Accountants Hawkwell: Have you found that filling in your self-assessment form each year is a real headache? You and a lot of other people in Hawkwell have to contend with this every year. Is it a better idea to get someone else to do this job for you? Is self-assessment a bit too complicated for you to do by yourself? Typically regular Hawkwell accountants will do this for approximately £220-£300. Instead of using a local Hawkwell accountant you could try one of the currently available online self-assessment services which might offer a saving on cost.

So, precisely what should you expect to pay for this service and what do you get for your cash? These days most people commence their search for an accountant or bookkeeping service on the world wide web. But, are they all trustworthy? Don't forget that anybody who's so inclined can set themselves up as an accountant in Hawkwell. Amazingly, there's not even a necessity for them to have any type of qualification.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. For simple self-assessment work an AAT qualification is what you need to look for. You can then be sure your tax returns are done correctly. Your accountant will add his/her fees as tax deductable. Sole traders and smaller businesses might get away with using a bookkeeper.

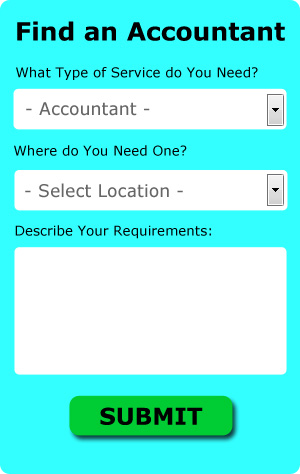

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. With Bark it is simply a process of ticking a few boxes and submitting a form. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. This kind of service may not suit everyone but could be the answer for your needs. Don't simply go with the first company you find on Google, take time to do some research. A good method for doing this is to check out any available customer reviews and testimonials.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. With a chartered accountant you will certainly have the best on your side.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Available software that will also help includes Absolute Topup, Taxfiler, Capium, Keytime, GoSimple, Nomisma, Gbooks, 123 e-Filing, Ajaccts, Taxforward, Ablegatio, Forbes, BTCSoftware, ACCTAX, Andica, Sage, Xero, CalCal, Taxshield, Basetax and TaxCalc. You will get a penalty if your tax return isn't in on time. You will receive a fine of £100 if you are up to three months late with your tax return.

Forensic Accountant Hawkwell

When you're looking for an accountant in Hawkwell you will doubtless come across the expression "forensic accounting" and be curious about what the difference is between a regular accountant and a forensic accountant. With the actual word 'forensic' literally meaning "denoting or relating to the application of scientific techniques and methods for the investigation of criminal activity", you should get a hint as to what is involved. Using auditing, investigative skills and accounting to detect discrepancies in financial accounts which have been involved in theft or fraud, it's also occasionally called 'forensic accountancy' or 'financial forensics'. There are even a few larger accountants firms throughout Essex who've got specialist divisions for forensic accounting, investigating professional negligence, personal injury claims, falsified insurance claims, tax fraud, bankruptcy, money laundering and insolvency.

Payroll Services Hawkwell

Payrolls for staff can be a complicated aspect of running a business enterprise in Hawkwell, regardless of its size. Managing company payrolls demands that all legal obligations regarding their transparency, timing and accuracy are followed to the finest detail.

Not all small businesses have the help that a dedicated financial specialist can provide, and an easy way to deal with employee pay is to employ an external Hawkwell payroll company. Working with HMRC and pension providers, a managed payroll service accountant will also deal with BACS payments to staff, making sure they're paid promptly every month, and that all deductions are done correctly.

Abiding by the current regulations, a decent payroll management accountant in Hawkwell will also present each of your employees with a P60 tax form after the end of each fiscal year. A P45 will also be presented to any member of staff who finishes working for the business, according to the current regulations.

Hawkwell accountants will help with management accounts, financial statements, sole traders, consulting services, general accounting services, debt recovery, inheritance tax, company secretarial services in Hawkwell, limited company accounting, consultancy and systems advice Hawkwell, estate planning, corporate finance Hawkwell, partnership registrations in Hawkwell, corporate tax in Hawkwell, tax investigations, bureau payroll services, investment reviews Hawkwell, capital gains tax Hawkwell, mergers and acquisitions, monthly payroll, double entry accounting, HMRC submissions, partnership accounts in Hawkwell, HMRC liaison Hawkwell, self-employed registrations, litigation support Hawkwell, accounting services for media companies, National Insurance numbers in Hawkwell, tax returns, taxation accounting services, financial and accounting advice in Hawkwell, assurance services and other forms of accounting in Hawkwell, Essex. These are just some of the duties that are accomplished by local accountants. Hawkwell professionals will tell you about their full range of accountancy services.

Hawkwell Accounting Services

- Hawkwell VAT Returns

- Hawkwell Bookkeeping Healthchecks

- Hawkwell Debt Recovery

- Hawkwell Self-Assessment

- Hawkwell Tax Returns

- Hawkwell Forensic Accounting

- Hawkwell Business Accounting

- Hawkwell Bookkeeping

- Hawkwell Tax Planning

- Hawkwell Payroll Management

- Hawkwell PAYE Healthchecks

- Hawkwell Personal Taxation

- Hawkwell Tax Services

- Hawkwell Tax Investigations

Also find accountants in: Herongate, Dedham, Sewardstone, Great Maplestead, Harlow, Coggeshall, Stones Green, Stow Maries, Holland On Sea, High Ongar, Maldon, Clatterford End, Goldhanger, Potter Street, Little Warley, Lawford, Bradfield, Berners Roding, Marks Tey, Althorne, Willows Green, Ranks Green, Little Walden, Jaywick, Bambers Green, Purleigh, Rawreth, Helions Bumpstead, Wickham Bishops, Fuller Street, Birchanger, Colchester, Dengie, Broomfield, Strethall and more.

Accountant Hawkwell

Accountant Hawkwell Accountants Near Me

Accountants Near Me Accountants Hawkwell

Accountants HawkwellMore Essex Accountants: Ilford, Great Dunmow, Hullbridge, Great Baddow, Southchurch, Danbury, West Mersea, Chigwell, Stanford-le-Hope, Epping, Westcliff-on-Sea, Rayleigh, Romford, South Ockendon, Wivenhoe, Buckhurst Hill, Colchester, Harwich, Grays, Witham, Loughton, South Benfleet, Holland-on-Sea, Galleywood, Hockley, Rainham, Chingford, Saffron Walden, Pitsea, Laindon, Stanway, Braintree, Corringham, Wickford, Chelmsford, Halstead, Great Wakering, Coggeshall, Heybridge, Langdon Hills, Billericay, Canvey Island, Stansted Mountfitchet, Purfleet, Hornchurch, Harlow, Writtle, Leigh-on-Sea, Brentwood, Brightlingsea, Basildon, South Woodham Ferrers, Clacton-on-Sea, Maldon, Rochford, Tiptree, Burnham-on-Crouch, Waltham Abbey, North Weald Bassett, Chipping Ongar, Hawkwell, Southminster, Upminster, Southend-on-Sea, Shoeburyness, Parkeston, Dagenham, Hadleigh, Ingatestone, Barking, Chafford Hundred, Manningtree, Frinton-on-Sea, Walton-on-the-Naze, Tilbury and West Thurrock.

TOP - Accountants Hawkwell - Financial Advisers

Financial Accountants Hawkwell - Tax Return Preparation Hawkwell - Bookkeeping Hawkwell - Tax Advice Hawkwell - Affordable Accountant Hawkwell - Auditing Hawkwell - Chartered Accountants Hawkwell - Self-Assessments Hawkwell - Investment Accounting Hawkwell