Accountants Ipswich: Does filling in your yearly self-assessment form give you nightmares? Lots of people in Ipswich and throughout the British Isles have to contend with this on a yearly basis. Finding a local Ipswich professional to do this for you could be the answer. This may be the best alternative if you consider self-assessment just too time-consuming. The average Ipswich accountant or bookkeeper will charge approximately £200-£300 for completing your tax returns. If you have no issues with using an online service rather than someone local to Ipswich, you may be able to get this done for much less.

There are different kinds of accountants found in Ipswich. Therefore, identify your exact requirements and choose an accountant that fits those needs. You may have the choice of an accountant who works within a bigger accountancy practice or one who works solo. Having several accounting experts together within a practice can have many advantages. It's likely that forensic accountants, tax preparation accountants, chartered accountants, actuaries, accounting technicians, cost accountants, investment accountants, bookkeepers, management accountants, auditors and financial accountants will be available within an accountancy firm of any note.

If you want your tax returns to be correct and error free it might be better to opt for a professional Ipswich accountant who is appropriately qualified. At the very least you should look for somebody with an AAT qualification. Qualified accountants may come with higher costs but may also save you more tax. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

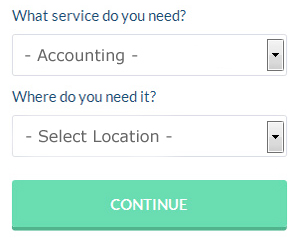

If you don't have the time to do a proper online search for local accountants, try using the Bark website. All that is required is the ticking of a few boxes so that they can understand your exact needs. It is then simply a case of waiting for some suitable responses. Try this free service because you've got nothing to lose.

If you prefer the cheaper option of using an online tax returns service there are several available. While not recommended in every case, it could be the ideal solution for you. If you decide to go with this method, pick a company with a decent reputation. Study online reviews so that you can get an overview of the services available.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? The process can be simplified even further by the use of software such as Nomisma, Basetax, TaxCalc, Keytime, Taxfiler, Sage, Xero, Absolute Topup, Taxshield, Gbooks, CalCal, Capium, BTCSoftware, Ajaccts, Ablegatio, ACCTAX, 123 e-Filing, GoSimple, Taxforward, Forbes or Andica. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. The standard fine for being up to three months late is £100.

Self Improvement for Business Through Better Money Management

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You get to be in charge of practically everything when you've got your own business -- your time, the work you do, and even your income! How scary is that? While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. So if you wish to know how you can manage your money correctly, keep reading.

Don't mix your business and personal expenses by having just one account. If you do, you run the risk of confusion. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

You can help yourself by finding out how to keep your books. Make sure you've got a system set up for your money, whether it's business or personal. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. In addition, you can make use of personal budgeting tools such as Mint.com. There are also many no-cost resources for those who own a small business to help them properly manage their bookkeeping. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Take control of your spending. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. You'll also be able to save money on office supplies if you buy in bulk. Invest in reliable computing equipment so you won't have to replace it all the time. You'll also need to be careful about how much money you spend on entertainment.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. You'll benefit a great deal if you remember and put these tips we've shared to use. You're in a much better position for business and personal success when you know how to manage your finances better.

Forensic Accountant Ipswich

During your search for a professional accountant in Ipswich there's a good chance that you'll happen on the term "forensic accounting" and be wondering what it is, and how it is different from regular accounting. With the word 'forensic' literally meaning "denoting or relating to the application of scientific techniques and methods for the investigation of criminal activity", you should get a clue as to precisely what is involved. Also referred to as 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to detect irregularities in financial accounts that have contributed to theft or fraud. There are a few larger accountants firms throughout Suffolk who've got specialist departments for forensic accounting, addressing tax fraud, bankruptcy, insolvency, false insurance claims, professional negligence, personal injury claims and money laundering. (Tags: Forensic Accountant Ipswich, Forensic Accountants Ipswich, Forensic Accounting Ipswich)

Actuary Ipswich

An actuary is a professional person who studies the measurement and managing of uncertainty and risk. They employ their wide-ranging knowledge of business and economics, along with their expertise in probability theory, statistics and investment theory, to provide financial, commercial and strategic guidance. Actuaries provide assessments of fiscal security systems, with an emphasis on their mathematics, their mechanisms and their complexity.

