Accountants Southminster: Does it seem like the only "reward" for filling in your yearly self-assessment form a massive headache? You're not alone in Southminster if this predicament worries you every year. Is finding a local Southminster accountant to do it for you a better alternative? Is self-assessment a bit too complicated for you to do on your own? This ought to cost you about £200-£300 if you use the services of an average Southminster accountant. Instead of using a local Southminster accountant you could try one of the readily available online self-assessment services which might offer a saving.

Southminster accountants come in many forms. Picking one that matches your needs precisely should be your objective. You may choose to pick one that works independently or one within a practice or firm. Each field of accounting will have their own specialists within an accountancy firm. Among the key accounting jobs are: costing accountants, bookkeepers, accounting technicians, tax preparation accountants, financial accountants, auditors, investment accountants, actuaries, management accountants, chartered accountants and forensic accountants.

It is advisable for you to find an accountant in Southminster who is properly qualified. You don't need a chartered accountant but should get one who is at least AAT qualified. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Make sure that you include the accountants fees in your expenses, because these are tax deductable. A lot of smaller businesses in Southminster choose to use bookkeepers rather than accountants.

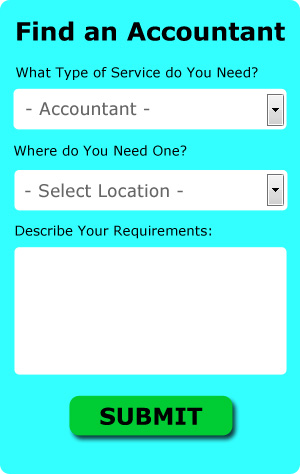

By using an online service such as Bark.com you could be put in touch with a number of local accountants. Little is required other than ticking a few boxes on the search form. Then you just have to wait for some prospective accountants to contact you. Try this free service because you've got nothing to lose.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. A number of self-employed people in Southminster prefer to use this simple and convenient alternative. You still need to pick out a company offering a reliable and professional service. The easiest way to do this is by studying online reviews. We are unable to advocate any individual accounting services on this site.

The very best in this profession are chartered accountants, they will also be the most expensive. The services these specialists provide are perhaps beyond the needs of the smaller business in Southminster. With a chartered accountant you will certainly have the best on your side.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! It is also a good idea to make use of some self-assessment software such as Absolute Topup, BTCSoftware, Taxfiler, Taxshield, Xero, Taxforward, Forbes, ACCTAX, 123 e-Filing, GoSimple, Nomisma, Capium, TaxCalc, CalCal, Andica, Ablegatio, Keytime, Gbooks, Basetax, Ajaccts or Sage to simplify the process. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. Penalties start at £100 and rise considerably if you are more that 3 months late.

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Luckily there are plenty of things that you can do to make it easier on yourself. Keep reading to learn how to be better at managing your money when you are in business for yourself.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

It's a good idea to do a weekly balancing of your books. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. Keep track of every payment received and every payment made, then at the end of the week, make sure that what you have on hand and in the bank actually matches what your numbers say you should have. This will save you the trouble of tracking down discrepancies each month or each quarter. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

Don't throw away your receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. Any business related expenses you have, you can keep track of them if you keep your receipts. Make sure you keep your receipts together in one place. Tracking your expenses becomes easy if you have all your receipts in one place. You can easily keep track of and access your receipts by putting them in an accordion file and placing that file in your desk drawer.

Proper management of your business finances involves a lot of different things. It's more than making a list of things you spent on, how much, and when. There are different things to keep track of and different ways to track them. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Small Business Accountants Southminster

Doing the accounts can be a pretty stress-filled experience for any owner of a small business in Southminster. If your accounts are getting you down and VAT and tax return issues are causing you sleepless nights, it would be wise to use a decent small business accountant in Southminster.

A good small business accountant will regard it as their responsibility to help your business to improve, supporting you with good guidance, and providing you with peace of mind and security concerning your financial situation at all times. An effective accounting firm in Southminster should be able to give proactive small business guidance to optimise your tax efficiency while at the same time minimising business expenditure; critical in the sometimes murky world of business taxation.

You also ought to be provided with a dedicated accountancy manager who understands your company's situation, your business structure and your future plans.

Auditors Southminster

An auditor is a person or a firm appointed by a company to conduct an audit, which is an official inspection of the accounts, usually by an impartial body. They offer businesses from fraud, point out discrepancies in accounting procedures and, on occasion, operate on a consultancy basis, helping firms to identify solutions to improve efficiency. Auditors have to be authorised by the regulatory authority for accounting and auditing and also have the required qualifications.

Forensic Accountant Southminster

You might well run into the phrase "forensic accounting" when you are looking to find an accountant in Southminster, and will perhaps be interested to find out about the distinction between forensic accounting and regular accounting. With the actual word 'forensic' meaning literally "appropriate for use in a court of law", you will get an idea as to exactly what is involved. Also known as 'forensic accountancy' or 'financial forensics', it uses auditing, investigative skills and accounting to detect inaccuracies in financial accounts which have been involved in theft or fraud. Some of the bigger accountancy firms in and near Southminster even have specialised departments addressing money laundering, falsified insurance claims, tax fraud, professional negligence, bankruptcy, insolvency and personal injury claims.

