qualified accountant in the Romford area. Qualified accountants in Romford might cost more but they will do a proper job. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Small businesses and sole traders can use a bookkeeper rather than an accountant.

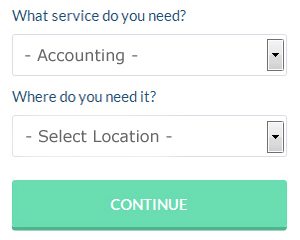

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. In no time at all you can fill out the job form and submit it with a single click. Your requirements will be distributed to accountants in the Romford area and they will be in touch with you directly.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. A number of self-employed people in Romford prefer to use this simple and convenient alternative. Do some homework to single out a company with a good reputation. A good method for doing this is to check out any available customer reviews and testimonials.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Taxfiler, Capium, Gbooks, Taxforward, Ajaccts, GoSimple, Taxshield, CalCal, Absolute Topup, Ablegatio, Xero, Forbes, Sage, Basetax, Keytime, 123 e-Filing, BTCSoftware, TaxCalc, Nomisma, ACCTAX and Andica. You'll receive a fine if your self-assessment is late. You can expect a fine of £100 if your assessment is in even 1 day late.

Auditors Romford

An auditor is a person or company sanctioned to review and verify the reliability of financial accounts to ensure that companies observe tax laws. They also sometimes act as advisors to recommend possible risk prevention measures and the application of cost savings. For anybody to start working as an auditor they need to have specific qualifications and be approved by the regulatory authority for accounting and auditing. (Tags: Auditor Romford, Auditors Romford, Auditing Romford)

Financial Actuaries Romford

An actuary advises on, manages and evaluates monetary and financial risks. They apply their detailed knowledge of business and economics, combined with their expertise in investment theory, statistics and probability theory, to provide strategic, commercial and financial advice. To be an actuary it's vital to have an economic, statistical and mathematical understanding of everyday situations in the world of finance.

Payroll Services Romford

For any business enterprise in Romford, from large scale organisations down to independent contractors, staff payrolls can be complicated. Dealing with payrolls demands that all legal requirements regarding their transparency, timings and exactness are followed in all cases.

Not all small businesses have their own in-house financial experts, and a simple way to take care of employee pay is to use an external Romford accountant. A payroll accountant will work along with HMRC, with pensions providers and set up BACS payments to guarantee that your staff are paid on time, and that all required deductions are accurate.

It will also be a requirement for a decent payroll management accountant in Romford to provide an accurate P60 tax form for each employee after the end of the financial year (by 31st May). Upon the termination of a staff member's contract with your company, the payroll service will supply a current P45 outlining what tax has been paid in the last financial period. (Tags: Payroll Accountants Romford, Payroll Outsourcing Romford, Payroll Services Romford).

Proper Money Management for Improving Your Business and Yourself

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. Making your business a profitable success is the most difficult thing of all because a lot can happen along the way to hurt your business and your confidence level. For example, failure on your part to properly manage your finances will contribute to this. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. Be aware, however, that managing your business money isn't going to get any simpler as your business grows; it'll simply become more complicated. This is where the following tips will prove to be helpful.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. So if you want to keep it all on your bank account, you need to make sure that you pay off your credit card in full each month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This way, you won't have a hard time keeping track of your business and personal finances. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. Just how much money you pay yourself is completely up to you. It can be a percentage of your business income or it can be an hourly rate.

Fight the urge to spend unnecessarily. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. Stick to buying only the things that you honestly need to keep your business running. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. You'll also be able to save money on office supplies if you buy in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. You'll also need to be careful about how much money you spend on entertainment.

There are lots of ways to practice self improvement in your business. For one, you can learn how to manage your finances better. Most people wish they were better money managers. When you learn proper money management, your self-confidence can be helped a lot. Most importantly, your business and personal life will become a lot easier to organize. We've shared some tips for better money management for your small business in this article, and as you work and learn, you'll come up with plenty of others.

Small Business Accountants Romford

Making sure your accounts are accurate can be a demanding job for anyone running a small business in Romford. A focused small business accountant in Romford will provide you with a hassle-free approach to keep your annual accounts, tax returns and VAT in perfect order.