Small Business Accountants Ipswich

Running a small business in Ipswich is pretty stressful, without needing to fret about preparing your accounts and other bookkeeping duties. Appointing a small business accountant in Ipswich will enable you to run your business knowing that your VAT, tax returns and annual accounts, and various other business tax requirements, are being met.

Helping you to grow your business, and offering financial advice relating to your specific situation, are just a couple of the means by which a small business accountant in Ipswich can be of benefit to you. The capricious and complex field of business taxation will be cleared and explained to you so as to lower your business costs, while improving tax efficiency.

You also ought to be offered an assigned accountancy manager who understands the structure of your business, your company's situation and your plans for the future. (Tags: Small Business Accountant Ipswich, Small Business Accountants Ipswich, Small Business Accounting Ipswich).

Ipswich accountants will help with payslips, bookkeeping, accounting services for media companies, estate planning, inheritance tax Ipswich, partnership accounts Ipswich, HMRC submissions, company secretarial services Ipswich, personal tax, employment law Ipswich, financial statements, capital gains tax, contractor accounts, taxation accounting services Ipswich, consulting services Ipswich, consultancy and systems advice in Ipswich, year end accounts, accounting services for the construction sector, pension forecasts Ipswich, business outsourcing in Ipswich, assurance services, management accounts, small business accounting in Ipswich, corporation tax, limited company accounting, investment reviews, tax preparation Ipswich, partnership registration, tax investigations Ipswich, accounting services for buy to let landlords, charities Ipswich, accounting and financial advice and other types of accounting in Ipswich, Suffolk. These are just a handful of the duties that are performed by local accountants. Ipswich specialists will keep you informed about their full range of services.

When looking for ideas and inspiration for auditing & accounting, small business accounting, personal tax assistance and self-assessment help, you will not really need to look much further than the world wide web to get all the information that you need. With such a vast array of well-written blog posts and webpages to choose from, you will pretty quickly be brimming with ideas for your upcoming project. Just recently we came across this illuminating article on the subject of choosing an accountant.

Ipswich Accounting Services

- Ipswich Personal Taxation

- Ipswich Payroll Services

- Ipswich Business Accounting

- Ipswich Debt Recovery

- Ipswich Taxation Advice

- Ipswich Account Management

- Ipswich Tax Services

- Ipswich Specialist Tax

- Ipswich Financial Advice

- Ipswich Tax Planning

- Ipswich Auditing

- Ipswich Bookkeepers

- Ipswich VAT Returns

- Ipswich Tax Returns

Also find accountants in: Stanstead, Harleston, Eyke, Wickham Street, Braiseworth, Coney Weston, Knettishall, Little Waldingfield, Coldfair Green, Bruisyard, Saxmundham, Coddenham, Sudbourne, Rushmere St Andrew, Southwold, Chickering, Ampton, Newbourne, Thorns, Falkenham, Thrandeston, Brundish Street, East End, Sutton, Dunstall Green, Denham, Haughley New Street, Little Bradley, Stratford St Mary, Long Thurlow, Bentley, Cavenham, Mickfield, Stoke By Clare, Chillesford and more.

Accountant Ipswich

Accountant Ipswich Accountants Near Me

Accountants Near Me Accountants Ipswich

Accountants IpswichMore Suffolk Accountants: Beccles, Sudbury, Ipswich, Newmarket, Felixstowe, Bury St Edmunds, Mildenhall, Stowmarket, Lowestoft and Haverhill.

TOP - Accountants Ipswich - Financial Advisers

Financial Advice Ipswich - Online Accounting Ipswich - Investment Accounting Ipswich - Auditors Ipswich - Affordable Accountant Ipswich - Tax Preparation Ipswich - Financial Accountants Ipswich - Chartered Accountants Ipswich - Small Business Accountant Ipswich