Payroll Services Southminster

For any business in Southminster, from large scale organisations down to independent contractors, dealing with staff payrolls can be tricky. Controlling payrolls requires that all legal obligations regarding their transparency, timings and accuracy are observed to the minutest detail.

A small business may well not have the advantage of an in-house financial specialist and the best way to work with staff payrolls is to retain the services of an outside accountant in Southminster. The accountant dealing with payrolls will work with HMRC and pension schemes, and take care of BACS payments to guarantee accurate and timely payment to all employees.

A dedicated payroll management accountant in Southminster will also, in keeping with current legislations, organise P60's at the conclusion of the financial year for every member of staff. At the end of an employee's contract, the payroll service will supply an updated P45 relating to the tax paid in the last financial period. (Tags: Payroll Accountant Southminster, Payroll Services Southminster, Payroll Outsourcing Southminster).

Financial Actuaries Southminster

An actuary is a professional person who evaluates the measurement and managing of risk and uncertainty. An actuary uses statistical and financial hypotheses to analyse the possibility of a specific event transpiring and the potential financial implications. To be an actuary it is essential to have a mathematical, statistical and economic awareness of real-life scenarios in the world of finance.

Southminster accountants will help with investment reviews, financial statements, VAT returns, bureau payroll services Southminster, small business accounting, limited company accounting, management accounts, monthly payroll Southminster, business acquisition and disposal Southminster, accounting support services in Southminster, estate planning, financial planning in Southminster, taxation accounting services in Southminster, workplace pensions Southminster, personal tax Southminster, charities, tax investigations, company secretarial services in Southminster, HMRC submissions, partnership accounts, cash flow, compliance and audit reporting Southminster, company formations, accounting and auditing Southminster, tax returns, corporation tax Southminster, pension planning, business support and planning, capital gains tax, consulting services in Southminster, self-employed registration, mergers and acquisitions and other kinds of accounting in Southminster, Essex. These are just a small portion of the duties that are handled by local accountants. Southminster providers will be happy to inform you of their whole range of services.

Using the world wide web as a useful resource it is of course quite simple to find lots of invaluable ideas and inspiration relating to self-assessment help, accounting for small businesses, personal tax assistance and accounting & auditing. As an example, with a quick search we located this enlightening article about how to locate an accountant to fill in your income tax return.

Southminster Accounting Services

- Southminster VAT Returns

- Southminster Chartered Accountants

- Southminster Account Management

- Southminster Taxation Advice

- Southminster Tax Returns

- Southminster Forensic Accounting

- Southminster Financial Advice

- Southminster Debt Recovery

- Southminster Bookkeeping

- Southminster Specialist Tax

- Southminster Business Accounting

- Southminster Tax Services

- Southminster Business Planning

- Southminster Payroll Services

Also find accountants in: Elmdon, Bradfield Heath, Hardys Green, Greensted, Rudley Green, Willingale, Takeley, North Shoebury, Kelvedon Hatch, Sewardstone, Shrub End, Chrishall, Gestingthorpe, Grange Hill, Great Wigborough, Wicken Bonhunt, Linford, Pleshey, Downham, Smiths Green, Ugley, Horsleycross Street, Howe Green, Takeley Street, Stapleford Abbotts, Woodham Ferrers, Bocking, Boxted, Little Chesterford, Ovington, Audley End, Aldham, Blacksmiths Corner, Church Langley, West Hanningfield and more.

Accountant Southminster

Accountant Southminster Accountants Near Southminster

Accountants Near Southminster Accountants Southminster

Accountants SouthminsterMore Essex Accountants: Hornchurch, Frinton-on-Sea, Chafford Hundred, Hockley, Wivenhoe, Heybridge, Rainham, Basildon, Rayleigh, Halstead, Braintree, Grays, Canvey Island, Manningtree, Harwich, Corringham, Stansted Mountfitchet, Ilford, Buckhurst Hill, Billericay, Holland-on-Sea, South Woodham Ferrers, Maldon, Brentwood, Waltham Abbey, Walton-on-the-Naze, Romford, Chigwell, Tiptree, Danbury, Shoeburyness, Brightlingsea, West Thurrock, Epping, Stanway, Southminster, North Weald Bassett, Chelmsford, Leigh-on-Sea, South Ockendon, Westcliff-on-Sea, Chingford, Great Wakering, Stanford-le-Hope, Rochford, Loughton, Great Dunmow, Barking, Hullbridge, Chipping Ongar, Wickford, Parkeston, Harlow, Upminster, Galleywood, Laindon, Clacton-on-Sea, Hadleigh, Dagenham, Saffron Walden, Colchester, Writtle, South Benfleet, Great Baddow, Pitsea, Langdon Hills, Southchurch, Ingatestone, West Mersea, Burnham-on-Crouch, Southend-on-Sea, Hawkwell, Witham, Tilbury, Purfleet and Coggeshall.

TOP - Accountants Southminster - Financial Advisers

Tax Advice Southminster - Chartered Accountants Southminster - Online Accounting Southminster - Tax Return Preparation Southminster - Self-Assessments Southminster - Cheap Accountant Southminster - Small Business Accountants Southminster - Financial Advice Southminster - Auditors Southminster