Helping you expand your business, and offering financial advice relating to your particular situation, are just a couple of the ways that a small business accountant in Romford can be of benefit to you. A responsible accounting firm in Romford will be able to give practical small business advice to maximise your tax efficiency while at the same time minimising business expenditure; essential in the sometimes shady world of business taxation.

It is essential that you clarify the structure of your business, your current financial circumstances and your plans for the future accurately to your small business accountant. (Tags: Small Business Accountants Romford, Small Business Accountant Romford, Small Business Accounting Romford).

Romford accountants will help with partnership registration, VAT registrations in Romford, estate planning, PAYE, pension forecasts, accounting and auditing, limited company accounting, corporation tax, payslips, double entry accounting in Romford, business outsourcing, self-employed registration, small business accounting, investment reviews, partnership accounts, accounting services for property rentals, financial planning Romford, accounting services for start-ups in Romford, mergers and acquisitions, debt recovery, consultancy and systems advice, audit and compliance issues, accounting and financial advice in Romford, personal tax Romford, financial statements Romford, year end accounts, sole traders, consulting services, taxation accounting services, company formations Romford, general accounting services, business planning and support Romford and other kinds of accounting in Romford, Essex. Listed are just an example of the tasks that are carried out by local accountants. Romford companies will be happy to tell you about their whole range of services.

Romford Accounting Services

- Romford Bookkeeping Healthchecks

- Romford Self-Assessment

- Romford Forensic Accounting

- Romford Debt Recovery

- Romford Financial Advice

- Romford Audits

- Romford Business Accounting

- Romford Specialist Tax

- Romford Payroll Services

- Romford Tax Investigations

- Romford Account Management

- Romford Bookkeepers

- Romford Personal Taxation

- Romford Tax Advice

Also find accountants in: Great Hallingbury, Rayleigh, Courtsend, Broad Green, Navestock, Blackheath, Norton Heath, Barr Hall, Cooksmill Green, Borley, Tye Common, Little Leighs, Dovercourt, Leigh On Sea, Church End, Hutton, Braintree, Bannister Green, Pentlow, Bicknacre, Broad Street Green, Horsley Cross, Cock Clarks, Tolleshunt Darcy, Halstead, Ostend, Coxtie Green, Southchurch, Clavering, South Weald, Hartford End, Great Chesterford, Bocking Churchstreet, Purfleet, Cressing and more.

Accountant Romford

Accountant Romford Accountants Near Me

Accountants Near Me Accountants Romford

Accountants RomfordMore Essex Accountants: Epping, Tiptree, West Mersea, Brightlingsea, Walton-on-the-Naze, Ingatestone, Chigwell, Rainham, Barking, Witham, Holland-on-Sea, Chipping Ongar, Westcliff-on-Sea, Canvey Island, Danbury, South Ockendon, Great Dunmow, Harlow, Tilbury, Saffron Walden, Great Wakering, Basildon, Waltham Abbey, Billericay, Manningtree, Chafford Hundred, Frinton-on-Sea, Writtle, Grays, Wickford, Braintree, Brentwood, Parkeston, North Weald Bassett, Chingford, Stanway, Shoeburyness, Clacton-on-Sea, Colchester, Stanford-le-Hope, Ilford, Hornchurch, Harwich, Coggeshall, Wivenhoe, West Thurrock, Chelmsford, Corringham, Hockley, Dagenham, South Woodham Ferrers, Halstead, Great Baddow, Hullbridge, Laindon, Buckhurst Hill, Langdon Hills, Hawkwell, Heybridge, Purfleet, Romford, Pitsea, Southchurch, Rochford, Galleywood, Southminster, Southend-on-Sea, Stansted Mountfitchet, Loughton, Maldon, South Benfleet, Hadleigh, Upminster, Leigh-on-Sea, Rayleigh and Burnham-on-Crouch.

TOP - Accountants Romford - Financial Advisers

Tax Advice Romford - Tax Preparation Romford - Small Business Accountant Romford - Financial Accountants Romford - Online Accounting Romford - Affordable Accountant Romford - Chartered Accountants Romford - Bookkeeping Romford - Investment Accounting Romford